Massachusetts Statement to Add to Credit Report

Description

How to fill out Statement To Add To Credit Report?

Are you presently in a circumstance that you need documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms offers a vast array of form templates, such as the Massachusetts Statement to Add to Credit Report, that are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Statement to Add to Credit Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct state/region.

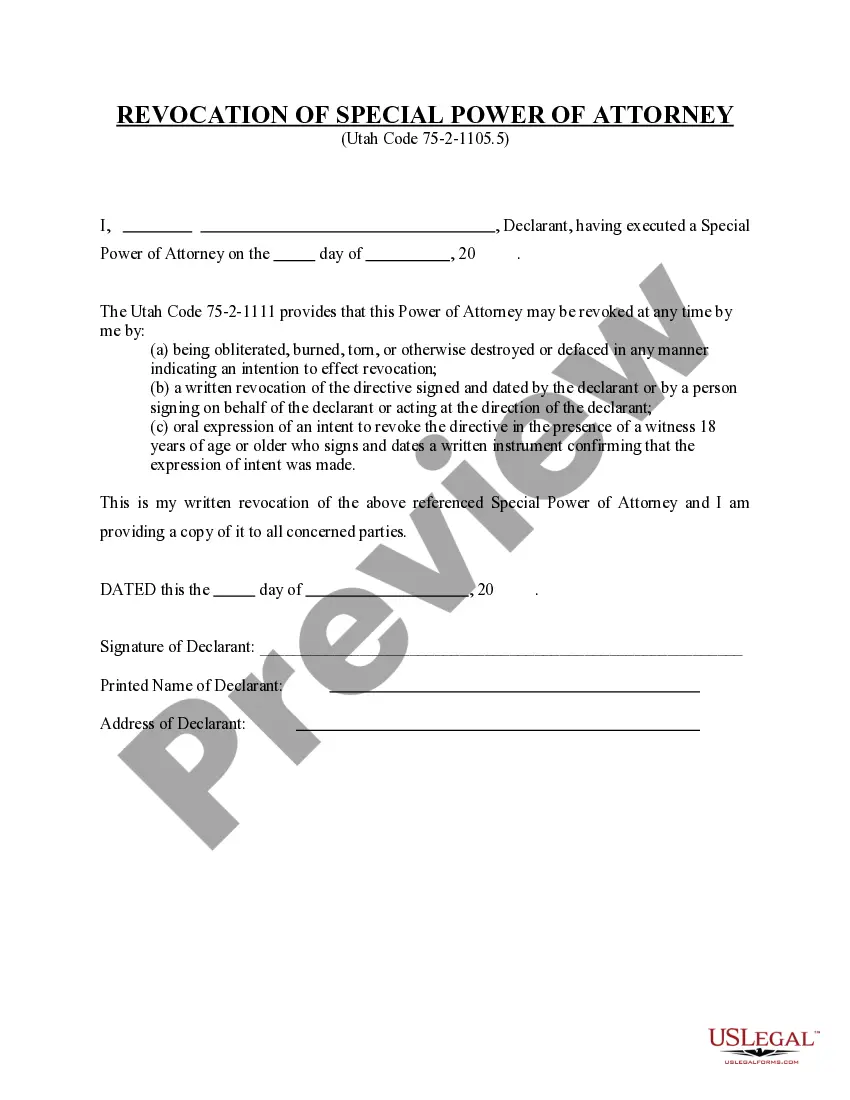

- Utilize the Preview button to view the document.

- Read the description to confirm you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the document that satisfies your needs and requirements.

- Once you find the appropriate form, click Buy now.

- Select the pricing plan you prefer, fill in the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Massachusetts Statement to Add to Credit Report at any time, if needed. Just click on the required form to download or print the document template.

Form popularity

FAQ

To increase your credit score by 100 points in 30 days, focus on paying down high credit card balances and making all your payments on time. Additionally, consider adding a Massachusetts Statement to Add to Credit Report, which can highlight positive financial behaviors. Using USLegalForms can help you create the necessary documentation quickly and efficiently, making this strategy easier to implement. By following these steps, you can see a significant improvement in your credit score.

Putting a freeze on your credit is a wise decision if you want to protect yourself from identity theft. By freezing your credit, you restrict access to your credit report, making it harder for fraudsters to open accounts in your name. If you ever need to add a Massachusetts Statement to Add to Credit Report, you can easily unfreeze it when necessary. This proactive step can provide you peace of mind as you safeguard your financial future.

To add a statement to your credit report, you first need to contact the credit reporting agencies directly. You can provide a brief explanation of the circumstances you want to clarify, and they will guide you through the submission process. Utilizing a Massachusetts Statement to Add to Credit Report can ensure your voice is heard, aiding in correcting any misunderstandings about your credit history. Consider using platforms like uslegalforms to simplify this process and ensure accuracy.

Building credit from 500 to 700 can take several months to a few years, depending on your financial habits. You can improve your credit score by making timely payments, reducing debt, and maintaining low credit utilization. Additionally, using a Massachusetts Statement to Add to Credit Report can provide context to your credit history, potentially aiding your score's growth. Staying consistent with these practices will help you reach your goal.

Yes, you can add a statement to your credit report. This option allows you to provide additional context regarding any negative entries under the Massachusetts Statement to Add to Credit Report. It's important to take this step if you feel that your credit history does not tell the whole story. Using platforms like US Legal Forms can help you create a well-structured statement to include.

Achieving an 800 credit score in 45 days requires focused effort on your credit habits. Start by paying down existing debts, particularly high credit card balances, and ensure you make all your payments on time. Regularly checking your credit report for errors, including adding a Massachusetts Statement to Add to Credit Report if necessary, can help you maintain a strong score. While it is ambitious, consistent, responsible credit behavior can lead you closer to your goal.

To add a statement to your credit report, you can contact the credit reporting agencies directly. Provide them with the Massachusetts Statement to Add to Credit Report that clearly states your concerns or explanations. You may need to submit this in writing or online, depending on the agency's requirements. Using platforms like US Legal Forms can simplify this process by providing the necessary templates and guidance.

Yes, you can include a statement on your credit report, and it can be up to 100 words. This Massachusetts Statement to Add to Credit Report allows you to explain any negative information. Ensure your statement is clear and concise to convey your message effectively. By adding this statement, you provide context that can influence how lenders view your credit history.