Massachusetts Management Agreement between a Trust and a Corporation

Description

How to fill out Management Agreement Between A Trust And A Corporation?

Choosing the right legal file template might be a have a problem. Of course, there are a variety of themes accessible on the Internet, but how do you get the legal type you require? Use the US Legal Forms website. The services offers 1000s of themes, such as the Massachusetts Management Agreement between a Trust and a Corporation, that you can use for enterprise and personal needs. Each of the varieties are checked out by experts and satisfy state and federal requirements.

Should you be already signed up, log in to the accounts and click the Down load switch to have the Massachusetts Management Agreement between a Trust and a Corporation. Make use of accounts to check from the legal varieties you may have bought earlier. Check out the My Forms tab of the accounts and acquire an additional backup of your file you require.

Should you be a whole new user of US Legal Forms, allow me to share basic directions for you to adhere to:

- Initially, make sure you have chosen the appropriate type to your metropolis/area. You may examine the shape utilizing the Preview switch and read the shape description to make certain this is basically the best for you.

- If the type does not satisfy your preferences, make use of the Seach industry to discover the correct type.

- When you are certain that the shape is acceptable, select the Acquire now switch to have the type.

- Opt for the pricing prepare you desire and enter in the needed information. Create your accounts and pay for the transaction utilizing your PayPal accounts or credit card.

- Choose the submit format and acquire the legal file template to the gadget.

- Comprehensive, edit and print out and sign the obtained Massachusetts Management Agreement between a Trust and a Corporation.

US Legal Forms may be the greatest catalogue of legal varieties where you can find a variety of file themes. Use the service to acquire appropriately-manufactured files that adhere to status requirements.

Form popularity

FAQ

Asset management is the practice of increasing total wealth over time by acquiring, maintaining, and trading investments that have the potential to grow in value. Asset management professionals perform this service for others. They may also be called portfolio managers or financial advisors.

The term asset management is synonymous with wealth management. As a financial service provider, an asset manager manages the assets of his or her clients. The task includes not only providing advice, but also making investment decisions based on the client's investment strategy, risk tolerance and financial situation.

In general, an AMA is a contractual relationship where a party agrees to manage gas supply and delivery arrangements, including transportation and storage capacity, for another party.

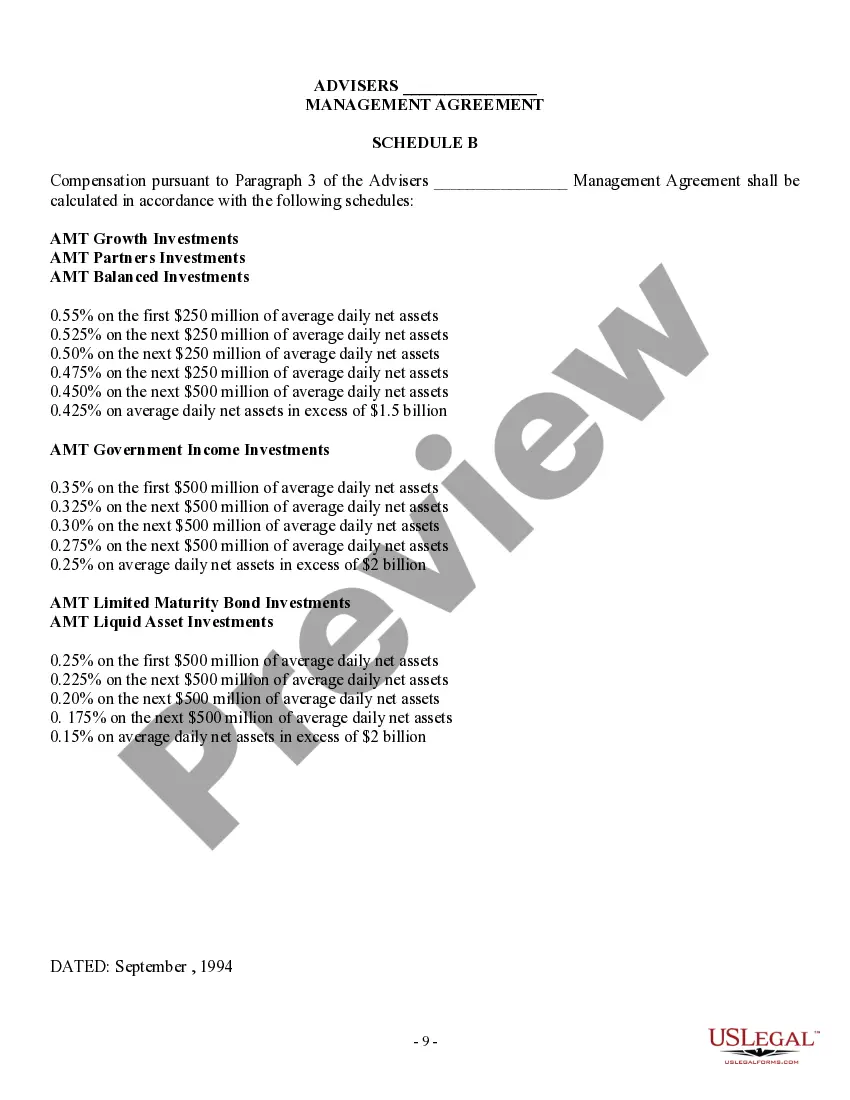

The main purpose of a management contract is to lay out the terms and conditions of the relationship. This includes the duties and responsibilities of the manager, as well as the compensation they would receive for their services.

An asset management agreement is a real estate agreement that determines the rights and obligations of both parties, typically a property owner and a property management company. The property owner is entering into a deal with a property management company to manage the property on its behalf.

The objective of a trust agreement is to give the trustee the legal rights to manage your assets on your behalf, and for the eventual benefit of your beneficiaries. The trustee can either be an individual or an organization.