A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Massachusetts Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

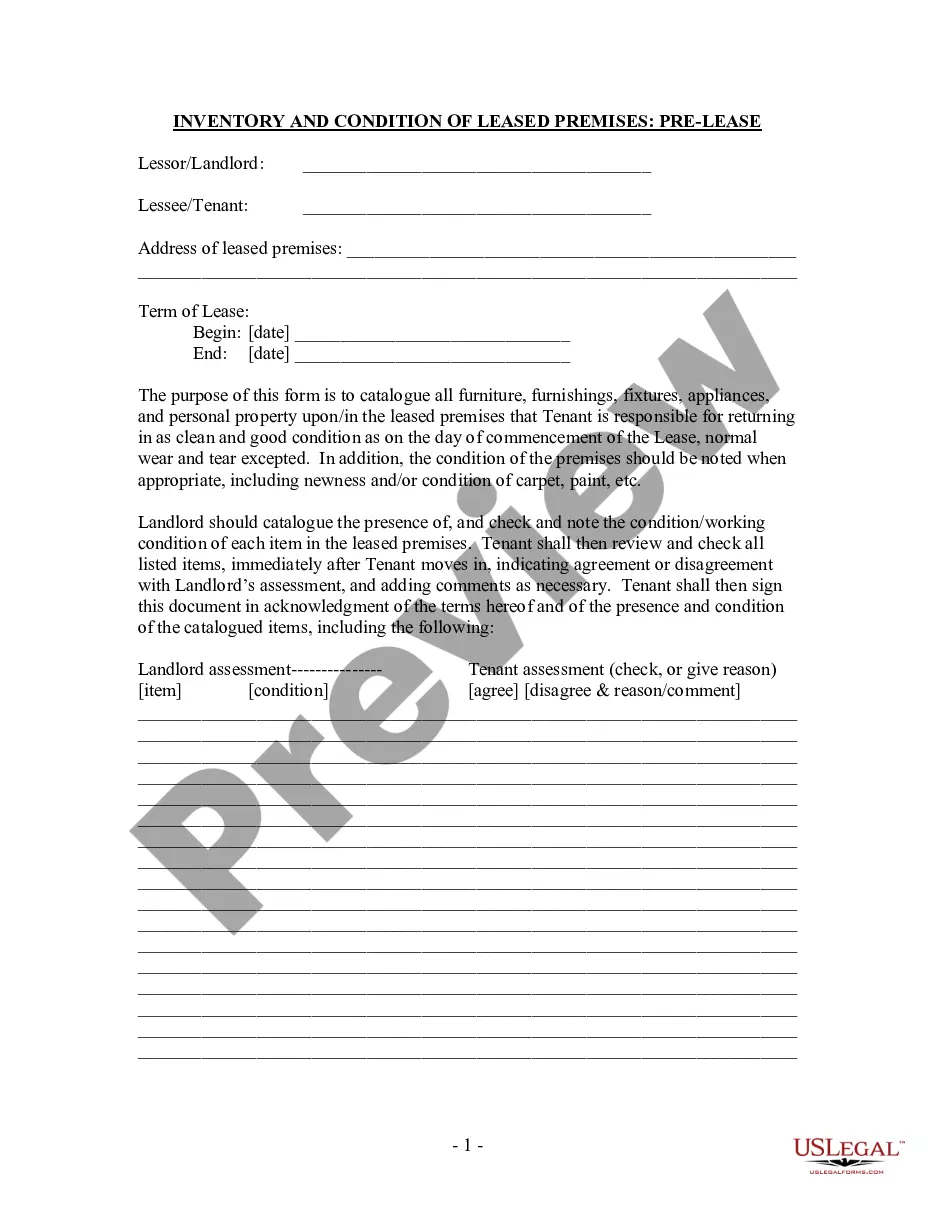

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

If you wish to fulfill, obtain, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Take advantage of the site's simple and convenient search to find the documents you require. Various templates for corporate and personal purposes are categorized by type and jurisdiction, or keywords.

Utilize US Legal Forms to acquire the Massachusetts Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law in just a few clicks.

Every legal document format you acquire is yours to keep indefinitely. You have access to every form you downloaded within your account. Visit the My documents section and select a form to print or download again.

Be proactive and acquire, and print the Massachusetts Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and then click the Download button to retrieve the Massachusetts Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions listed below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to peruse the content of the form. Don't forget to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the display to find alternative types of your legal document format.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Process the payment. You may use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, revise, and print or sign the Massachusetts Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

Form popularity

FAQ

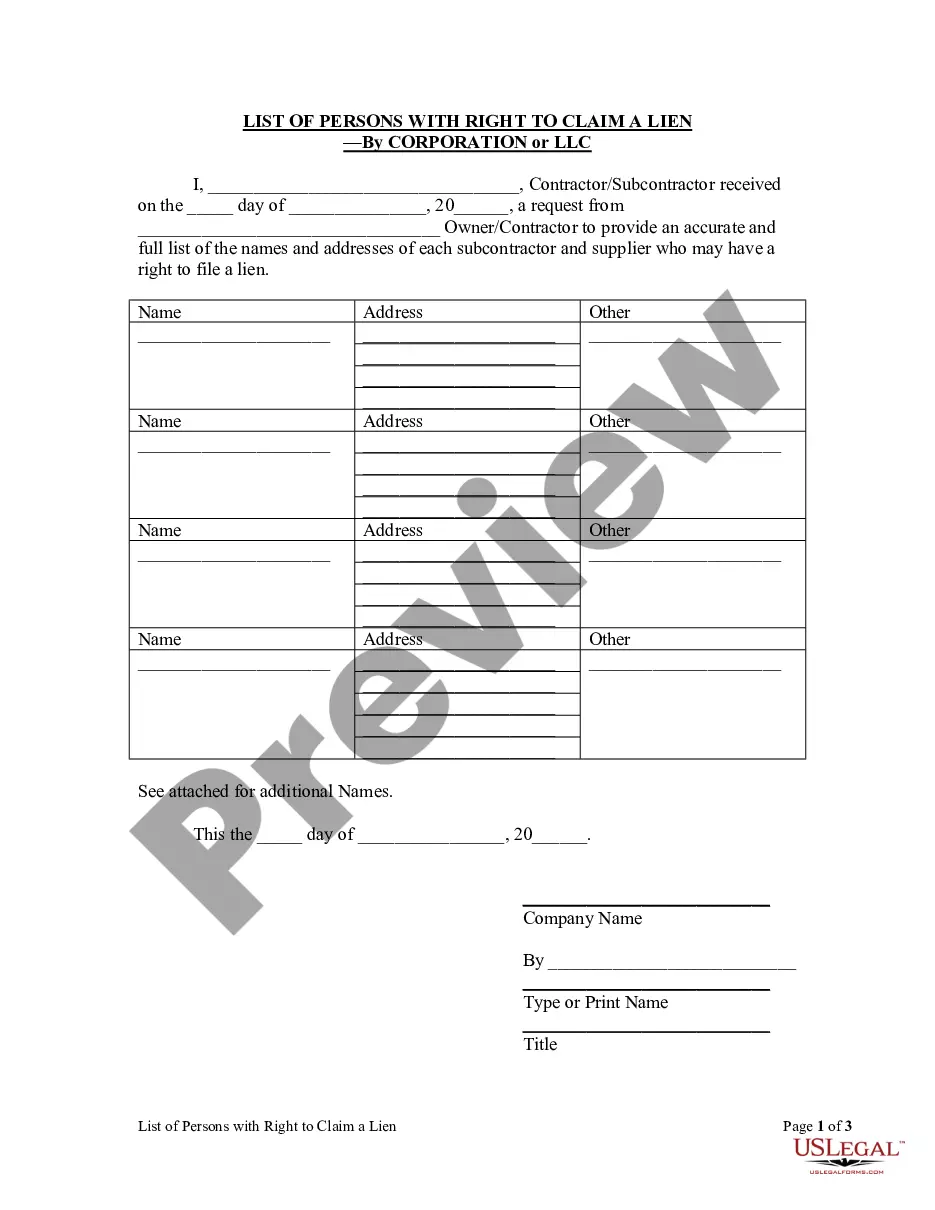

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Massachusetts laws "The statute of limitations for consumer-related debt is six years. This period applies to credit card debt and oral and written contracts. However, if the debt collector has obtained a judgment against the debtor, the statute of limitations extends to 20 years."

Write and Mail a LetterState that you're requesting validation of the debt or removal of the debt from your credit report. Then mail the letter and request a return receipt so you have proof that you sent it and that the collection agency received it.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay. Get help with your money questions.

Requesting validation of the debt is crucial. It serves two purposes: First, it requires the debt collector to provide proof that the debt is actually yours. This includes proof of the debt itself, and proof of assignment if the account is now owned by someone else.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

It's a violation of the collection practices act for a debt collector to refuse to send a validation notice or fail to respond to your verification letter. If you encounter such behavior, you can file a complaint with the Consumer Financial Protection Bureau.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.