Massachusetts Affidavit of Heirship for the Owner of the Property

Description

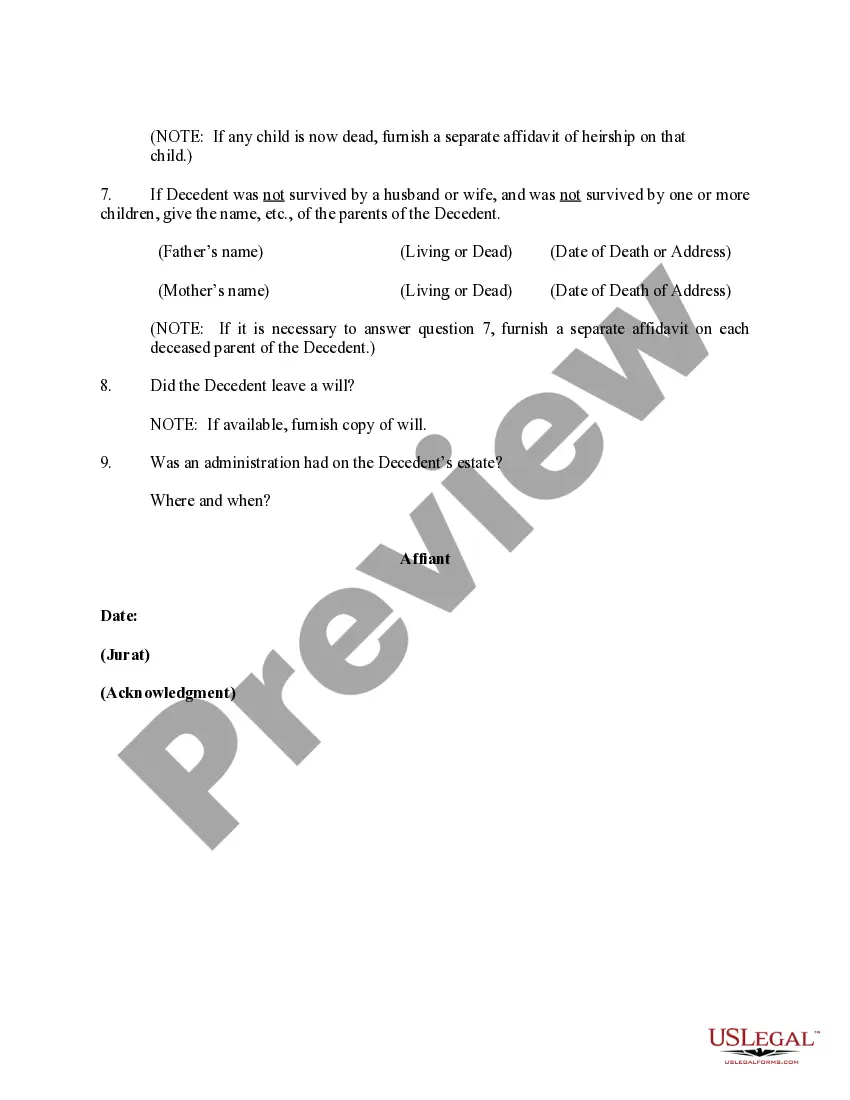

How to fill out Affidavit Of Heirship For The Owner Of The Property?

If you have to comprehensive, obtain, or produce lawful file themes, use US Legal Forms, the biggest assortment of lawful varieties, which can be found on the web. Make use of the site`s easy and handy research to discover the files you require. Various themes for enterprise and personal purposes are sorted by types and claims, or keywords and phrases. Use US Legal Forms to discover the Massachusetts Affidavit of Heirship for the Owner of the Property in a couple of clicks.

Should you be already a US Legal Forms client, log in to the bank account and click on the Acquire button to find the Massachusetts Affidavit of Heirship for the Owner of the Property. You can also entry varieties you formerly downloaded inside the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the right metropolis/nation.

- Step 2. Utilize the Review choice to look over the form`s articles. Never overlook to learn the information.

- Step 3. Should you be not satisfied with the develop, make use of the Look for discipline towards the top of the monitor to locate other types in the lawful develop format.

- Step 4. Upon having identified the form you require, click on the Purchase now button. Choose the rates strategy you choose and add your references to register for the bank account.

- Step 5. Method the transaction. You can utilize your charge card or PayPal bank account to perform the transaction.

- Step 6. Choose the file format in the lawful develop and obtain it on your device.

- Step 7. Comprehensive, revise and produce or indication the Massachusetts Affidavit of Heirship for the Owner of the Property.

Every lawful file format you acquire is your own for a long time. You have acces to each and every develop you downloaded inside your acccount. Go through the My Forms section and select a develop to produce or obtain once more.

Remain competitive and obtain, and produce the Massachusetts Affidavit of Heirship for the Owner of the Property with US Legal Forms. There are millions of specialist and status-distinct varieties you may use to your enterprise or personal needs.

Form popularity

FAQ

What is an heir property owner? You are considered to be an heir property owner if you inherited your primary residence (also called a ?residence homestead?) by (1) will, (2) transfer on death deed, or (3) intestacy ? regardless of whether your ownership interest is recorded in the county's real property records.

An affidavit of heirship is a document used to give property to the heirs of a person who has died. It may be needed if the person did not have a will, or if the will was not approved within four years of their death.

When the probate court appoints a personal representative, it issues a document called "Letters." This document is proof of the personal representative's legal authority to collect and manage estate property. The personal representative is entitled to collect a reasonable fee for the work performed for the estate.

All beneficiaries must agree to the terms of the sale, and the purchase must be made at fair market value.

Each county in Texas has a different filing fee, but the cost of filing an affidavit of heirship runs from $50 to $75. You will likely also need to pay a notary public to witness the document signing.

An affidavit of heir is a written statement that allows an estate to move forward with an uncontested probate. The person who signs the affidavit is agreeing that they are the rightful owner of the assets and that they will transfer them to the appropriate parties as soon as the probate process is complete.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.