Massachusetts Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant

Description

How to fill out Subscription Agreement Between Ichargeit.Com, Inc. And Prospective Investor For The Purchase Of Units Consisting Of Common Stock And Common Stock Warrant?

Are you currently inside a placement the place you need papers for possibly enterprise or specific uses almost every day time? There are a lot of legal file web templates accessible on the Internet, but finding versions you can rely on is not straightforward. US Legal Forms provides thousands of develop web templates, such as the Massachusetts Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant, that happen to be created in order to meet federal and state demands.

Should you be currently informed about US Legal Forms site and have your account, merely log in. Next, you can down load the Massachusetts Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant format.

Should you not offer an account and wish to begin to use US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is for your appropriate town/region.

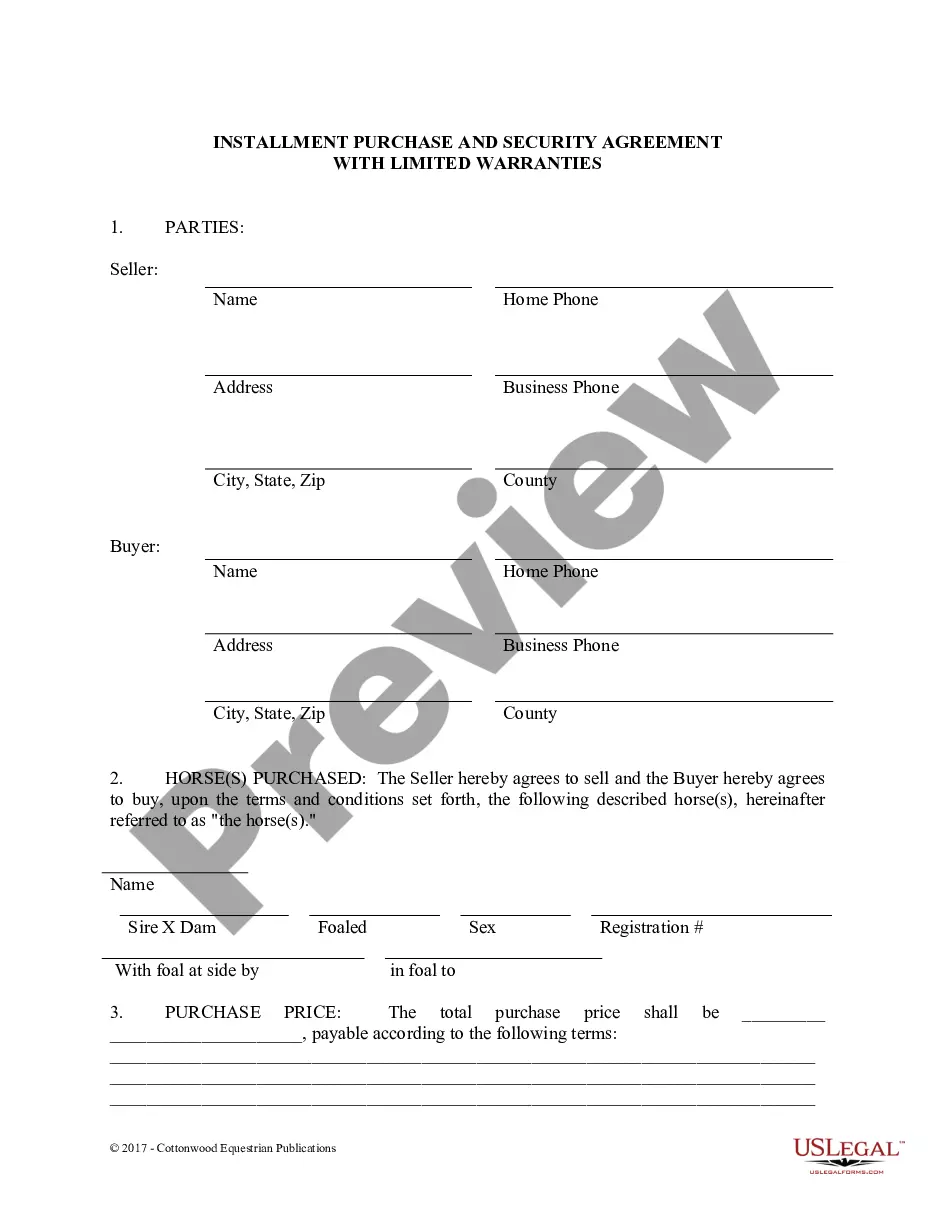

- Use the Preview key to examine the shape.

- See the description to ensure that you have chosen the right develop.

- If the develop is not what you are seeking, use the Search field to get the develop that meets your requirements and demands.

- Whenever you get the appropriate develop, click on Buy now.

- Opt for the costs plan you would like, submit the specified details to create your bank account, and pay for an order using your PayPal or charge card.

- Pick a convenient data file file format and down load your copy.

Locate all the file web templates you possess purchased in the My Forms food selection. You may get a extra copy of Massachusetts Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant any time, if needed. Just select the required develop to down load or print the file format.

Use US Legal Forms, one of the most extensive assortment of legal forms, to conserve time as well as prevent mistakes. The service provides skillfully produced legal file web templates which you can use for an array of uses. Produce your account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

Depending on the requirements of each company, a share subscription agreement can vary widely, but some common clauses are confidentiality, fulfillment of a precondition, tranches, and guarantee and indemnity. A share purchase agreement is an agreement made between two parties.

What is a Subscription Agreement? A master subscription agreement is a legal document that outlines the terms and conditions of a subscription-based relationship between a business and its users.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.

What is an LLC Subscription Agreement? An LLC subscription agreement is an investor's application to join a limited liability company (LLC). It is also a two-way guarantee between a company and a new shareholder (subscriber).

A well organized and well-structured subscription agreement will include the details about the transaction, the number of shares being sold and the price per share, and any legally binding confidentiality agreements and clauses.

There are advantages as well as disadvantages of each agreement. A share purchase agreement differs from a share subscription agreement because a share purchase agreement has a seller that is not the business itself. In a subscription agreement, the business agrees to sell shares to a subscriber.

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.