Massachusetts While You Were Out

Description

How to fill out While You Were Out?

Have you ever found yourself needing documents for either business or personal purposes almost daily.

There are numerous legal document templates available online, but finding reliable ones isn't simple.

US Legal Forms offers thousands of form templates, such as the Massachusetts While You Were Out, that are designed to meet state and federal requirements.

Once you find the right form, just click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Massachusetts While You Were Out template.

- If you don’t have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it’s for the correct state/region.

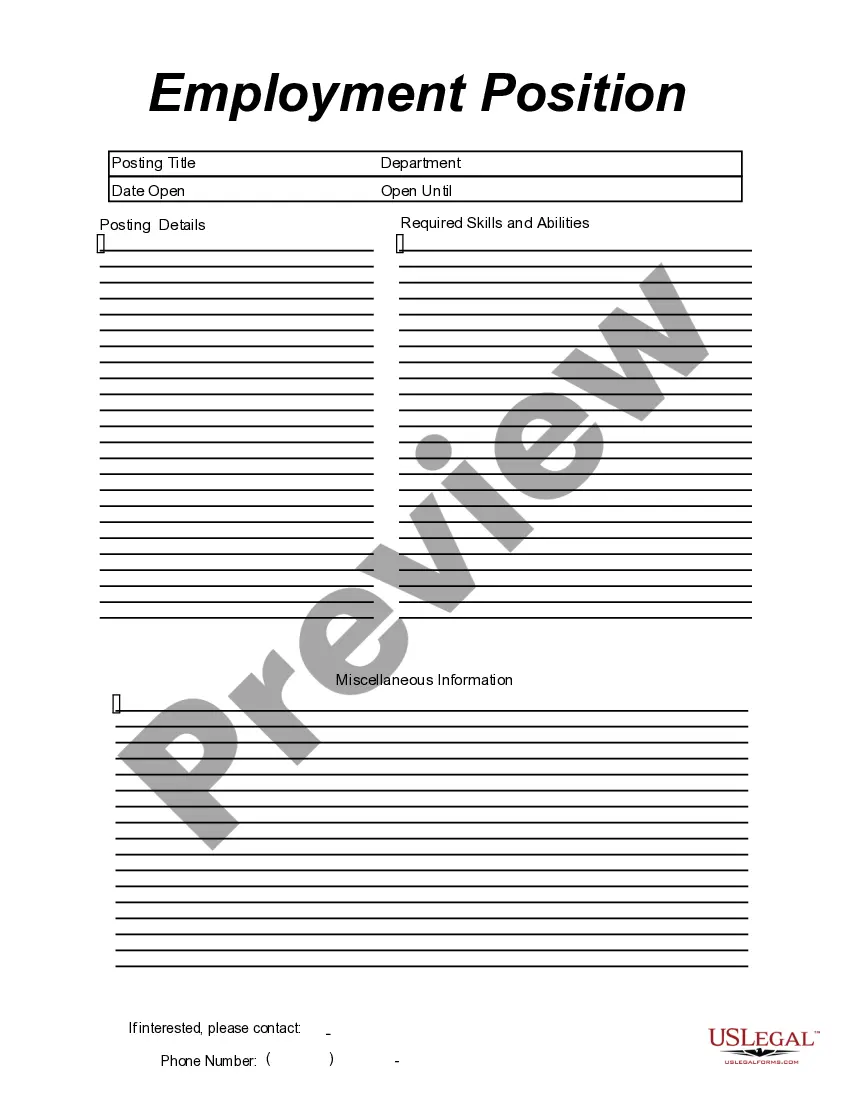

- Use the Review option to check the form.

- Read the description to make sure you have selected the correct document.

- If the form isn’t what you are looking for, use the Search section to find the form that matches your requirements.

Form popularity

FAQ

A Resident of Massachusetts is an individual who is domiciled in Massachusetts or maintains a permanent place of abode in MA and spends more than 183 days in the state. A Nonresident of Massachusetts is an individual who was not domiciled in Massachusetts but earned MA income.

14e: Non-Massachusetts source income - This is any additional income you would include if you were a full year Massachusetts resident. See information on including non-Massachusetts military service compensation for calculating Line 14e.

You can check your state's department of revenue website for more information to confirm your residency status. If your resident state collects income taxes, you must file a tax return for that state.

Resident aliens legally work and live in the U.S. and may owe U.S. tax on all of their income. However, many resident aliens qualify for one of several exceptions to the residency requirements. Nonresident aliens live outside the U.S. but earn some income from a U.S. source. They owe tax on their U.S. earnings.

If you're a nonresident of Massachusetts, you must file a Massachusetts Income Tax Return if you received Massachusetts source income in excess of your personal exemption multiplied by the ratio of your Massachusetts source income to your total income, or your gross income was more than $8,000 whether received from

A California resident includes an individual who is either (1) in California for other than a temporary or transitory purpose, or (2) domiciled in California, but outside California for a temporary or transitory purpose. Cal. Rev. & Tax.

You are considered a nonresident for tax purposes if you have not passed the green card or substantial test and are not a US citizen or national.

How do I prove I'm a NEW Massachusetts resident?Massachusetts (MA) driver's license.Massachusetts-issued professional license.Annual Social Security Statement (most current)Property Tax Bill (most current)Utility Bill (no more than 60 days old) with Massachusetts address.Voter Registration card (current)More items...?

A resident is a person who maintains a permanent place of abode in Massachusetts and spends more than 183 days of the taxable year in Massachusetts. Whether a person maintains a permanent place of abode in Massachusetts is a factual determination.

resident is a person who resides in one jurisdiction but has interests in another. Nonresident status is often important in determining one's eligibility for taxes, government benefits, jury duty, education, voting, and other government functions.