This form is used to resolve any question as to how royalty is to be paid to the Parties in the event of production, under the Lease, on any part of the Lands. The Parties are entering into this Agreement to stipulate and agree to the ownership of each Party's respective share of the royalty reserved in the Lease payable for production attributable to their Interests from a well located anywhere on the Lands.

Massachusetts Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

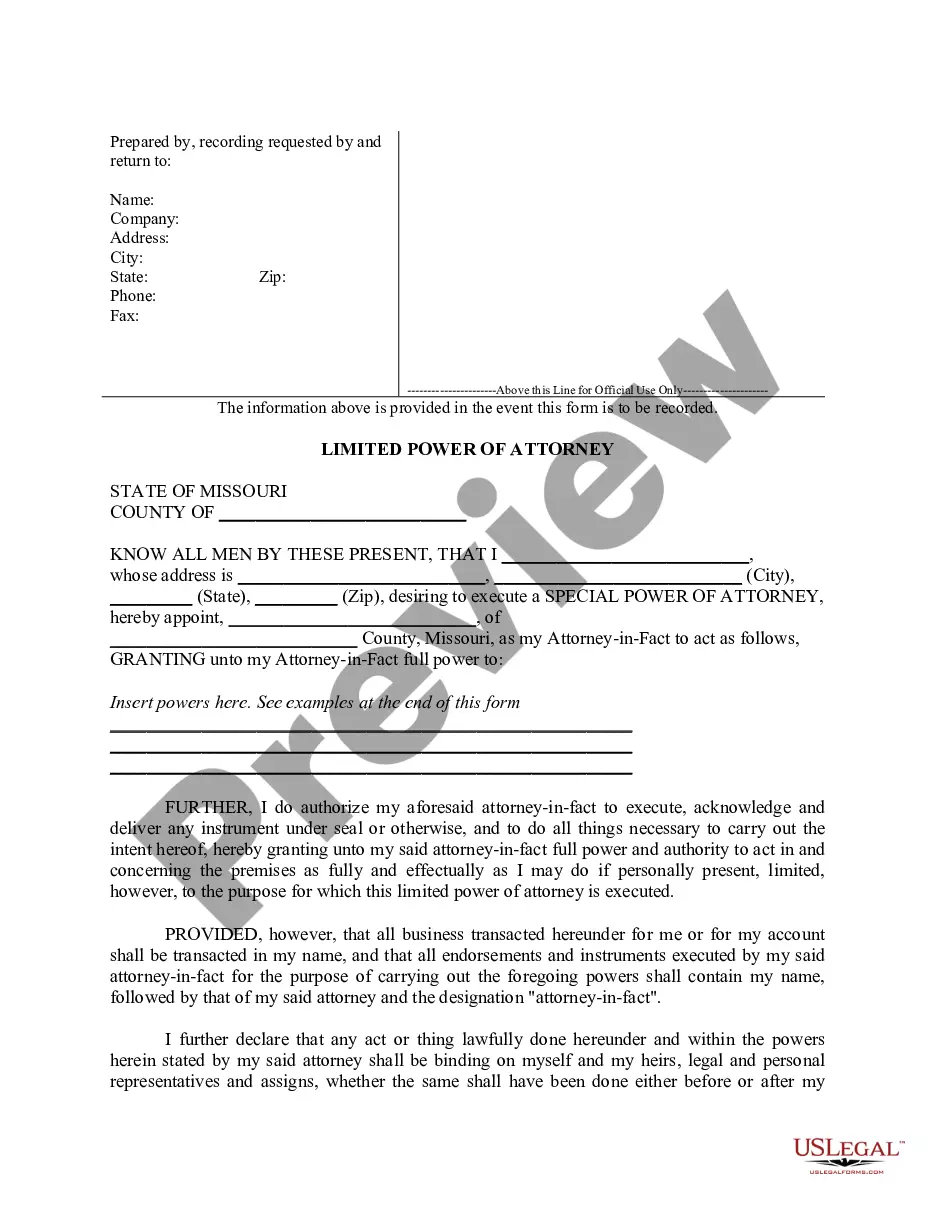

How to fill out Agreement Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

US Legal Forms - one of the biggest libraries of legitimate kinds in the States - gives a wide array of legitimate record layouts you are able to obtain or print out. Making use of the internet site, you can get a huge number of kinds for enterprise and specific functions, categorized by types, suggests, or keywords.You can find the latest types of kinds just like the Massachusetts Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease within minutes.

If you currently have a registration, log in and obtain Massachusetts Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease from your US Legal Forms catalogue. The Obtain option can look on every kind you view. You have access to all formerly acquired kinds inside the My Forms tab of the account.

In order to use US Legal Forms initially, allow me to share basic directions to help you get began:

- Be sure to have picked the right kind for your town/state. Click the Preview option to check the form`s content. Read the kind information to actually have chosen the appropriate kind.

- If the kind doesn`t fit your needs, make use of the Look for field at the top of the display to find the one that does.

- Should you be satisfied with the shape, confirm your selection by simply clicking the Purchase now option. Then, choose the pricing prepare you want and give your references to sign up for an account.

- Approach the financial transaction. Utilize your charge card or PayPal account to complete the financial transaction.

- Choose the structure and obtain the shape on the gadget.

- Make adjustments. Fill out, revise and print out and indication the acquired Massachusetts Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Every format you included with your money does not have an expiration day which is the one you have permanently. So, if you would like obtain or print out an additional copy, just check out the My Forms section and click on in the kind you will need.

Obtain access to the Massachusetts Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease with US Legal Forms, the most extensive catalogue of legitimate record layouts. Use a huge number of skilled and express-distinct layouts that fulfill your company or specific requires and needs.

Form popularity

FAQ

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

The right of governments to levy royalties from oil and gas companies derives from their ownership of natural resources. Through royalty payments, governments are compensated by oil and gas companies for the extraction of public natural resources.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.