Massachusetts Self-Employed Business Development Executive Agreement

Description

How to fill out Self-Employed Business Development Executive Agreement?

Have you ever found yourself in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available on the internet, but locating reliable ones can be challenging.

US Legal Forms offers thousands of template options, including the Massachusetts Self-Employed Business Development Executive Agreement, which are formulated to comply with federal and state regulations.

You can obtain another copy of the Massachusetts Self-Employed Business Development Executive Agreement at any time, if needed.

Simply click the required form to download or print the template. Use US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid errors. The service provides professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Massachusetts Self-Employed Business Development Executive Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Search for the form you need and ensure it is for the correct city/state.

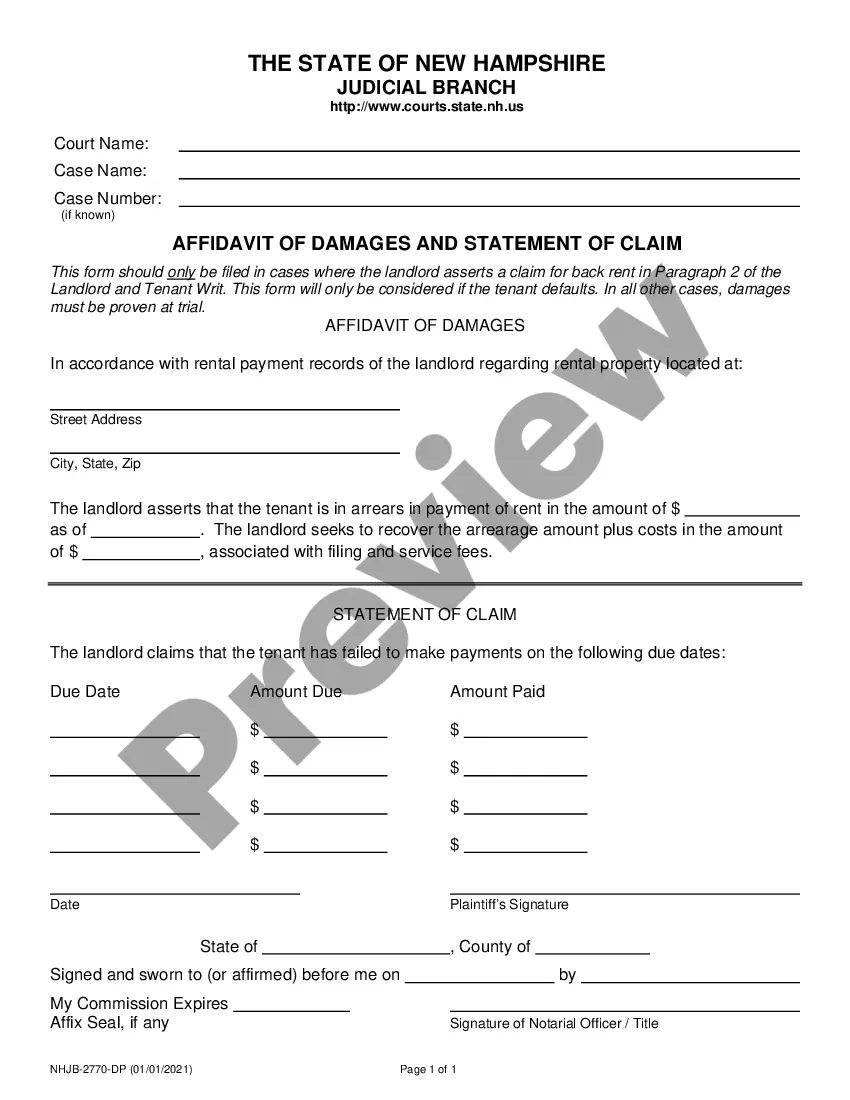

- Utilize the Review button to check the form.

- Examine the information to confirm that you have selected the right document.

- If the form is not what you're seeking, use the Lookup field to find the document that meets your needs and requirements.

- Once you obtain the appropriate form, click Get now.

- Select the pricing plan you desire, fill in the required details to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all of the document templates you have purchased in the My documents menu.

Form popularity

FAQ

Yes, an LLC can exist without an operating agreement in Massachusetts, but it’s not advisable. Operating without this document can lead to confusion and potential conflicts among members regarding their roles and responsibilities. If you are aiming to establish a strong foundation for your business, particularly when navigating a Massachusetts Self-Employed Business Development Executive Agreement, an operating agreement is a crucial element to consider.

Although it is not required, having an operating agreement for your LLC in Massachusetts is highly recommended. This document helps define the management structure and operating procedures, ensuring smooth operations. For those involved in a Massachusetts Self-Employed Business Development Executive Agreement, an operating agreement can further clarify roles and provide legal protection in potential disputes.

While Massachusetts does not require an operating agreement for LLCs, a few states do mandate one. For example, California, New York, and Delaware require an operating agreement as part of their registration processes. Understanding these regulations is essential, especially for individuals creating agreements like the Massachusetts Self-Employed Business Development Executive Agreement, as they lay the groundwork for your LLC’s governance.

While Massachusetts law does not legally require an LLC to have an operating agreement, it strongly recommends having one. This document serves as the internal guide for the LLC's operations and helps prevent misunderstandings among members. For those entering into a Massachusetts Self-Employed Business Development Executive Agreement, an operating agreement can clarify the partnership's structure and duties, making it easier to manage the business.

A business development agreement is a contract that outlines the partnership between a business and a development executive in order to foster growth and expansion. This agreement details roles, responsibilities, compensation, and other essential terms. If you're working as a self-employed business development executive in Massachusetts, such an agreement can provide a clear framework for your collaboration and expectations, particularly when tied to your Massachusetts Self-Employed Business Development Executive Agreement.

Yes, if you are operating a business in Massachusetts, even if it is registered out of state, you typically need to register your business with the Massachusetts Secretary of State. This registration can formalize your operations and clarify your legal responsibilities. Including this provision in your Massachusetts Self-Employed Business Development Executive Agreement ensures compliance.

The self-employment tax rate is typically set at 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare. However, your total tax burden may vary based on additional income and applicable deductions. Understanding this is vital when forming your Massachusetts Self-Employed Business Development Executive Agreement, as it aids in accurate budget planning.

Yes, you can draft your own Massachusetts Self-Employed Business Development Executive Agreement. However, creating a comprehensive and legally sound contract can be complex. It is essential to ensure that your agreement covers all necessary terms and protects your interests. Using a reliable service like US Legal Forms can provide you with templates and guidance, making the process smoother and more efficient.

Yes, employment contracts, including a Massachusetts Self-Employed Business Development Executive Agreement, are generally enforceable in Massachusetts, provided they meet specific legal criteria. These contracts must include clear terms, such as job responsibilities, compensation, and duration of the agreement. Additionally, both parties must agree to the terms willingly, without coercion or deception. For those navigating these agreements, platforms like uslegalforms can offer valuable templates and guidance to ensure compliance with state laws.