US Legal Forms - among the largest libraries of legitimate varieties in America - provides an array of legitimate record web templates it is possible to download or print out. While using website, you will get a large number of varieties for company and personal functions, categorized by classes, claims, or search phrases.You will discover the most up-to-date models of varieties like the Virgin Islands Guide to Complying with the Red Flags Rule under FCRA and FACTA in seconds.

If you already possess a registration, log in and download Virgin Islands Guide to Complying with the Red Flags Rule under FCRA and FACTA from your US Legal Forms local library. The Acquire switch will show up on every single kind you perspective. You have accessibility to all previously saved varieties from the My Forms tab of your own account.

In order to use US Legal Forms the first time, allow me to share basic recommendations to help you began:

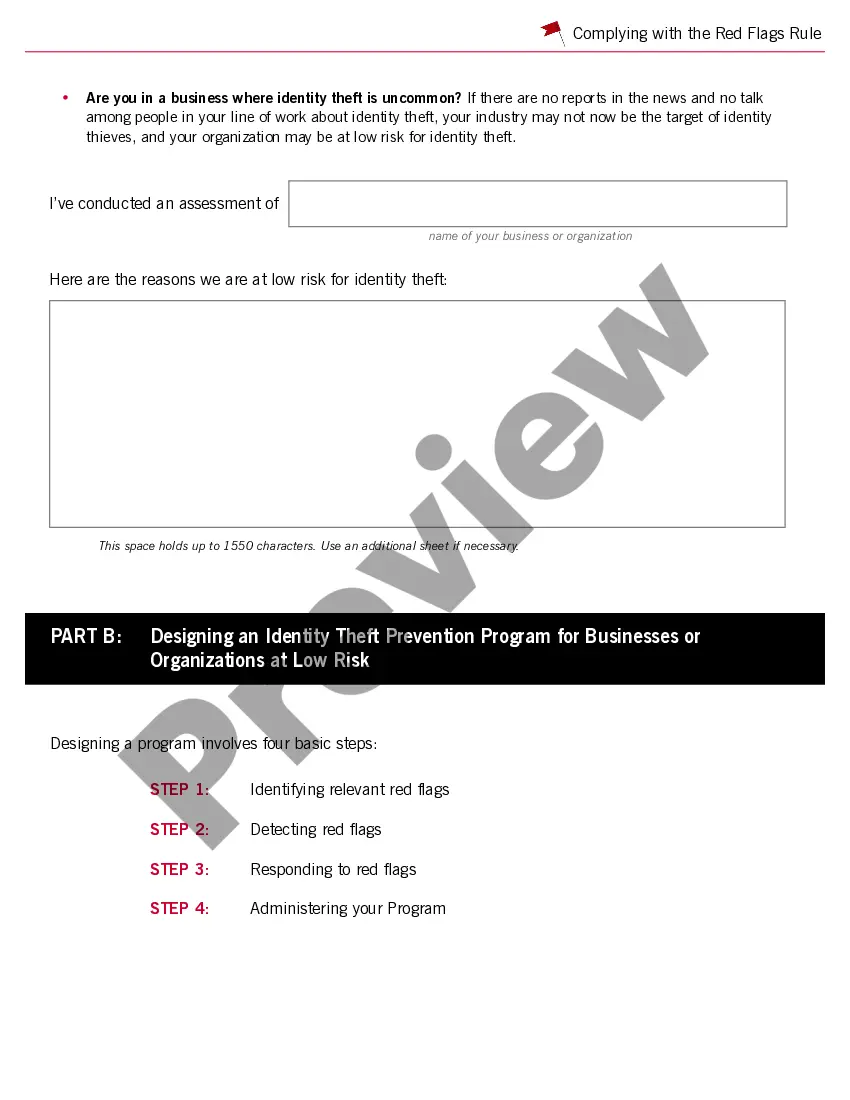

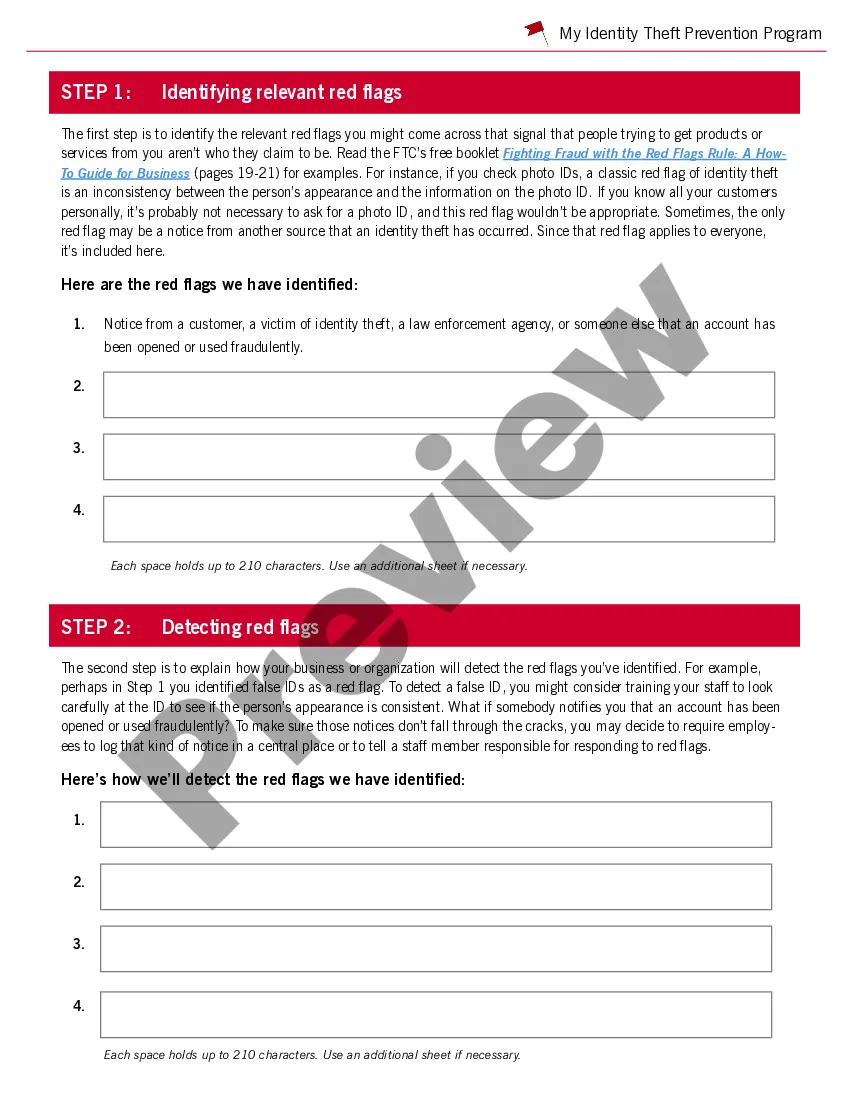

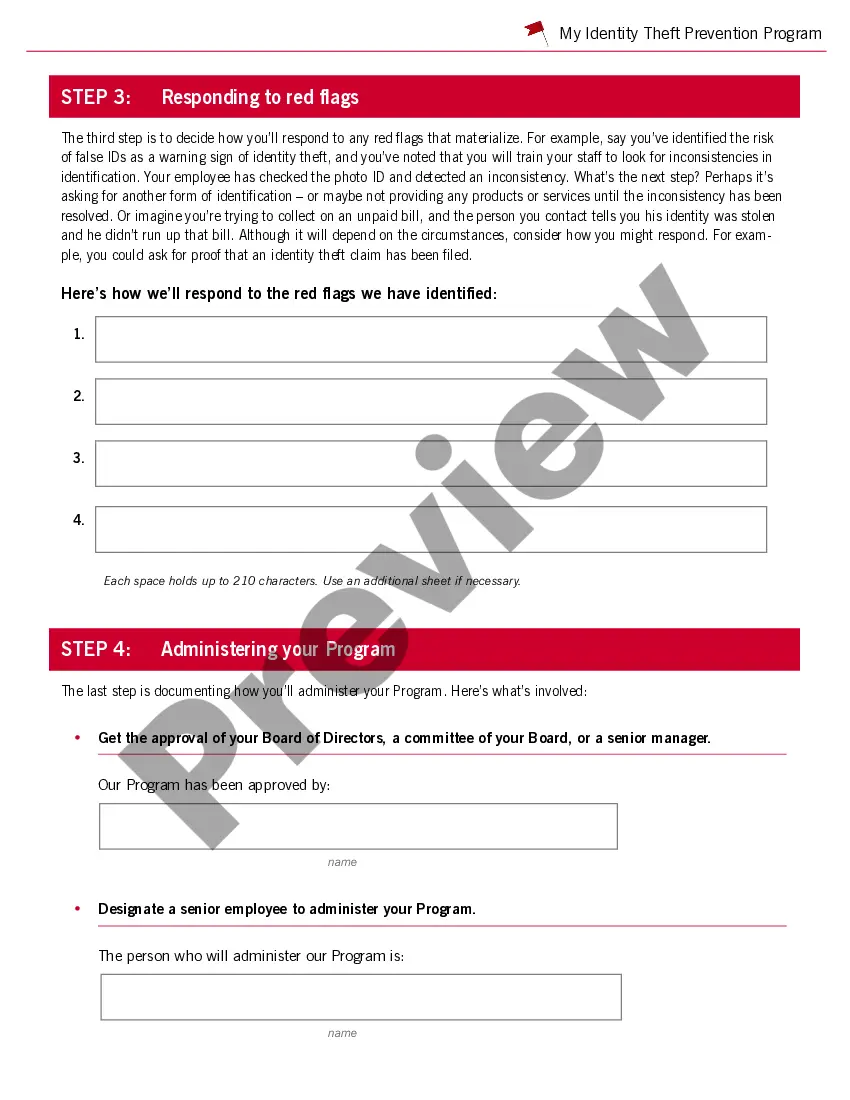

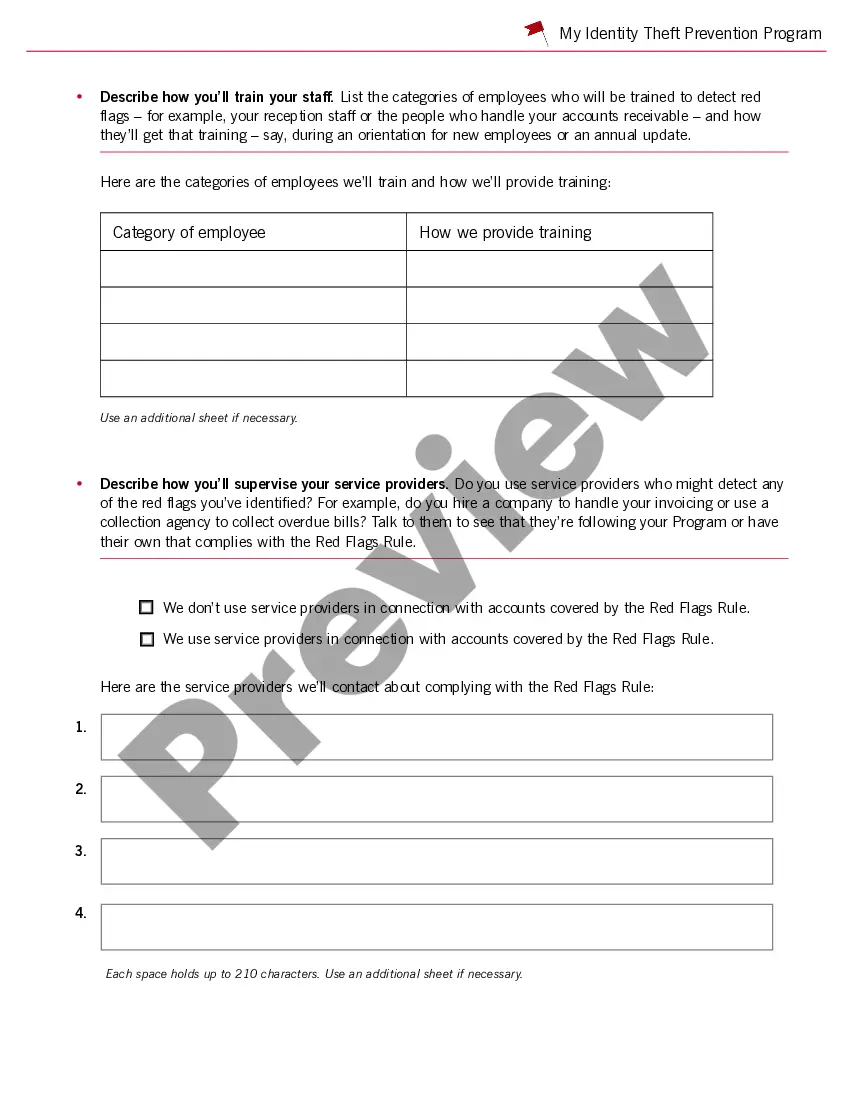

- Be sure you have chosen the correct kind for your city/area. Go through the Preview switch to analyze the form`s content. Browse the kind description to ensure that you have selected the proper kind.

- In the event the kind doesn`t suit your demands, utilize the Search discipline at the top of the monitor to discover the one who does.

- If you are satisfied with the form, validate your decision by simply clicking the Purchase now switch. Then, choose the prices program you want and provide your references to register for the account.

- Method the deal. Make use of Visa or Mastercard or PayPal account to finish the deal.

- Find the formatting and download the form on the gadget.

- Make changes. Load, change and print out and sign the saved Virgin Islands Guide to Complying with the Red Flags Rule under FCRA and FACTA.

Each format you included in your account lacks an expiry time which is your own eternally. So, if you wish to download or print out one more copy, just go to the My Forms section and click around the kind you want.

Gain access to the Virgin Islands Guide to Complying with the Red Flags Rule under FCRA and FACTA with US Legal Forms, the most considerable local library of legitimate record web templates. Use a large number of professional and condition-distinct web templates that fulfill your organization or personal requirements and demands.