Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Massachusetts Special Rules for Designated Settlement Funds IRS Code 468B

Description

How to fill out Special Rules For Designated Settlement Funds IRS Code 468B?

US Legal Forms - one of the largest libraries of lawful forms in the USA - provides a wide array of lawful file templates it is possible to acquire or printing. Making use of the internet site, you will get 1000s of forms for organization and individual functions, sorted by types, states, or keywords.You can get the most up-to-date variations of forms such as the Massachusetts Special Rules for Designated Settlement Funds IRS Code 468B in seconds.

If you currently have a membership, log in and acquire Massachusetts Special Rules for Designated Settlement Funds IRS Code 468B through the US Legal Forms library. The Acquire option will appear on each and every kind you look at. You get access to all earlier acquired forms from the My Forms tab of your accounts.

If you wish to use US Legal Forms initially, listed below are simple instructions to obtain began:

- Be sure to have picked the correct kind for your area/region. Click on the Review option to review the form`s content. Look at the kind explanation to ensure that you have selected the right kind.

- When the kind does not satisfy your specifications, utilize the Search field near the top of the screen to discover the one that does.

- When you are content with the form, validate your selection by clicking on the Purchase now option. Then, pick the pricing plan you like and supply your qualifications to sign up for the accounts.

- Procedure the transaction. Use your credit card or PayPal accounts to finish the transaction.

- Find the structure and acquire the form in your device.

- Make changes. Fill up, change and printing and sign the acquired Massachusetts Special Rules for Designated Settlement Funds IRS Code 468B.

Each and every design you put into your account does not have an expiry day and is the one you have permanently. So, if you would like acquire or printing yet another version, just visit the My Forms area and then click about the kind you require.

Gain access to the Massachusetts Special Rules for Designated Settlement Funds IRS Code 468B with US Legal Forms, by far the most considerable library of lawful file templates. Use 1000s of expert and express-certain templates that fulfill your organization or individual requirements and specifications.

Form popularity

FAQ

Form P626 for PAYE Settlement Agreements - a Freedom of Information request to HM Revenue and Customs - WhatDoTheyKnow. Form P626 for PAYE Settlement Agreements - WhatDoTheyKnow whatdotheyknow.com ? request ? form_p62... whatdotheyknow.com ? request ? form_p62...

Apply by post Write to HMRC Business Tax and Customs describing the expenses and benefits you want the PSA to cover. Once HMRC have agreed on what can be included, they'll send you 2 draft copies of form P626. Sign and return both copies. HMRC will authorise your request and send back a form - this is your PSA . How to get a PSA and tell HMRC what you owe - GOV.UK GOV.UK ? paye-settlement-agreements GOV.UK ? paye-settlement-agreements

The form PSA1 is used or a calculation is sent to tell HMRC about the value of items included in your PAYE Settlement Agreement (PSA). You can now tell HMRC the value of items in your PAYE Settlement Agreement by using the online form or by posting your calculation to HMRC. HMRC form: PSA1 - CIPP cipp.org.uk ? resources ? news ? hmrc-form... cipp.org.uk ? resources ? news ? hmrc-form...

In most settlement agreements, you will be paid up to the termination date as normal. Since these wages are part of your earnings, they will be taxed in the usual way. Settlement Agreements and Tax | Thompsons Solicitors Thompsons Solicitors ? support ? legal-guides Thompsons Solicitors ? support ? legal-guides

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

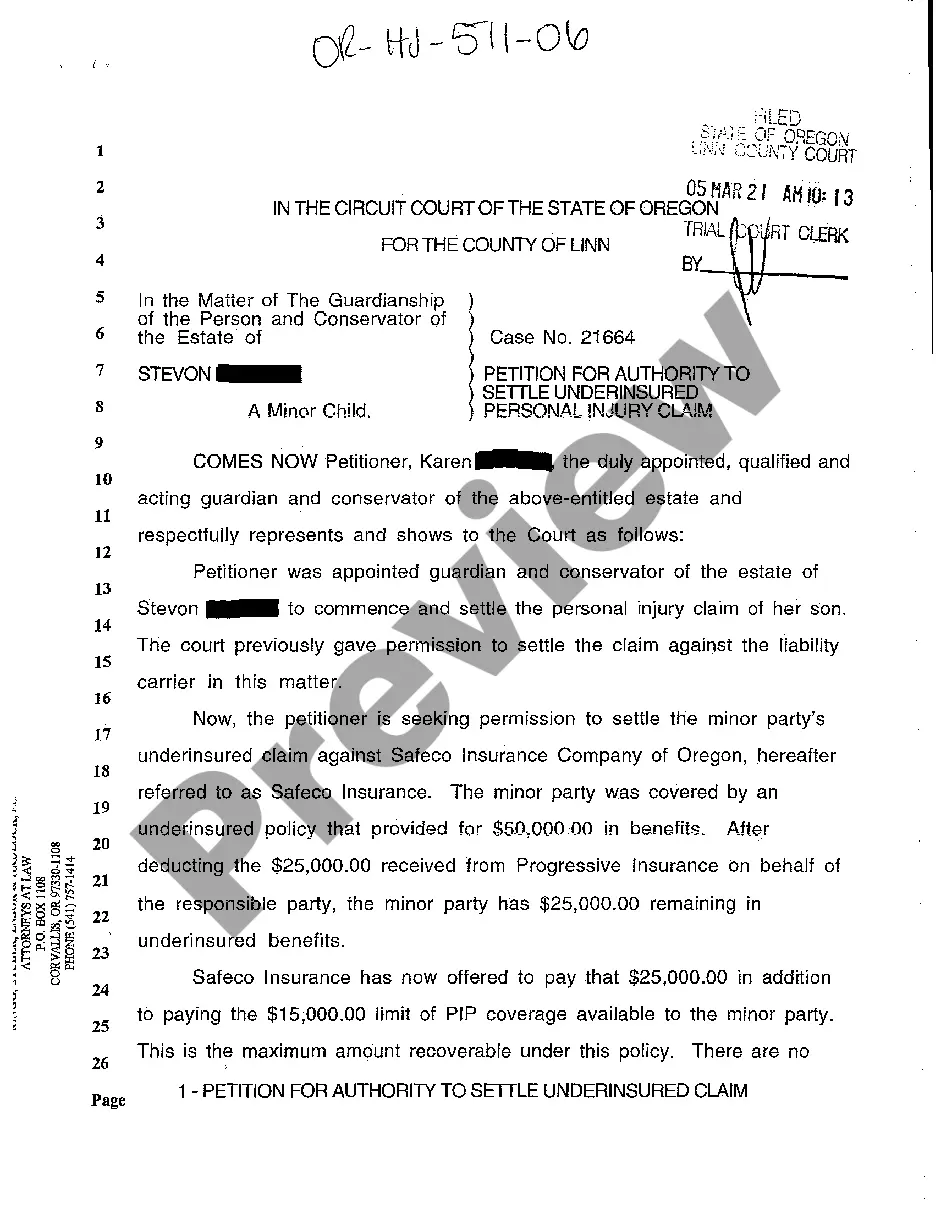

Internal Revenue Code (IRC) § 468B provides for the taxation of designated settlement funds and directs the Department of the Treasury to prescribe regulations providing for the taxation of an escrow account, settlement fund, or similar fund, whether as a grantor trust or otherwise.

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

If you receive a settlement in California that is considered taxable income, you will need to report it on your tax return. You will typically receive a Form 1099-MISC, which reports the amount of taxable income you received during the year.