Massachusetts Affidavit of Heirship - Descent

Description

How to fill out Affidavit Of Heirship - Descent?

You are able to devote several hours on the Internet searching for the legal papers template that suits the federal and state requirements you will need. US Legal Forms gives 1000s of legal varieties that happen to be examined by professionals. You can actually acquire or print the Massachusetts Affidavit of Heirship - Descent from your services.

If you currently have a US Legal Forms bank account, you can log in and click on the Download option. Following that, you can total, edit, print, or indicator the Massachusetts Affidavit of Heirship - Descent. Every legal papers template you get is yours forever. To acquire one more duplicate for any purchased kind, visit the My Forms tab and click on the related option.

If you use the US Legal Forms web site initially, follow the straightforward recommendations under:

- First, ensure that you have chosen the proper papers template for the region/city of your choice. Read the kind description to ensure you have picked out the right kind. If readily available, make use of the Preview option to look throughout the papers template at the same time.

- In order to get one more model of the kind, make use of the Research industry to get the template that meets your needs and requirements.

- After you have found the template you desire, click on Get now to carry on.

- Find the prices plan you desire, type in your references, and sign up for a free account on US Legal Forms.

- Total the deal. You can use your bank card or PayPal bank account to fund the legal kind.

- Find the file format of the papers and acquire it to the product.

- Make alterations to the papers if required. You are able to total, edit and indicator and print Massachusetts Affidavit of Heirship - Descent.

Download and print 1000s of papers web templates making use of the US Legal Forms web site, which offers the biggest collection of legal varieties. Use expert and express-distinct web templates to handle your company or person requires.

Form popularity

FAQ

Ing to MA Intestate Succession Laws, the spouse receives the first $200k of the estate and then 2/3 of remaining assets. The rest is inherited by the parents. For example, let's assume an estate is worth $800k. A surviving spouse would receive $200k and $400k (2/3 of $600k).

Typically, you have to probate the decedent's estate if you need to: Find out if the decedent's will is valid. Change the title (ownership) of real estate or personal property, such as bank accounts, stocks, or bonds, that is only in the decedent's name without any right of survivorship.

Beneficiaries have the right to be informed about the administration of the estate, including being notified about the start of the probate process. They have the right to receive a copy of the will and are entitled to an accounting of the estate's assets, debts, and distributions.

Degrees of kinship are used to identify heirs at law in the ?next of kin? category ONLY if there are no members in the first four groups of heirs: (1) surviving spouse, (2) children and their descendants, (3) parents, and (4) brothers/sisters and their descendants.

With children: All assets pass to your children equally. Without children: Assets are divided among parents equally. No surviving parents: Assets go to siblings equally. No siblings or children: Assets pass to the next closest group of relatives, usually cousins.

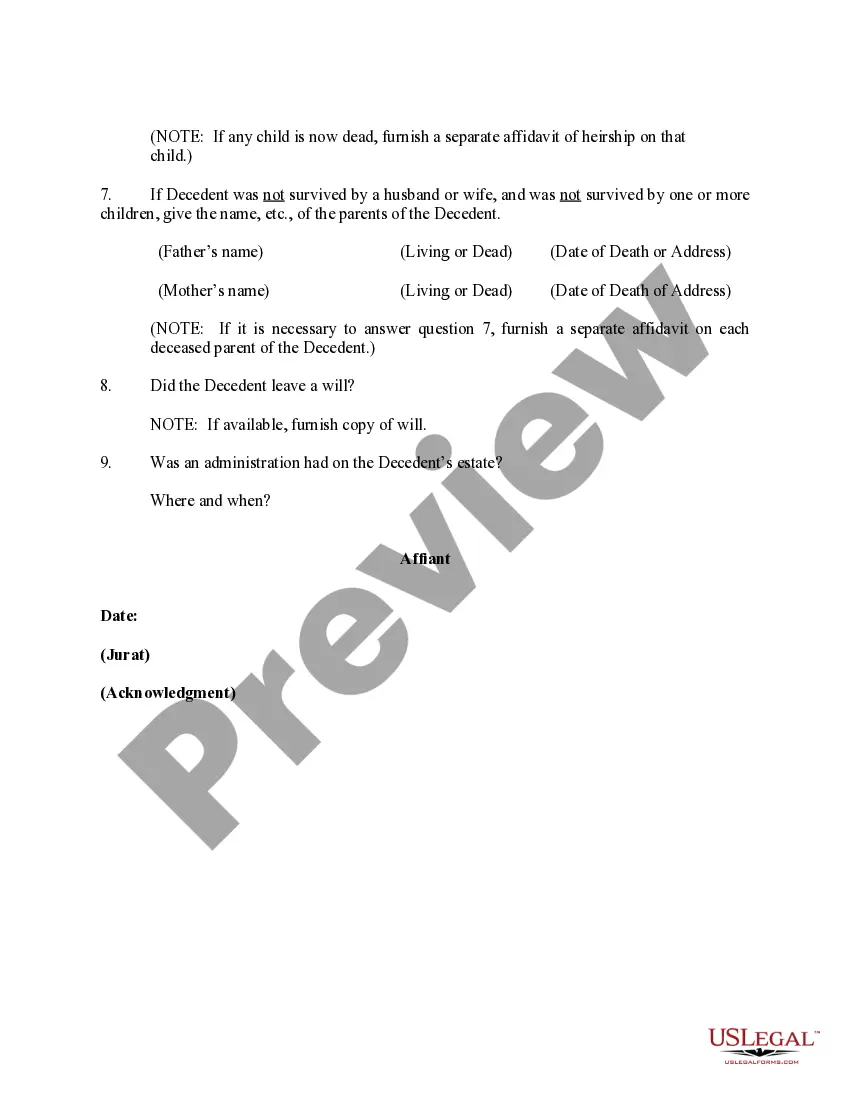

An Affidavit of Heirship is a legal document used to establish the heirs of a deceased person and their respective interests in the deceased person's estate when the deceased person dies without a will (intestate) or when there are uncertainties about the heirs and their inheritance rights.

Intestate Succession: What It Means These laws prioritize your closest family members, beginning with your spouse, followed by your children (if you're not married to their other parent), parents, siblings, and sometimes even cousins.

In its simplest terms ? if the gross estate plus all lifetime gifts does not exceed $1 million, then the estate is not taxable. If the gross estate (with or without lifetime gifts) exceeds $1 million, then the net estate is fully taxable. (See below for further explanation).