The following form is a Petition that adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another.

Ohio Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate

Description

How to fill out Petition Of Creditor Of An Estate Of A Decedent For Distribution Of The Remaining Assets Of The Estate?

US Legal Forms - one of many biggest libraries of lawful kinds in the USA - delivers a wide range of lawful record themes you are able to obtain or print out. Utilizing the web site, you can get thousands of kinds for business and specific reasons, categorized by types, claims, or search phrases.You will find the most recent versions of kinds such as the Ohio Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate within minutes.

If you already possess a monthly subscription, log in and obtain Ohio Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate from the US Legal Forms local library. The Download button will show up on each kind you see. You get access to all earlier downloaded kinds in the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, listed here are basic directions to get you began:

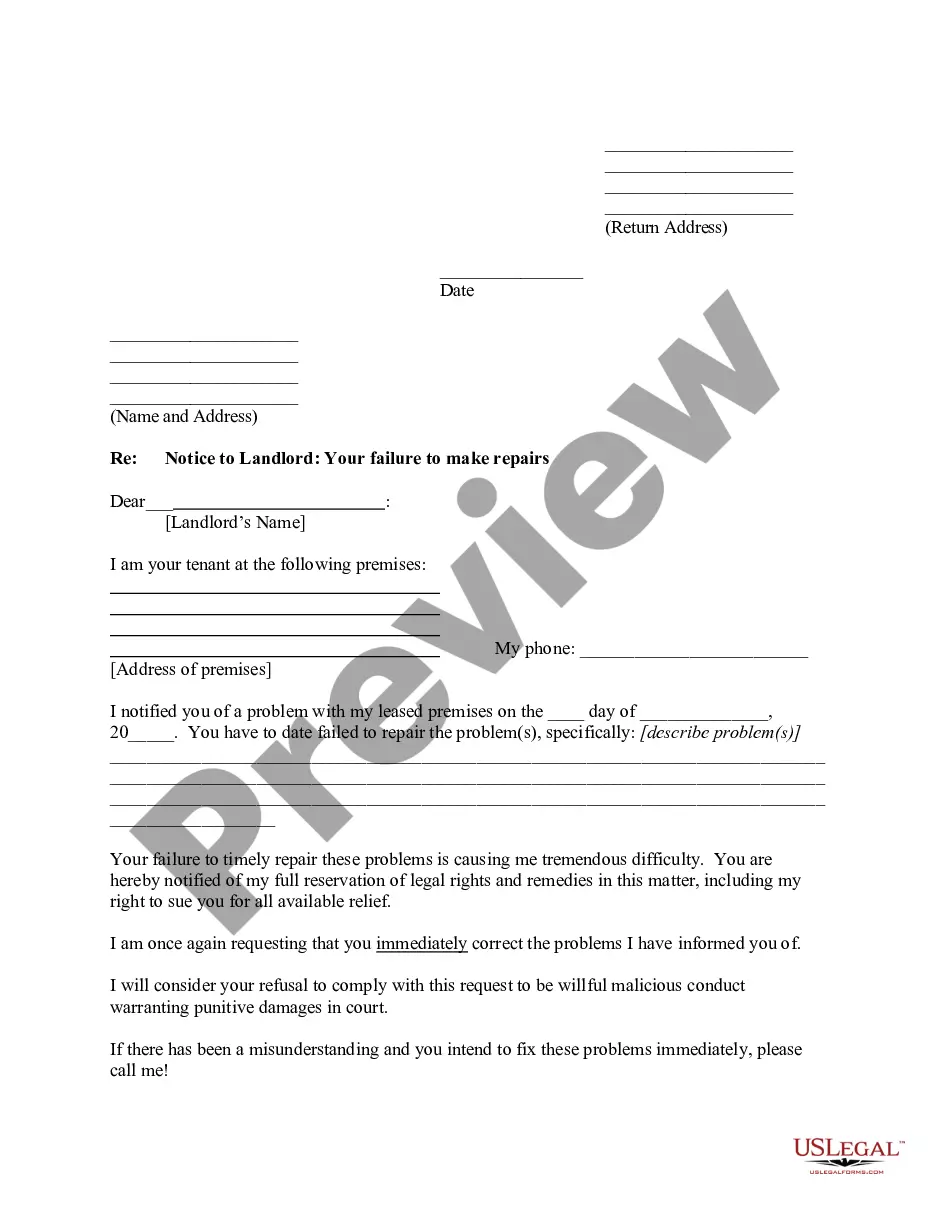

- Be sure to have chosen the proper kind for the town/area. Click the Review button to examine the form`s articles. See the kind explanation to ensure that you have selected the correct kind.

- If the kind doesn`t suit your demands, utilize the Search discipline near the top of the screen to get the the one that does.

- Should you be content with the form, verify your option by clicking the Purchase now button. Then, opt for the costs prepare you favor and supply your credentials to sign up for an accounts.

- Method the transaction. Use your charge card or PayPal accounts to complete the transaction.

- Pick the structure and obtain the form on your own system.

- Make changes. Fill up, edit and print out and signal the downloaded Ohio Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate.

Each template you included in your money does not have an expiration particular date which is your own property for a long time. So, if you wish to obtain or print out yet another version, just proceed to the My Forms segment and click on about the kind you require.

Gain access to the Ohio Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate with US Legal Forms, probably the most substantial local library of lawful record themes. Use thousands of expert and status-distinct themes that meet your organization or specific needs and demands.

Form popularity

FAQ

To the executor or administrator in writing, and to the probate court by filing with it a copy of the written claim that has been filed with the fiduciary, or. By sending a written claim by ordinary mail addressed to the decedent if it is actually received by the fiduciary within 6 months of the date of death.

A notice will contain the name of the person who passed away, the deadline for creditors to make claims, and the address they should contact. After the deadline has passed, the executor can begin distributing assets, and so creditors may lose out.

Creditor's claim (sometimes referred to as a proof of claim) is a filing with a bankruptcy or probate court to establish a debt owed to that individual or organization.

However, the deceased individual's estate may be liable for properly-presented claims. In Ohio, a creditor of a deceased person has 6 months from the person's date of death to formally present a claim for payment.

Probate is the court supervised process of identifying and gathering a person's assets after their death, paying all of their debts, and distributing the balance to the rightful heirs or beneficiaries.

(B)(1) Every administrator and executor, within six months after appointment, shall render a final and distributive account of the administrator's or executor's administration of the estate unless one or more of the following circumstances apply: (a) An Ohio estate tax return must be filed for the estate.

Credit Card Debt However, Ohio law allows the creditor to file a claim against the estate, and that debt still must be paid before heirs can receive their inheritance, so it is possible that estate funds will be used up to satisfy creditors.