Massachusetts COBRA Continuation Waiver Letter

Description

How to fill out COBRA Continuation Waiver Letter?

You can spend hours online searching for the legal documents template that satisfies the federal and state regulations you require.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

You can easily download or print the Massachusetts COBRA Continuation Waiver Letter from the service.

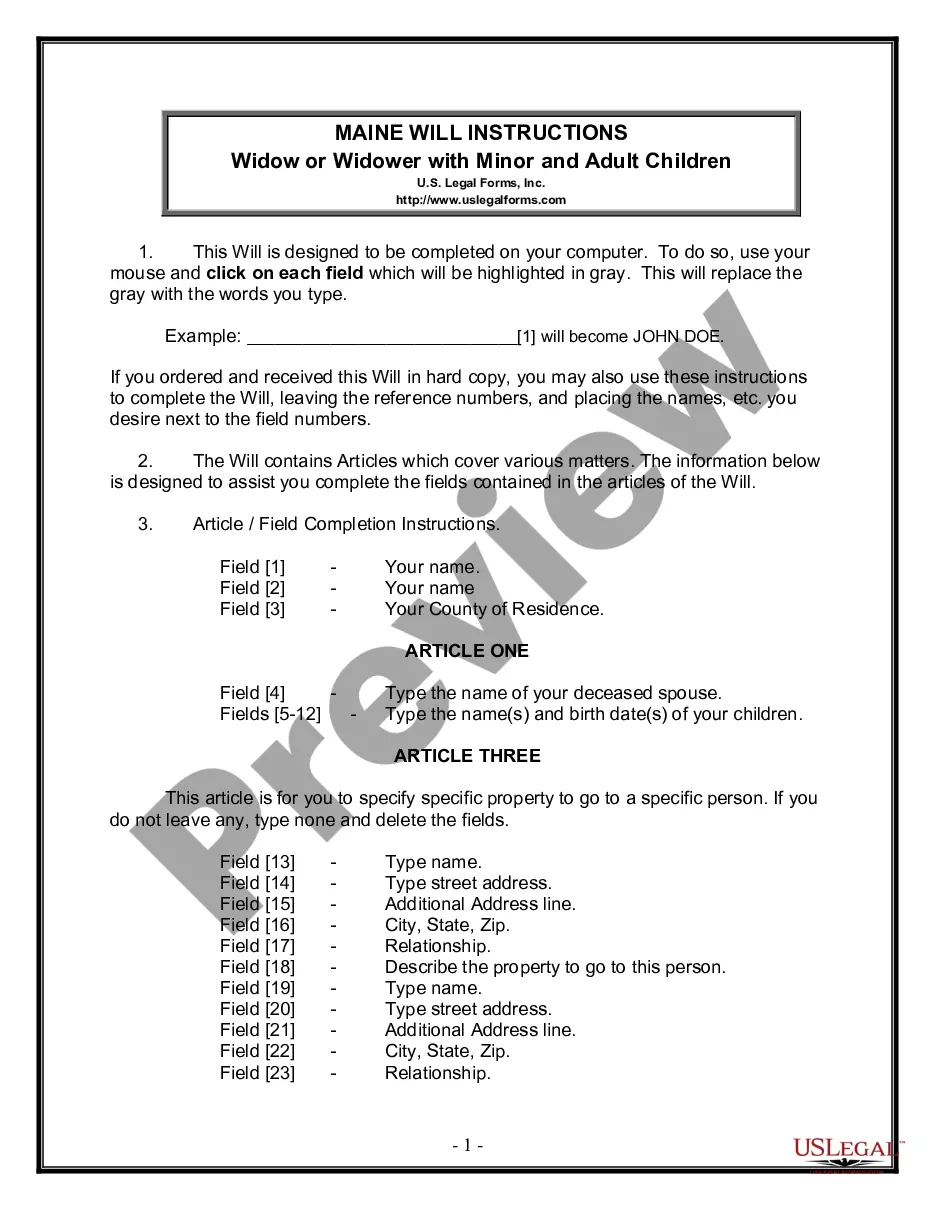

If available, utilize the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, edit, print, or sign the Massachusetts COBRA Continuation Waiver Letter.

- Every legal document template you obtain is yours permanently.

- To get another copy of any purchased form, visit the My documents tab and click the respective button.

- If this is your first time using the US Legal Forms website, follow these simple instructions.

- First, ensure you've selected the correct document template for the county/town of your choice.

- Read the form description to confirm you've chosen the right form.

Form popularity

FAQ

COBRA typically includes a 30-day grace period for premium payments, allowing you to catch up on your dues. This is vital for maintaining your health coverage without interruption. Use the Massachusetts COBRA Continuation Waiver Letter to ensure you are aware of your payment deadlines and maintain continuous coverage.

Typically, you can stay on COBRA for up to 18 months following your qualifying event. However, there are specific cases where this period can extend to 36 months. It's important to review your circumstances to determine your eligibility for the Massachusetts COBRA Continuation Waiver Letter, as this could affect your coverage duration.

If you waive COBRA coverage during the election period, you must be permitted later to revoke your waiver of coverage and to elect continuation coverage as long as you do so during the election period. Then, the plan need only provide continuation coverage beginning on the date you revoke the waiver.

COBRA is a federal law and is not enforced by the Division of Insurance. Mini-COBRA is a state law and is enforced by the Division of Insurance. COBRA generally applies to group health plans offered by employers with 20 or more employees.

Massachusetts Has Mini-COBRA COBRA applies to self-funded and group plans offered by employers with 20 or more employees. Mini-COBRA does not apply to self-funded plans.

The general notice describes general COBRA rights and employee obligations. This notice must be provided to each covered employee and each covered spouse of an employee who becomes covered under the plan. The notice must be provided within the first 90 days of coverage under the group health plan.

Q3: Which employers are required to offer COBRA coverage? COBRA generally applies to all private-sector group health plans maintained by employers that had at least 20 employees on more than 50 percent of its typical business days in the previous calendar year.

Instead, Assistance Eligible Individuals do not have to pay any of the COBRA premium for the period of coverage from April 1, 2021 through September 30, 2021. The premium is reimbursed directly to the employer, plan administrator, or insurance company through a COBRA premium assistance credit.

If you want to avoid paying the COBRA cost, go with a short-term plan if you're waiting for approval on another health plan. Choose a Marketplace or independent plan for broader coverage. Choose a high-deductible plan to keep your costs low.

COBRA Coverage PeriodsYou can cancel the COBRA coverage at any time within 18 months. You're not locked in. You will likely want to drop COBRA once you become eligible for a different health plan, such as if you get another job. If you stop paying premiums, COBRA coverage will end automatically.