Massachusetts Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan

Description

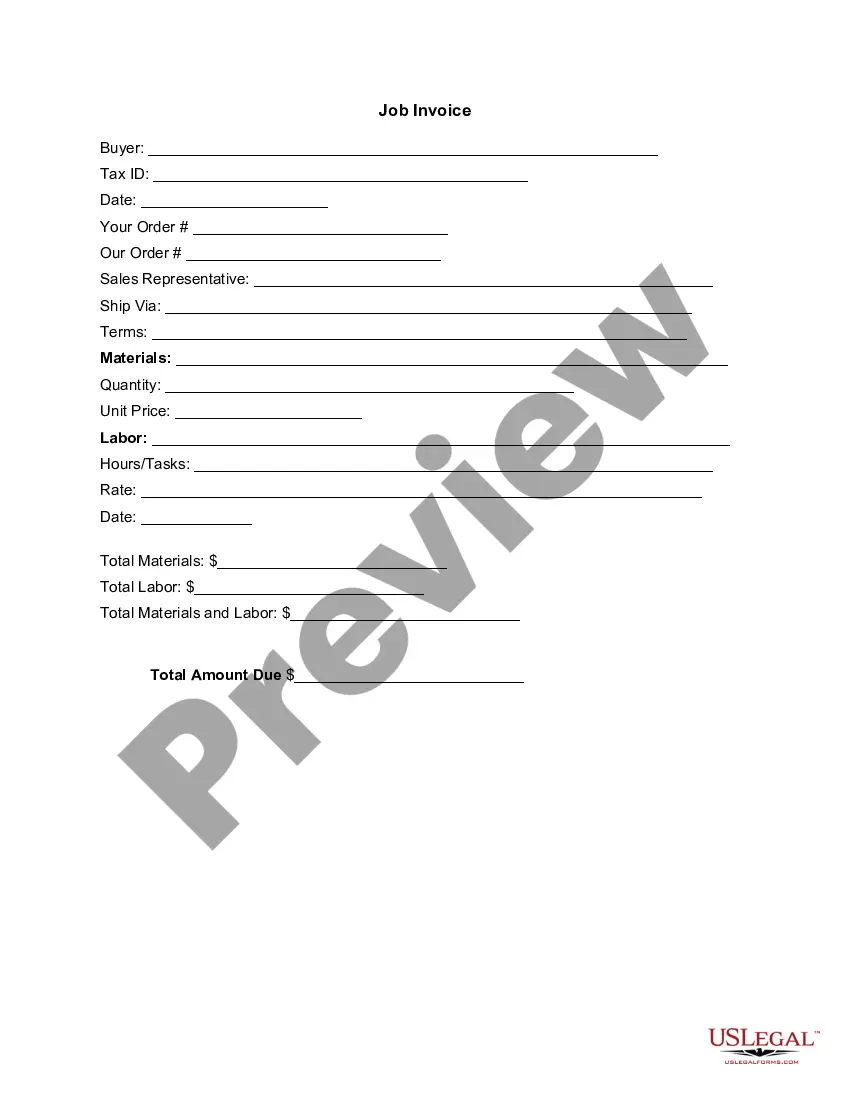

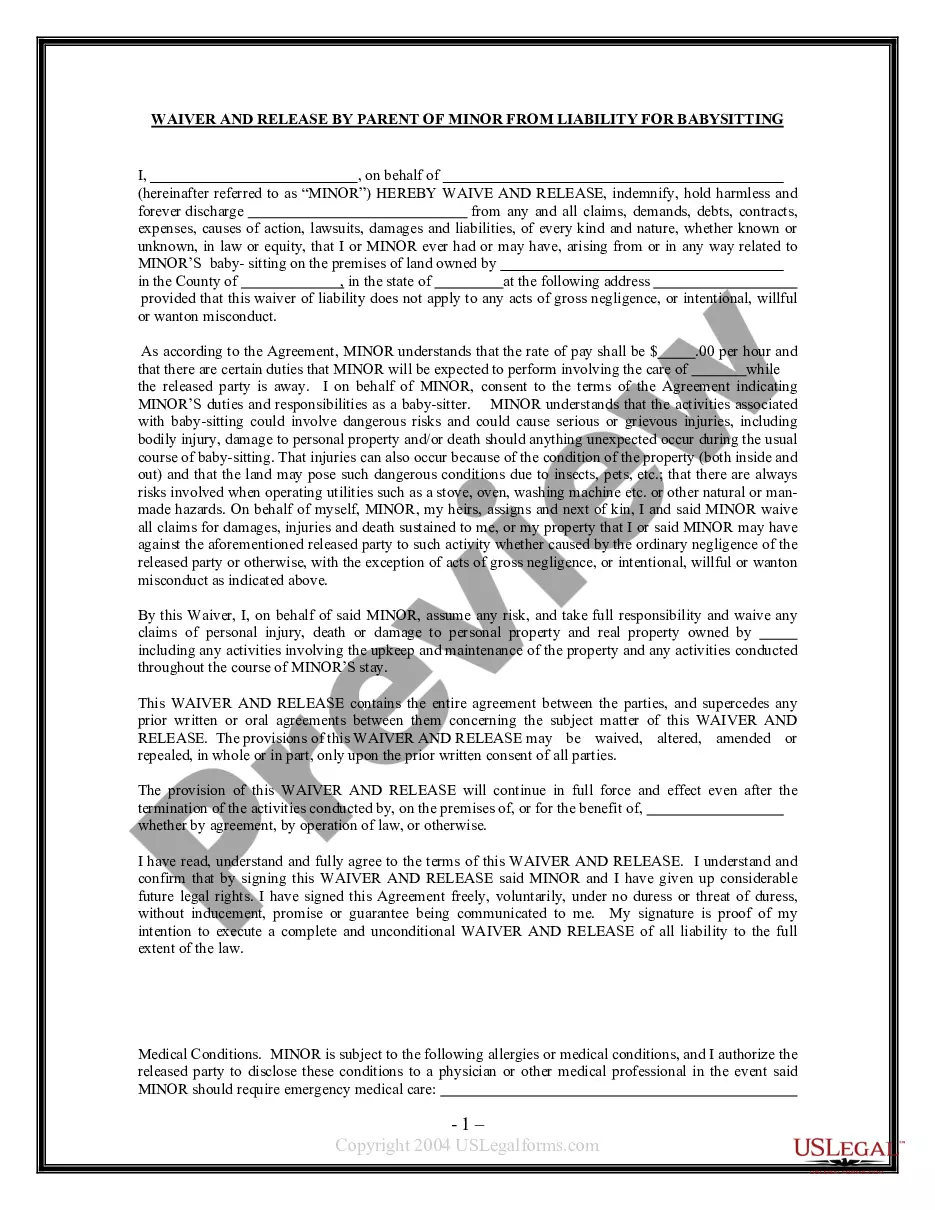

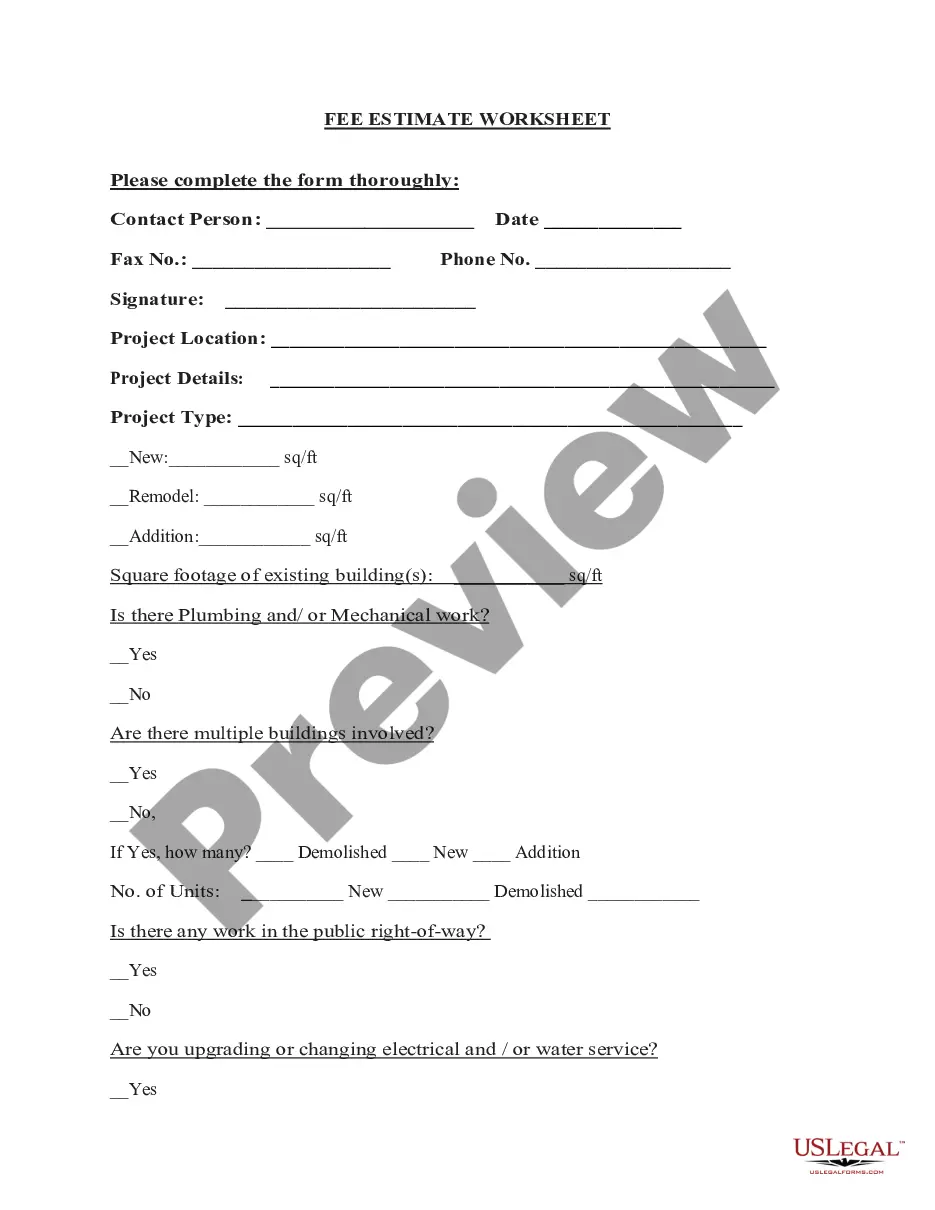

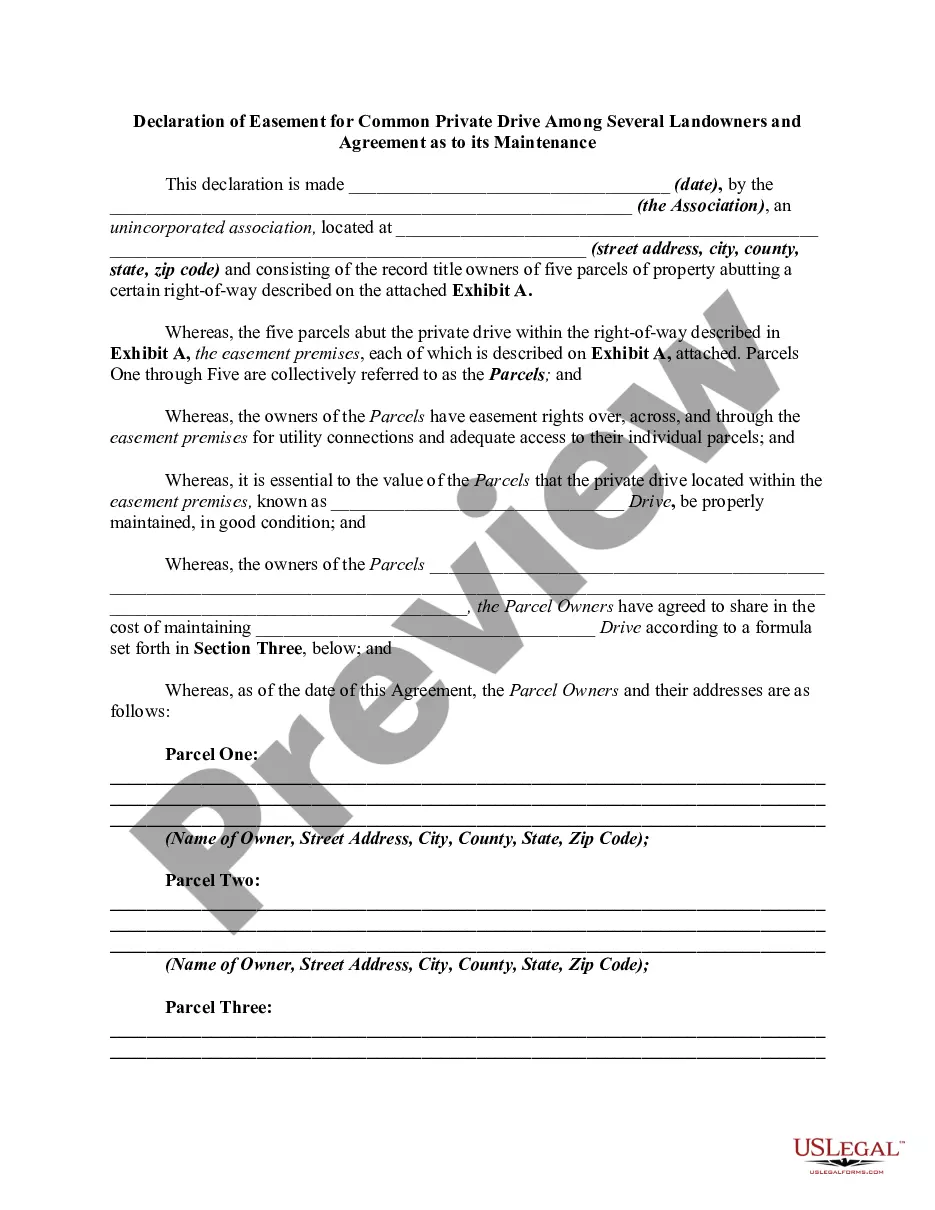

How to fill out Adoption Of Nonemployee Directors Deferred Compensation Plan With Copy Of Plan?

US Legal Forms - one of the biggest libraries of legal kinds in the States - gives an array of legal record templates you are able to down load or print out. Utilizing the site, you may get 1000s of kinds for organization and individual functions, sorted by categories, says, or keywords and phrases.You can find the latest types of kinds like the Massachusetts Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan within minutes.

If you already possess a subscription, log in and down load Massachusetts Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan through the US Legal Forms library. The Acquire option will show up on every single kind you look at. You get access to all earlier downloaded kinds inside the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, allow me to share straightforward recommendations to help you started off:

- Be sure to have selected the proper kind for your personal area/area. Click on the Review option to analyze the form`s articles. See the kind information to ensure that you have chosen the appropriate kind.

- In case the kind does not match your specifications, make use of the Research discipline towards the top of the display to get the the one that does.

- When you are content with the shape, validate your selection by clicking on the Purchase now option. Then, choose the costs plan you favor and offer your references to register for the profile.

- Procedure the financial transaction. Make use of your bank card or PayPal profile to perform the financial transaction.

- Find the formatting and down load the shape on the product.

- Make changes. Fill out, change and print out and signal the downloaded Massachusetts Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan.

Each and every design you included with your account does not have an expiry date and is yours permanently. So, in order to down load or print out yet another backup, just go to the My Forms segment and click about the kind you need.

Gain access to the Massachusetts Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan with US Legal Forms, by far the most comprehensive library of legal record templates. Use 1000s of professional and state-particular templates that fulfill your organization or individual requires and specifications.

Form popularity

FAQ

Put the plan in writing: Think of it as a contract with your employee. Be sure to include the deferred amount and when your business will pay it. Decide on the timing: You'll need to choose the events that trigger when your business will pay an employee's deferred income.

If you leave your company or retire early, funds in a Section 409A deferred compensation plan aren't portable. They can't be transferred or rolled over into an IRA or new employer plan. Unlike many other employer retirement plans, you can't take a loan against a Section 409A deferred compensation plan.

The Massachusetts Deferred Compensation 457 SMART Plan is a retirement savings program available for Commonwealth of Massachusetts state and municipal employees. Eligible employees can save and invest before-tax and after-tax dollars through salary deferrals into our wide array of low fee investments options.

Types of Deferred Compensation Salary Reduction Arrangements: Employees on a deferred compensation plan may choose to defer a portion of their salary until a future year. For example, an employee that earns $80,000 per year may choose to defer $30,000 of their salary and only receive $50,000 for the current year.

Deferred compensation plans can be a powerful tool for early retirement goals. Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state.

One easy way to increase your retirement savings is to contribute a percentage of your income to your Deferred Compensation Plan (DCP) account. Consider saving between 7% and 10% of your salary. The DCP makes it easy for you to save a percentage of your income through the percent-of-pay feature.

Your employer will set aside funds in your deferred compensation plan, and the exact amount will be determined by an agreement. You don't have to pay federal income taxes on the contributed funds until you receive the money at a later date, but Social Security and Medicare taxes could apply.

Primary Beneficiary: A person or trust you name to receive your DCP account in the event of your death. If you name multiple primary beneficiaries and any of them die before you, the percentage such beneficiary would have received will be divided equally among your surviving primary beneficiaries.