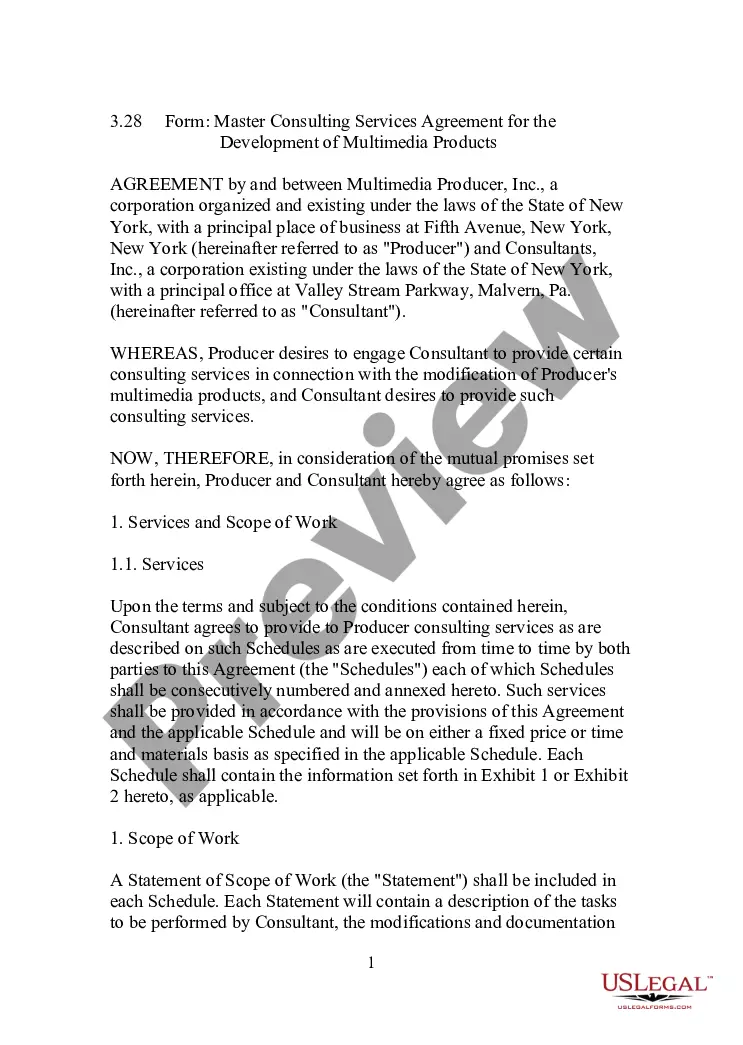

Massachusetts Multimedia Product Modification Agreement

Description

How to fill out Multimedia Product Modification Agreement?

US Legal Forms - one of many biggest libraries of authorized forms in America - gives an array of authorized document templates you can acquire or print. Making use of the website, you will get a huge number of forms for business and person functions, sorted by categories, states, or keywords.You can find the most up-to-date versions of forms just like the Massachusetts Multimedia Product Modification Agreement in seconds.

If you have a membership, log in and acquire Massachusetts Multimedia Product Modification Agreement from the US Legal Forms collection. The Download key will appear on each and every type you see. You get access to all earlier acquired forms inside the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, listed here are simple guidelines to get you started out:

- Be sure to have selected the right type for your town/county. Click on the Review key to check the form`s content material. Browse the type description to actually have chosen the right type.

- When the type doesn`t satisfy your needs, make use of the Look for industry on top of the monitor to get the one who does.

- If you are satisfied with the form, affirm your choice by visiting the Buy now key. Then, choose the prices strategy you want and supply your references to register on an bank account.

- Procedure the financial transaction. Use your charge card or PayPal bank account to complete the financial transaction.

- Choose the file format and acquire the form on the device.

- Make alterations. Complete, change and print and indicator the acquired Massachusetts Multimedia Product Modification Agreement.

Every web template you included in your money does not have an expiration date and it is yours eternally. So, in order to acquire or print another copy, just visit the My Forms portion and click in the type you require.

Obtain access to the Massachusetts Multimedia Product Modification Agreement with US Legal Forms, probably the most comprehensive collection of authorized document templates. Use a huge number of specialist and condition-distinct templates that meet your business or person requirements and needs.

Form popularity

FAQ

(a) General Rule. Generally, charges for the access or use of software on a remote server are subject to tax. However, where there is no charge for the use of the software and the object of the transaction is acquiring a good or service other than the use of the software, sales or use tax does not apply.

Ing to the Department~'s data processing regulations, the punching or input of data is taxable only if it is the sole service provided under a contract. It is not taxable when performed as a step in processing a client's data.

When is the cooling-off period allowed? Door-to-Door Sales: If you make a purchase for over $25 at a place other than a merchant's usual place of business, Massachusetts and federal law allows you three days to cancel and get your money back.

ITT72 | IT Network Services, Communications Services and Related Equipment. IntraSystems has been awarded ITT72, IT Network Services, Communications Services, and Related Equipment for the Commonwealth of Massachusetts.

Massachusetts broadly taxes SaaS and other cloud services, but taxes virtually no digital goods, but for gaming, which the state has determined is taxable. This means that businesses that provide SaaS products will need to collect and remit sales tax to the state.

Oklahoma does not tax any cloud, SaaS, or digital products. Generally speaking, the state only taxes physical goods and limited, explicitly enumerated services. This means that businesses offering digital products in the state most likely do not need to collect and remit sales tax on Oklahoma transactions.

California generally does not require sales tax on Software-as-a-Service.

Sales of food for human consumption (other than meals sold by a restaurant) and clothing costing $175 or less. For items that cost more than $175, sales tax is only due on the amount over $175 per item.