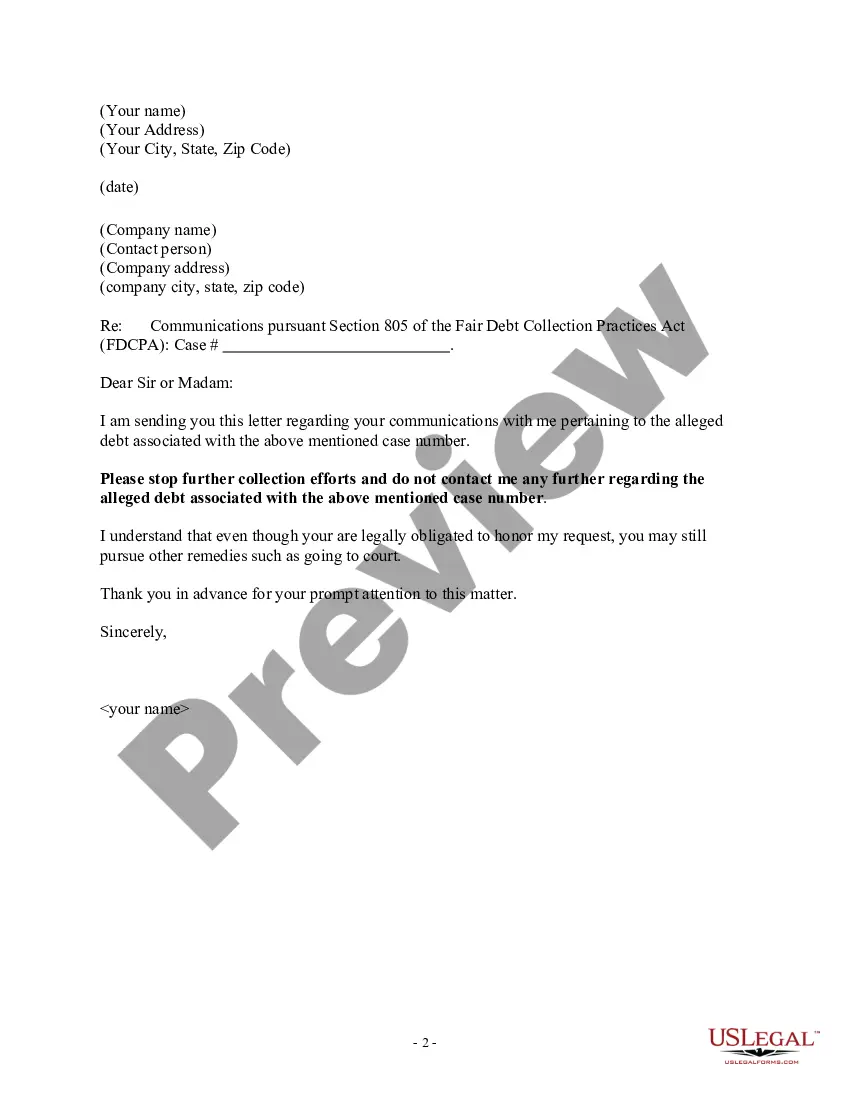

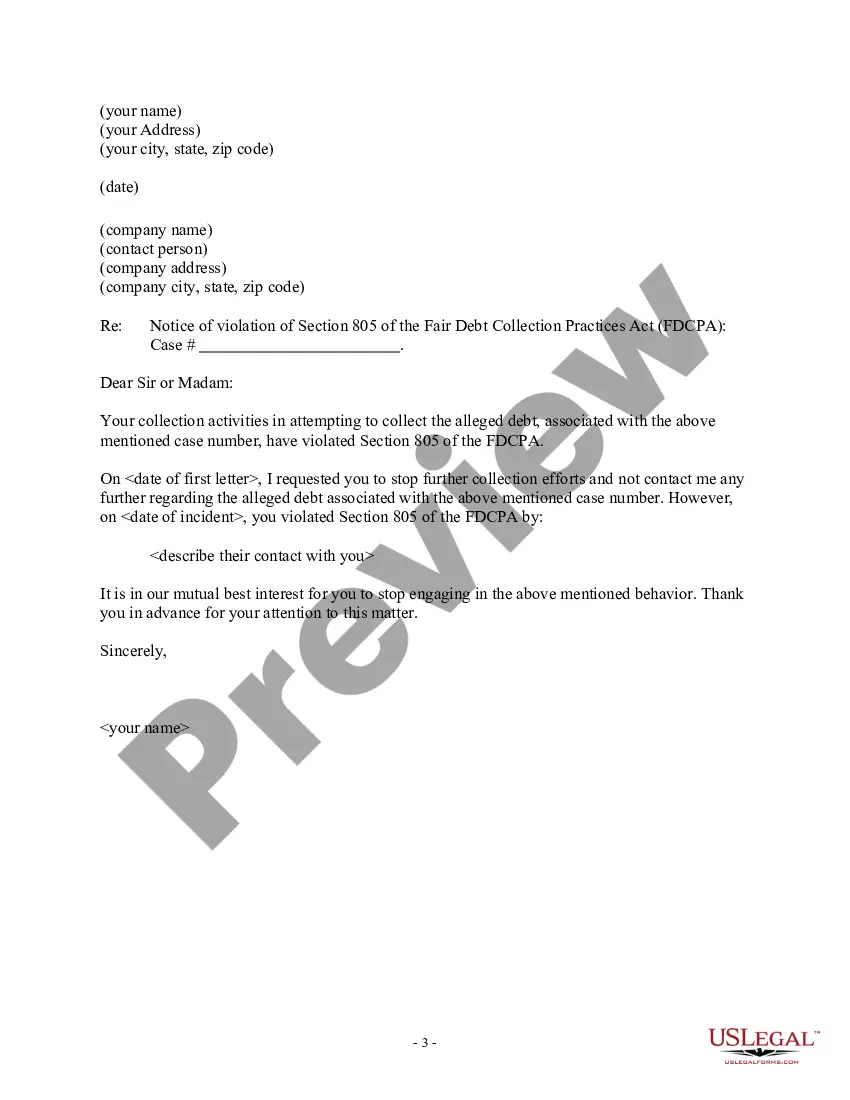

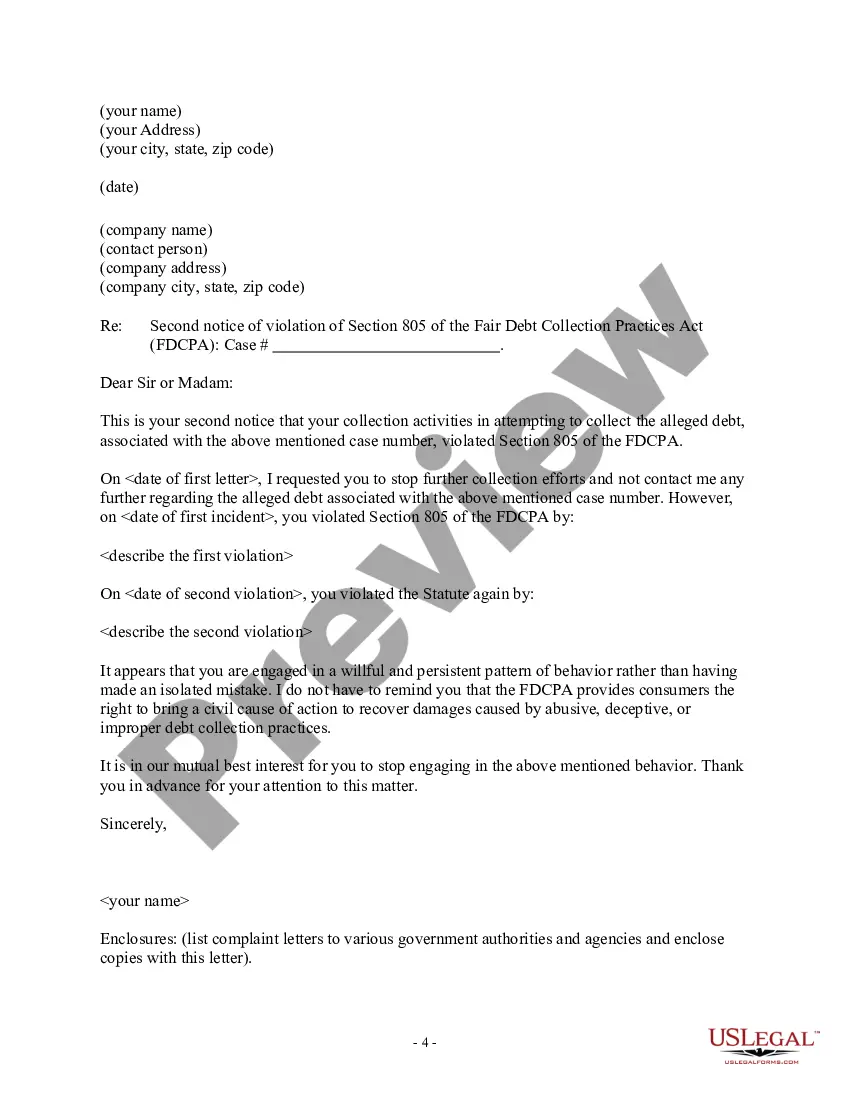

Massachusetts Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a broad selection of legal form templates that you can download or print. Utilizing the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can swiftly acquire the latest versions of forms such as the Massachusetts Notice of Violation of Fair Debt Act - Notice to Cease Communication.

If you already possess a membership, sign in and procure the Massachusetts Notice of Violation of Fair Debt Act - Notice to Cease Communication from your US Legal Forms library. The Download button will appear on every form you access. You have access to all previously downloaded forms within the My documents tab of your account.

Finalize the transaction. Use your credit card or PayPal account to complete the purchase.

Choose the format and download the form to your device. Make edits. Fill out, adjust, print, and sign the downloaded Massachusetts Notice of Violation of Fair Debt Act - Notice to Cease Communication. Every template you add to your account does not expire and is yours permanently. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Massachusetts Notice of Violation of Fair Debt Act - Notice to Cease Communication with US Legal Forms, the most comprehensive library of legal form templates. Utilize thousands of expert and state-specific templates that cater to your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s content.

- Consult the form description to confirm you have selected the right form.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find the one that does.

- If you are content with the form, validate your selection by clicking the Get now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

It's a violation of the collection practices act for a debt collector to refuse to send a validation notice or fail to respond to your verification letter. If you encounter such behavior, you can file a complaint with the Consumer Financial Protection Bureau.

How do I answer the complaint?Read the summons and make sure you know the date you must answer by.Read the complaint carefully.Write your answer.Sign and date the answer.Make copies for the plaintiff and yourself.Mail a copy to the plaintiff.File your answer with the court by the date on the summons.

The statute of limitations for debt collection in Massachusetts is six years. That means that a creditor or debt collector has six years from the last payment on a debt to take a Massachusetts resident to court (even if the company is in a state that has a different statute of limitations).

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

Requesting validation of the debt is crucial. It serves two purposes: First, it requires the debt collector to provide proof that the debt is actually yours. This includes proof of the debt itself, and proof of assignment if the account is now owned by someone else.

Write and Mail a LetterState that you're requesting validation of the debt or removal of the debt from your credit report. Then mail the letter and request a return receipt so you have proof that you sent it and that the collection agency received it.

Take your written answer to the clerk's office. The clerk will take your documents and stamp each set of papers "filed" with the date. They will then give the copies back to you. One copy is for you to keep. The other copy you're responsible for delivering to the plaintiff (or their attorney).

The Consumer Financial Protection Bureau announced an interim rule on Monday, April 19th, 2021, that will allow tenants to sue debt collectors who violate the CDC's national ban on evictions. Attorneys for landlords and other debt collectors who wrongly evict tenants could also face federal and state prosecution.

Massachusetts Deadline for Answering a Debt Collection Summons.Massachusetts Answer to Summons Forms.Create an Answer Document.Answer each issue of the Complaint.Assert affirmative defenses and counterclaims.File the answer with the court and serve the plaintiff.Statute of Limitations on Debt in Massachusetts.More items...?