Massachusetts Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Annual Disbursements To Members Of The Company?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template forms that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can quickly obtain the latest forms such as the Massachusetts Notice of Meeting of LLC Members To Discuss Annual Disbursements to Members of the Company.

If you already have an account, Log In to download the Massachusetts Notice of Meeting of LLC Members To Discuss Annual Disbursements to Members of the Company from the US Legal Forms collection. The Acquire button will be available on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Complete the payment process. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded Massachusetts Notice of Meeting of LLC Members To Discuss Annual Disbursements to Members of the Company.

Each template you have added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need.

Access the Massachusetts Notice of Meeting of LLC Members To Discuss Annual Disbursements to Members of the Company with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Ensure you have chosen the correct form for your region/state.

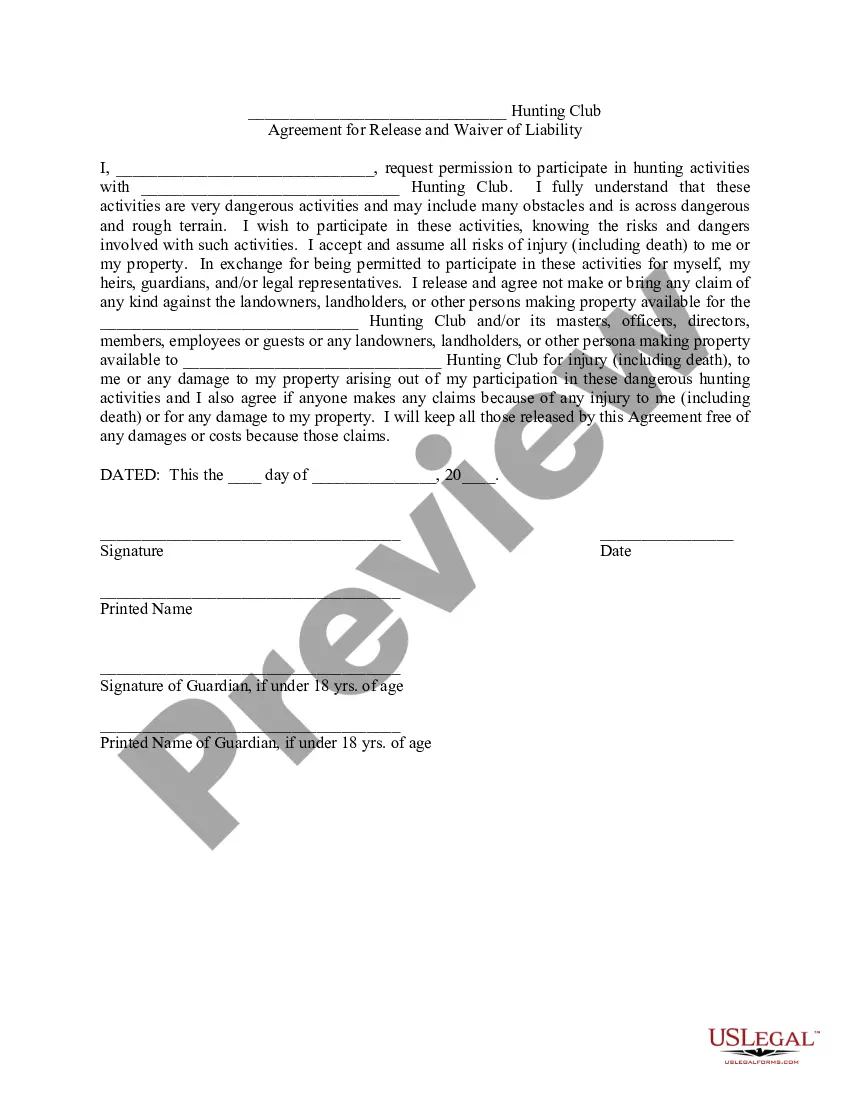

- Click the Preview button to review the form's contents.

- Check the form description to confirm you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search box at the top of the page to find the one that does.

- If you are happy with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Notice to Shareholders Most states require notice of any shareholder meeting be mailed to all shareholders at least 10 days prior to the meeting. The notice should contain the date, time and location of the meeting as well as an agenda or explanation of the topics to be discussed.

Therefore, all shareholders should be invited to the meeting, at which point they will discuss official business items that need to be addressed. Such items might include electing of new board members, financial issues, and other future short-term and long-term goals and objectives.

A corporate seal is no longer required by LLCs or Corporations and any state in the United States.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Your notice must follow state and company guidelines, but it should have your company name , the date and time of the meeting, the location of the meeting, an agenda , and notes . For more information about how to prepare a notice of meeting, read this article.

The general meeting of shareholders (GMS) is where shareholders can exercise their rights to make certain decisions relating to the Company, to receive reports from the Board of Commissioners and the Board of Directors on their performance and accountability and to question the Boards about their actions.

Notice of a Meeting:It should be under proper authority.It should state the name of the organisation.It should state the day, date, time, and place.It should be well in advance.It should state the purpose and, if possible, the agenda.It should carry the date of circulation and convener's/secretary's signature.More items...

Prepare an Operating AgreementAn LLC operating agreement is not required in Massachusetts, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state.

You have to file an amendment if your Massachusetts LLC designates managers and did not previously have managers; to reflect any change in the managers or authorized signatories of the LLC; or to change any other information required to be included in the original certificate of organization.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.