Massachusetts Security ownership of directors, nominees and officers showing sole and shared ownership

Description

How to fill out Security Ownership Of Directors, Nominees And Officers Showing Sole And Shared Ownership?

US Legal Forms - one of the largest libraries of authorized forms in the United States - offers a variety of authorized file web templates it is possible to obtain or produce. While using website, you may get thousands of forms for company and specific uses, categorized by groups, claims, or search phrases.You can get the most recent types of forms just like the Massachusetts Security ownership of directors, nominees and officers showing sole and shared ownership within minutes.

If you currently have a membership, log in and obtain Massachusetts Security ownership of directors, nominees and officers showing sole and shared ownership from your US Legal Forms library. The Obtain button will show up on each and every form you look at. You gain access to all in the past downloaded forms inside the My Forms tab of your own profile.

If you want to use US Legal Forms initially, allow me to share simple recommendations to get you started:

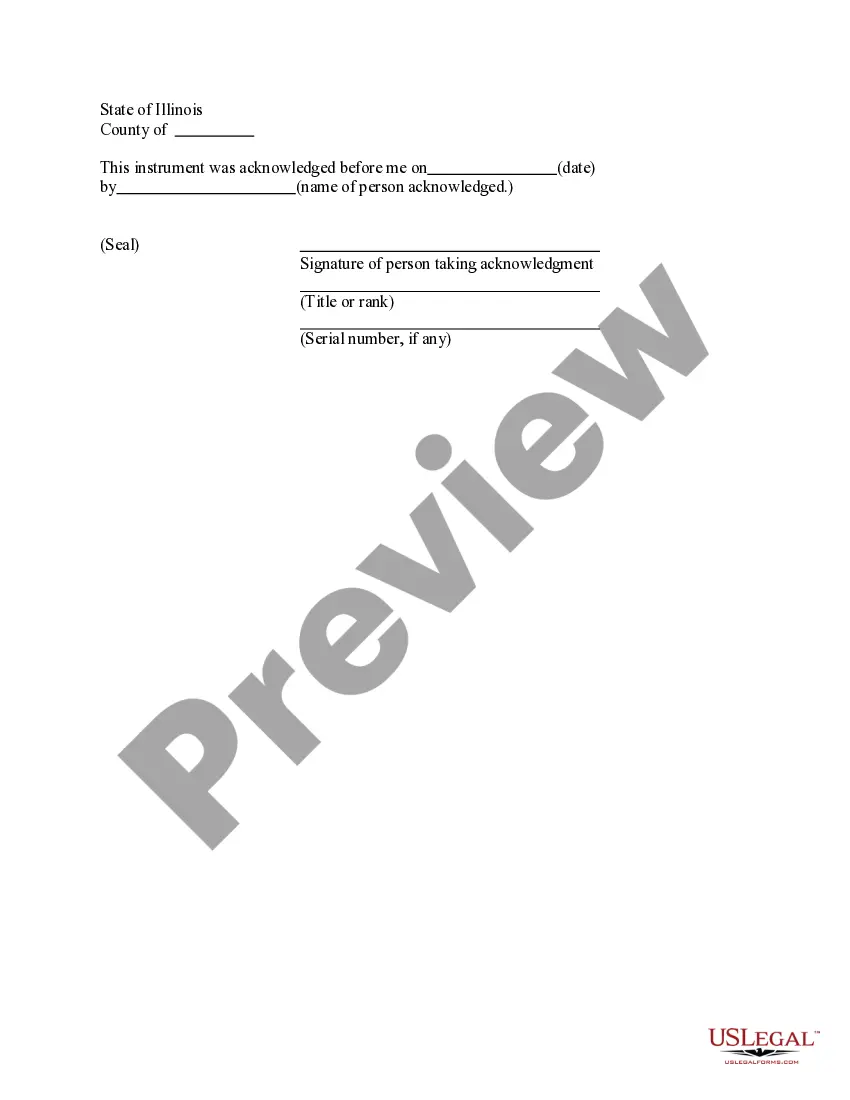

- Be sure to have picked the right form for your personal area/region. Select the Preview button to check the form`s content material. Look at the form outline to ensure that you have selected the proper form.

- If the form does not fit your requirements, take advantage of the Look for field near the top of the display to get the the one that does.

- Should you be content with the form, verify your decision by simply clicking the Get now button. Then, select the rates prepare you want and supply your credentials to register for an profile.

- Procedure the financial transaction. Make use of your charge card or PayPal profile to perform the financial transaction.

- Select the formatting and obtain the form in your gadget.

- Make alterations. Fill out, edit and produce and sign the downloaded Massachusetts Security ownership of directors, nominees and officers showing sole and shared ownership.

Every single format you put into your money lacks an expiration time and it is your own property for a long time. So, if you want to obtain or produce another backup, just proceed to the My Forms segment and then click around the form you need.

Get access to the Massachusetts Security ownership of directors, nominees and officers showing sole and shared ownership with US Legal Forms, one of the most comprehensive library of authorized file web templates. Use thousands of professional and state-particular web templates that meet up with your business or specific requires and requirements.

Form popularity

FAQ

The board of directors of a public company is elected by shareholders. The board makes key decisions on issues such as mergers and dividends, hires senior managers, and sets their pay. Board of directors candidates can be nominated by the company's nominations committee or by outsiders seeking change.

On August 25, 2010, the SEC adopted Rule 14a-11, mandating proxy access at all public companies. Any shareholder or shareholder group that held more than 3% of a public company's shares for more than 3 years would be eligible to nominate candidates for up to 25% of the company's board seats (the ?Rule 14a-11 Formula?).

A beneficiary is someone designated to receive money, property, or other benefits of assets via a trust or will. The difference between beneficial owner vs. beneficiary is that beneficiaries usually need to have ownership (either legal or beneficial) over the assets they benefit from.

Rights to acquire beneficial ownership: Under Rule 13d-3(d)(1), a person is deemed a beneficial owner of an equity security if the person (1) has a right to acquire beneficial ownership of the equity security within 60 days or (2) acquires the right to acquire beneficial ownership of the equity security with the ...

What Is Schedule 13D? Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.

Under Section 13(d)(3) of the Exchange Act, the group is treated as a new ?person? for purposes of Section 13(d)(1), and the group is deemed to have acquired, by operation of Rule 13d-5(b), beneficial ownership of the shares beneficially owned by its members.

Under the company's Bylaws, a shareholder wishing to nominate a director at a shareholders meeting must deliver written notice to the company's corporate secretary of the intention to make such a nomination.

Beneficial Ownership Percentage is calculated by dividing the number of Ordinary Shares and Share Equivalents of which a person is a Beneficial Owner as of a specific date by the total number of Ordinary Shares outstanding at that moment.

§ 240.14a-18 Disclosure regarding nominating shareholders and nominees submitted for inclusion in a registrant's proxy materials pursuant to applicable state or foreign law, or a registrant's governing documents.

Investors, banks, and lending companies can also appoint a shadow director to represent their interests in a company. The main purpose of having a nominee director is to give the appointing person or organization some level of control over the company, without having to serve as shareholders or directors themselves.