Massachusetts Royalty Owner's Statement of Ownership

Description

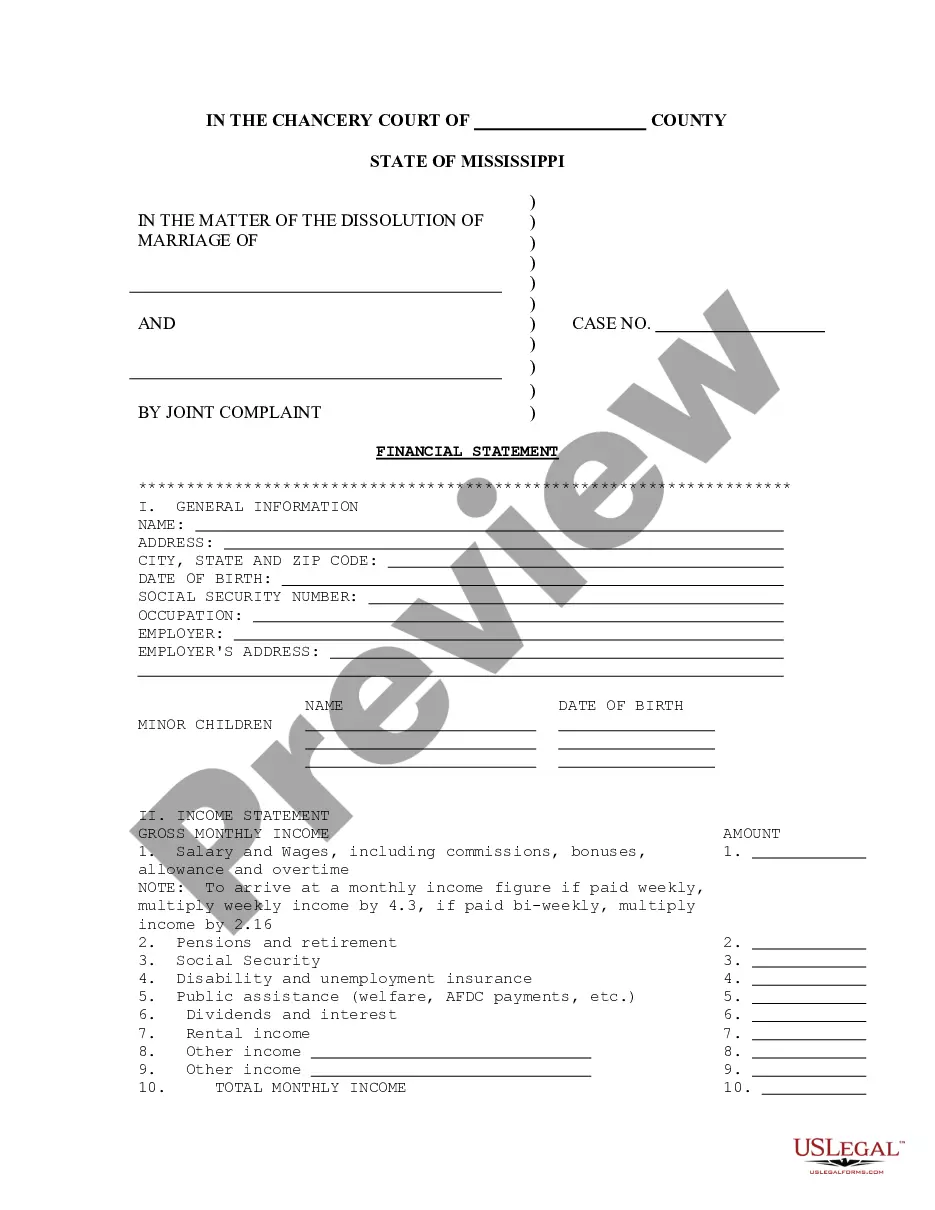

How to fill out Royalty Owner's Statement Of Ownership?

US Legal Forms - among the largest libraries of lawful kinds in the United States - offers an array of lawful papers layouts you may down load or printing. While using website, you will get thousands of kinds for enterprise and specific reasons, categorized by categories, says, or keywords and phrases.You will discover the most up-to-date versions of kinds just like the Massachusetts Royalty Owner's Statement of Ownership within minutes.

If you have a monthly subscription, log in and down load Massachusetts Royalty Owner's Statement of Ownership from the US Legal Forms library. The Down load button will appear on each and every type you perspective. You gain access to all formerly acquired kinds inside the My Forms tab of your profile.

If you wish to use US Legal Forms the first time, listed below are easy recommendations to get you began:

- Make sure you have picked out the best type for your personal town/county. Select the Review button to analyze the form`s information. See the type explanation to actually have chosen the appropriate type.

- If the type doesn`t fit your requirements, utilize the Search discipline on top of the screen to get the the one that does.

- If you are content with the shape, verify your selection by simply clicking the Purchase now button. Then, choose the pricing strategy you want and provide your accreditations to sign up for the profile.

- Approach the transaction. Utilize your credit card or PayPal profile to perform the transaction.

- Select the structure and down load the shape in your product.

- Make changes. Load, revise and printing and indicator the acquired Massachusetts Royalty Owner's Statement of Ownership.

Each format you included with your money does not have an expiry day and it is the one you have forever. So, in order to down load or printing another duplicate, just proceed to the My Forms area and click in the type you want.

Obtain access to the Massachusetts Royalty Owner's Statement of Ownership with US Legal Forms, probably the most considerable library of lawful papers layouts. Use thousands of expert and state-specific layouts that meet your small business or specific requirements and requirements.

Form popularity

FAQ

Massachusetts source income includes items of gross income derived from or effectively connected with any trade or business, including any employment, carried on by the taxpayer in Massachusetts, whether or not the non-resident is actively engaged in a trade or business or employment in Massachusetts in the year in ...

Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources. Use the same format as on Schedule E.

If you're a full-year resident with an annual Massachusetts gross income of more than $8,000, you must file a Massachusetts tax return.

The amount someone pays you to use your property, after you subtract the expenses you have for the property. Royalty income includes any payments you get from a patent, a copyright, or some natural resource that you own.

Personal income taxpayers who have rental, royalty and REMIC income or loss and farm rental income and expenses; income or loss from partnerships and S corporations; and income or loss from grantor-type trusts and non- Massachusetts estates or trusts are required to report income or loss from these sources on a ...