Massachusetts Milker Services Contract - Self-Employed

Description

How to fill out Milker Services Contract - Self-Employed?

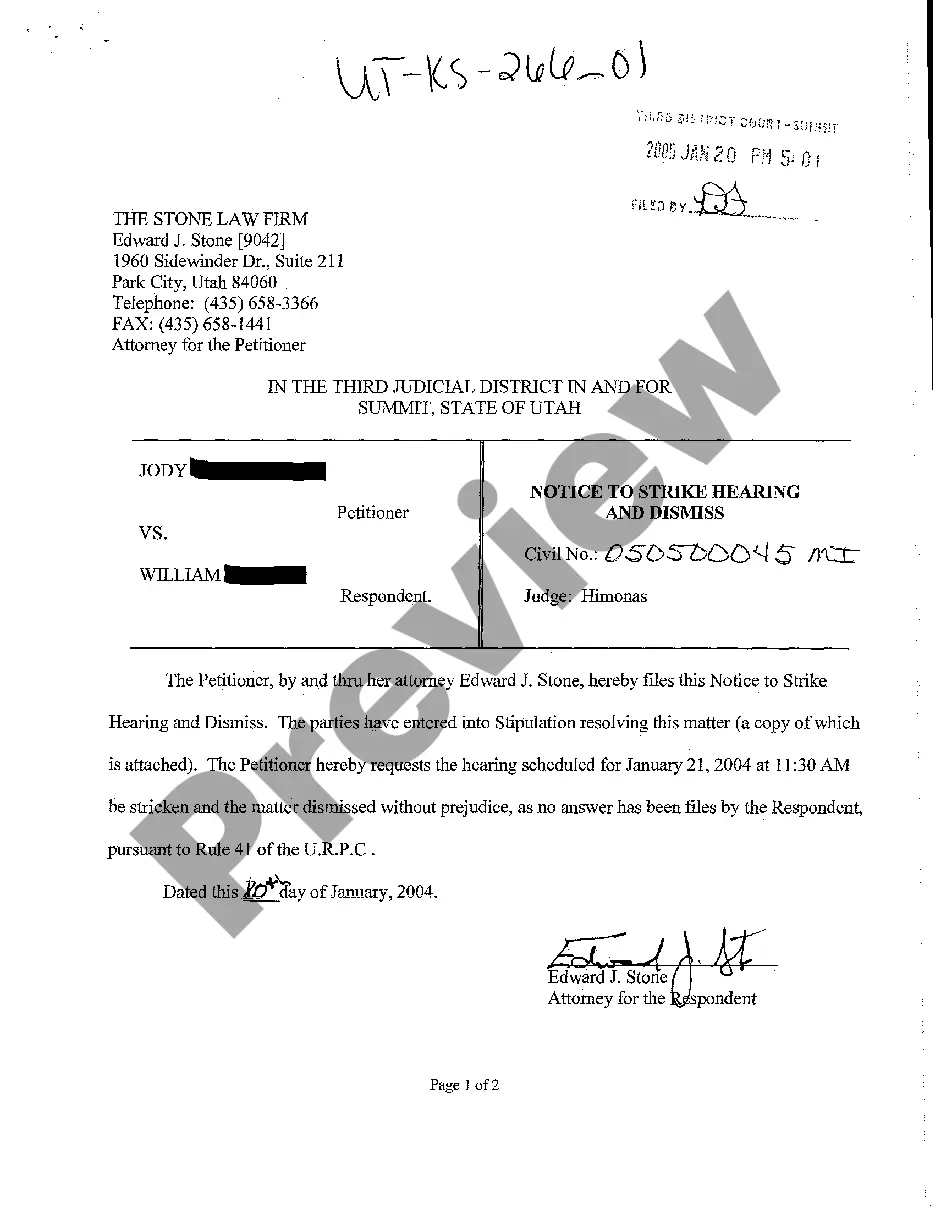

You can dedicate multiple hours online trying to locate the legal document template that meets the federal and state requirements you have. US Legal Forms offers a multitude of legal documents that can be reviewed by professionals.

If you already possess a US Legal Forms account, you may Log In and click the Download button. Afterwards, you can complete, modify, print, or sign the Massachusetts Milker Services Contract - Self-Employed. Every legal document template you purchase is yours permanently.

To obtain another copy of any acquired form, navigate to the My documents section and click the corresponding button. If you are using the US Legal Forms website for the first time, follow these simple instructions.

Select the format of your document and download it to your device. Make adjustments to your document if required. You can complete, modify, sign, and print the Massachusetts Milker Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- Firstly, ensure you have chosen the correct document template for your state/town of preference.

- Read the form description to confirm you have selected the right form.

- If available, utilize the Review button to examine the document template as well.

- To acquire another version of your form, use the Search field to find the template that suits your needs and requirements.

- Once you have located the template you need, click on Purchase now to continue.

- Choose the pricing plan you desire, enter your details, and register for an account on US Legal Forms.

- Finalize the transaction. You may use your Visa or Mastercard or PayPal account to pay for the legal form.

Form popularity

FAQ

The 3 hour rule in Massachusetts generally refers to labor regulations that protect workers by requiring employers to compensate them for a minimum amount of time if their work is canceled. For self-employed individuals, understanding such regulations is crucial for your operations. A Massachusetts Milker Services Contract - Self-Employed can help ensure compliance and outline your rights. Knowledge of local laws can empower you in your independent work.

Self-employed individuals operate their own businesses, while contracted workers provide services to a client under specific terms. A Massachusetts Milker Services Contract - Self-Employed can clarify this distinction by outlining the expectations and obligations for both parties. Understanding this difference helps you navigate your options as a business professional. Having a clear contract is key to your success.

Not having a contract can lead to numerous complications in your freelance work. A Massachusetts Milker Services Contract - Self-Employed serves as your safeguard, defining the terms of your agreement with clients. Without a contract, you may struggle to prove your work terms or defend against payment disputes. Having a signed contract is essential for peace of mind.

Yes, you can be an independent contractor in Massachusetts, and many individuals choose this route. To protect your interests, a Massachusetts Milker Services Contract - Self-Employed is highly beneficial. This contract outlines your rights and responsibilities while ensuring compliance with state regulations. Using a detailed contract can greatly enhance your professional dealings.

While it is possible to work as a 1099 employee without a formal contract, it is not recommended. A Massachusetts Milker Services Contract - Self-Employed outlines the details of your engagement, including project scope and payment methods. Without this clear agreement, you may face challenges in establishing your rights or expectations. Therefore, always consider using a contract for your protection.

Yes, having a contract is crucial for self-employed individuals. A Massachusetts Milker Services Contract - Self-Employed ensures clarity regarding your responsibilities and the expectations of your clients. This contract also provides legal protection if a disagreement occurs. Ultimately, having a clear contract fosters trust and professionalism in your freelance work.

While it is technically possible to freelance without a contract, it is not advisable. A Massachusetts Milker Services Contract - Self-Employed protects both you and your client by defining the scope of work, payment terms, and other essential details. Without a contract, misunderstandings can arise, leading to disputes. Therefore, securing a contract is a wise move for freelancers.

To write a contract for a 1099 employee, specify the nature of the work, payment terms, and deadlines. Ensure you outline the responsibilities and deliverables clearly, as this will help in avoiding misunderstandings. Templates like the Massachusetts Milker Services Contract - Self-Employed available on US Legal Forms can streamline this process and provide you with a solid framework.

Writing a self-employed contract requires clarity and precision in detailing the work expectations. Start with a title, include the parties involved, and specify the services, payment terms, and deadlines. If you utilize a Massachusetts Milker Services Contract - Self-Employed from US Legal Forms, you can easily adhere to these guidelines and ensure a strong contractual foundation.

To demonstrate that you are self-employed, gather documents such as tax returns, profit and loss statements, and contracts with clients. In addition, you may want to document your work hours and services provided. Having a clear Massachusetts Milker Services Contract - Self-Employed can enhance your credibility and provide verification of your self-employment status.