Full text and statutory guidelines for the Financial Services Modernization Act (Gramm-Leach-Bliley Act)

Massachusetts Financial Services Modernization Act (Gramm-Leach-Bliley Act)

Description

How to fill out Financial Services Modernization Act (Gramm-Leach-Bliley Act)?

Finding the right authorized file template might be a have difficulties. Of course, there are plenty of web templates available online, but how would you find the authorized form you need? Make use of the US Legal Forms website. The support offers thousands of web templates, including the Massachusetts Financial Services Modernization Act (Gramm-Leach-Bliley Act), which you can use for organization and personal requires. Each of the kinds are inspected by professionals and satisfy federal and state specifications.

When you are previously signed up, log in to your accounts and click on the Acquire option to obtain the Massachusetts Financial Services Modernization Act (Gramm-Leach-Bliley Act). Use your accounts to look from the authorized kinds you might have purchased earlier. Proceed to the My Forms tab of the accounts and acquire one more duplicate of the file you need.

When you are a new consumer of US Legal Forms, allow me to share easy guidelines so that you can adhere to:

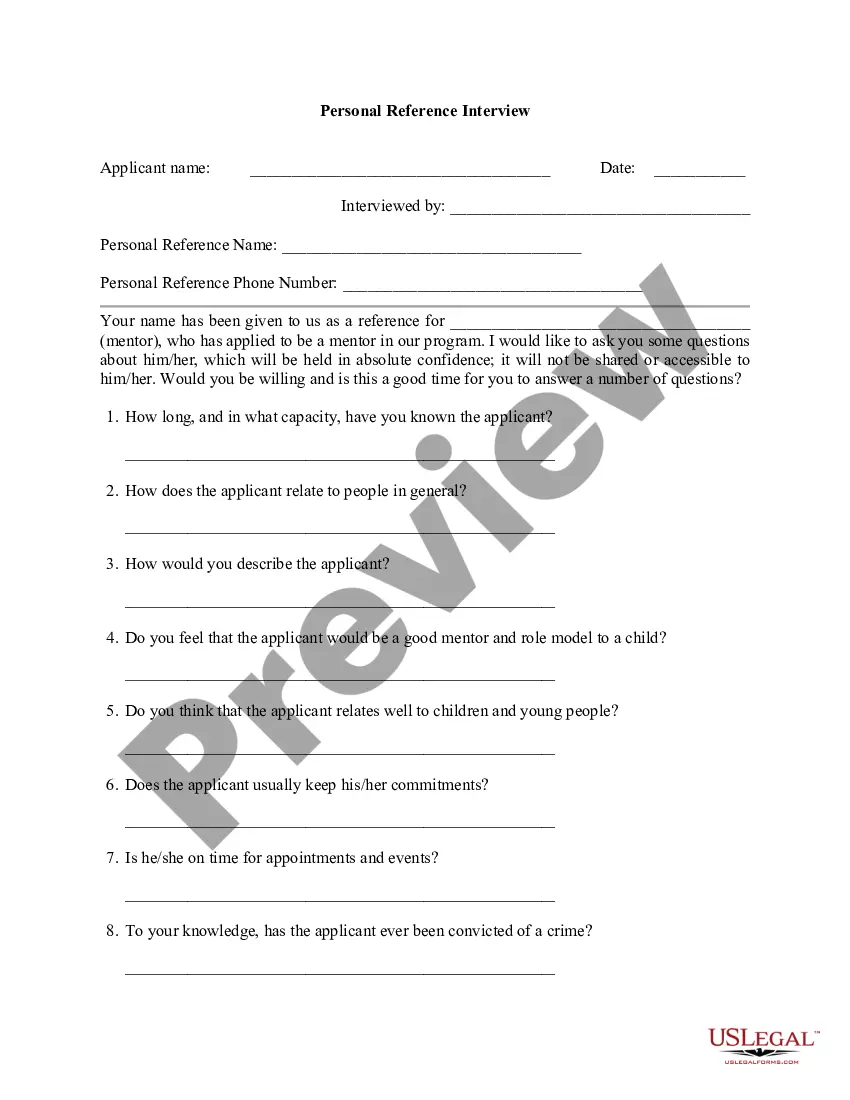

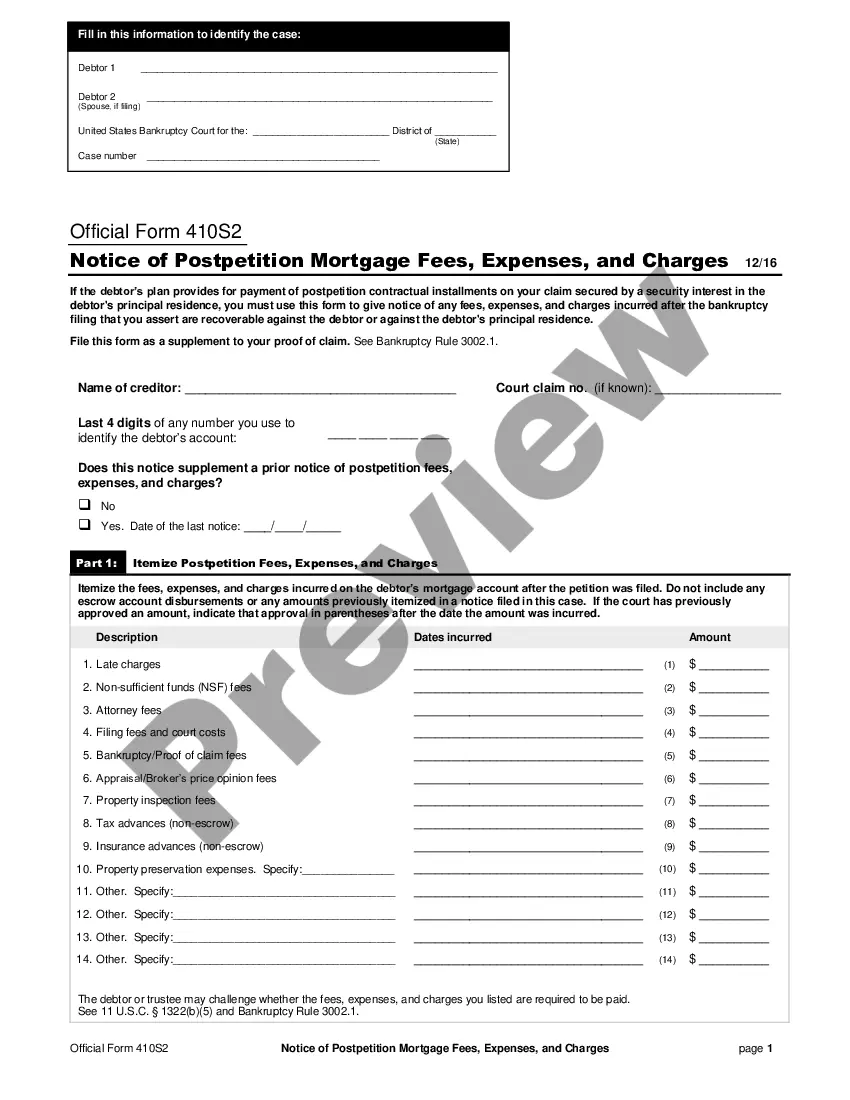

- Very first, make certain you have selected the correct form for the city/area. You may check out the shape while using Review option and read the shape description to make certain this is the right one for you.

- If the form fails to satisfy your expectations, use the Seach discipline to get the right form.

- When you are certain the shape is acceptable, go through the Buy now option to obtain the form.

- Select the rates strategy you need and enter in the needed information and facts. Make your accounts and pay money for the order with your PayPal accounts or bank card.

- Choose the document formatting and down load the authorized file template to your gadget.

- Complete, revise and produce and sign the attained Massachusetts Financial Services Modernization Act (Gramm-Leach-Bliley Act).

US Legal Forms may be the largest local library of authorized kinds where you can discover different file web templates. Make use of the company to down load professionally-produced paperwork that adhere to express specifications.

Form popularity

FAQ

To be GLBA compliant, financial institutions must communicate to their customers how they share the customers' sensitive data, inform customers of their right to opt-out if they prefer that their personal data not be shared with third parties, and apply specific protections to customers' private data in ance with ...

Examples of activities that GLB would apply to include administering financial aid, processing of credit card information, and collecting of any other form of customer financial information. University units must document all such collection and processing activities.

The Gramm-Leach-Bliley Act requires financial institutions ? companies that offer consumers financial products or services like loans, financial or investment advice, or insurance ? to explain their information-sharing practices to their customers and to safeguard sensitive data.

The Financial Services Modernization Act of 1999 is a law that serves to partially deregulate the financial industry. The law allows companies working in the financial sector to integrate their operations, invest in each other's businesses, and consolidate.

The Financial Services Modernization Act of 1999 is a law that serves to partially deregulate the financial industry. The law allows companies working in the financial sector to integrate their operations, invest in each other's businesses, and consolidate.

The Gramm Leach Bliley Act (GLBA) is a comprehensive, federal law affecting institutions. The law requires financial institutions to develop, implement and maintain administrative, technical and physical safeguards to protect the security, integrity andconfidentiality of customer information.

Gramm-Leach- Bliley brought about sweeping deregulation to the financial services industry. In essence, Gramm -Leach-Bliley swept away almost six decades of financial services regulation precipitated by the Great Depression of the 1930s.

The three sections include the following: Financial Privacy Rule. This rule, often referred to as the Privacy Rule, places requirements on how organizations may collect and disclose private financial data. ... Safeguard Rule. ... Pretexting Rule.