Massachusetts Affidavit of Heirship for House

Description

How to fill out Affidavit Of Heirship For House?

You can devote several hours on the web attempting to find the legitimate papers template which fits the state and federal requirements you require. US Legal Forms supplies 1000s of legitimate kinds which can be reviewed by experts. It is simple to download or print out the Massachusetts Affidavit of Heirship for House from your support.

If you already have a US Legal Forms bank account, you can log in and then click the Down load option. After that, you can complete, change, print out, or indication the Massachusetts Affidavit of Heirship for House. Every legitimate papers template you purchase is yours forever. To acquire yet another backup of any acquired kind, visit the My Forms tab and then click the related option.

Should you use the US Legal Forms internet site initially, adhere to the simple guidelines beneath:

- Initially, ensure that you have selected the correct papers template for that county/city of your liking. Read the kind information to make sure you have selected the proper kind. If accessible, make use of the Preview option to search throughout the papers template too.

- In order to discover yet another variation of your kind, make use of the Look for industry to discover the template that meets your requirements and requirements.

- After you have discovered the template you need, click on Get now to carry on.

- Select the prices strategy you need, enter your accreditations, and register for an account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal bank account to fund the legitimate kind.

- Select the structure of your papers and download it in your system.

- Make changes in your papers if required. You can complete, change and indication and print out Massachusetts Affidavit of Heirship for House.

Down load and print out 1000s of papers layouts while using US Legal Forms web site, which offers the greatest assortment of legitimate kinds. Use professional and status-certain layouts to take on your company or individual demands.

Form popularity

FAQ

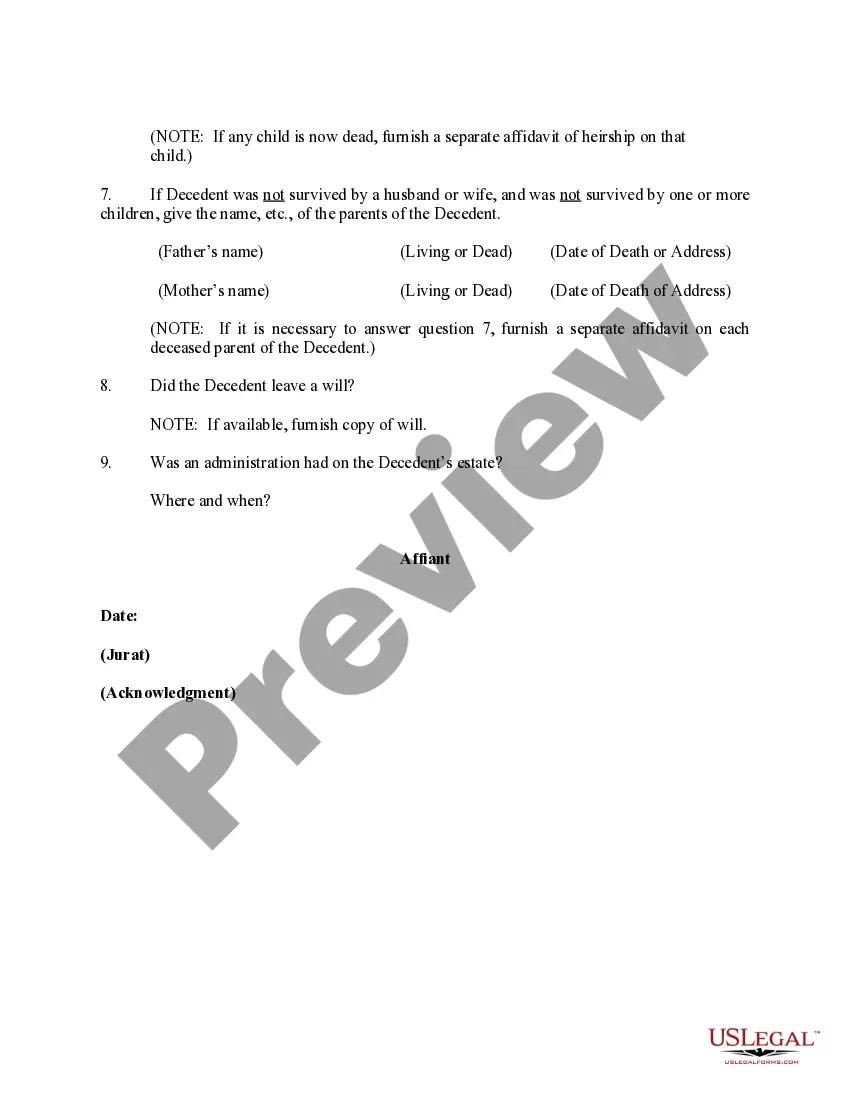

Heirs at law are persons entitled to receive the Decedent's property under the intestacy succession laws if there is no will.

The general rule is that an estate has to be probated within 3 years of when the decedent died. However, this deadline doesn't apply to: A voluntary administration. Determining heirs.

As part of the probate process, letters testamentary are issued by your state's probate court. To obtain the document, you need a copy of the will and the death certificate, which are then filed with the probate court along with whatever letters testamentary forms the court requires as part of your application.

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

A Massachusetts small estate affidavit, officially titled the ?Voluntary Administration Statement (MPC 170),? is a petition to settle the estate of a deceased person (the decedent) without a formal probate hearing.

In Massachusetts, once that person is appointed by the court to manage the probate estate, he/she is called the "Personal Representative". Before, adopting the Massachusetts Uniform Probate Code in 2012, this person was referred to as the "Executor" or the "Executrix". The bottom line is that they mean the same thing.

Typically the roles and responsibilities of a personal representative include probating your Last Will and Testament, collecting your assets, valuing your assets, filing your final tax returns, canceling credit cards and other accounts, preparing an inventory and accounting of the estate assets, determining and paying ...

When the probate court appoints a personal representative, it issues a document called ?Letters of Authority.? This document is proof of the personal representative's legal authority to collect and manage estate property. The personal representative is entitled to collect a fee for the work performed for the estate.