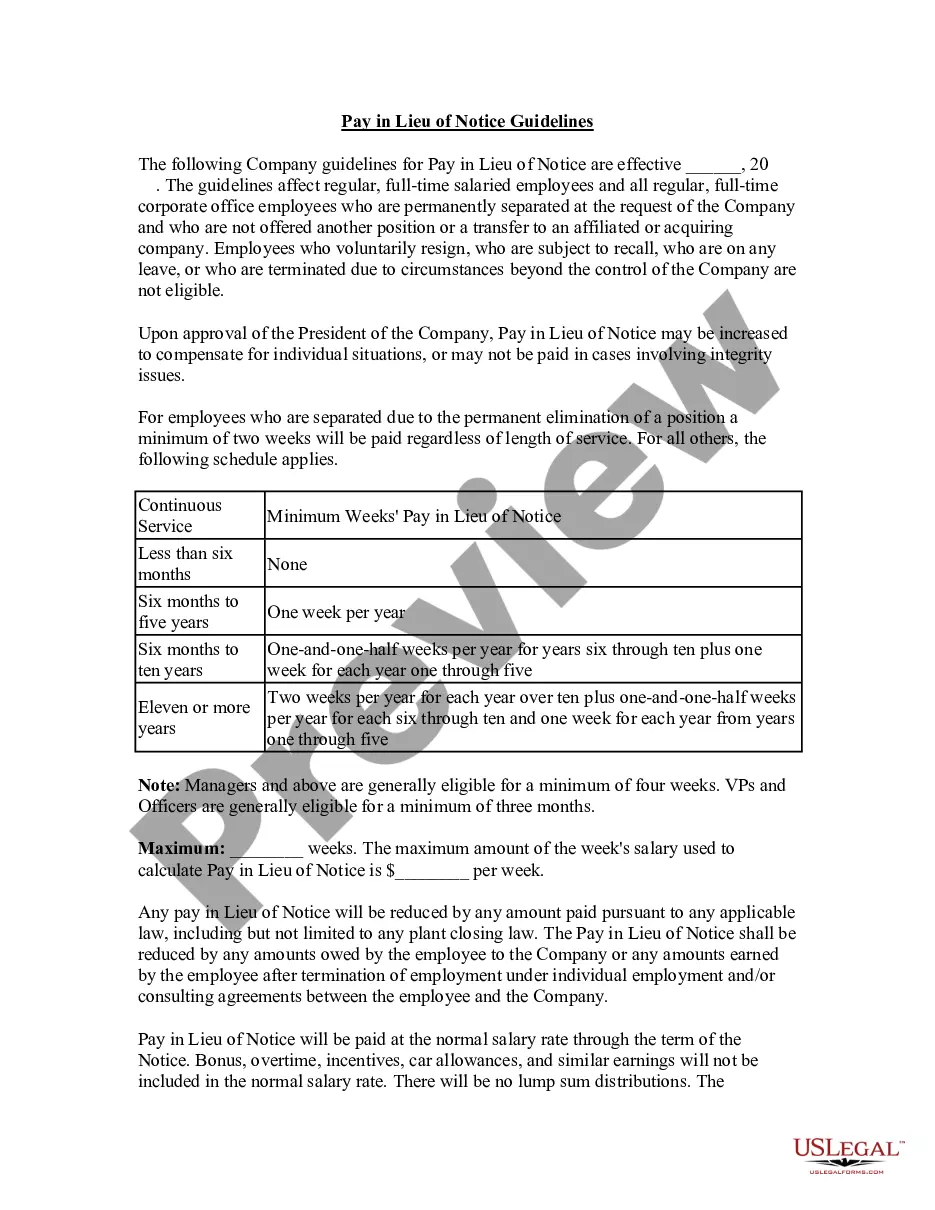

Massachusetts Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

Have you found yourself in a scenario where you need documents for both professional or personal reasons almost constantly.

There are numerous valid document templates accessible online, but locating ones you can trust isn't straightforward.

US Legal Forms offers a vast array of form templates, including the Massachusetts Pay in Lieu of Notice Guidelines, which can be filled out to comply with state and federal regulations.

Once you locate the correct form, click Get now.

Select the pricing plan you want, provide the necessary information to create your account, and complete your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Massachusetts Pay in Lieu of Notice Guidelines template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

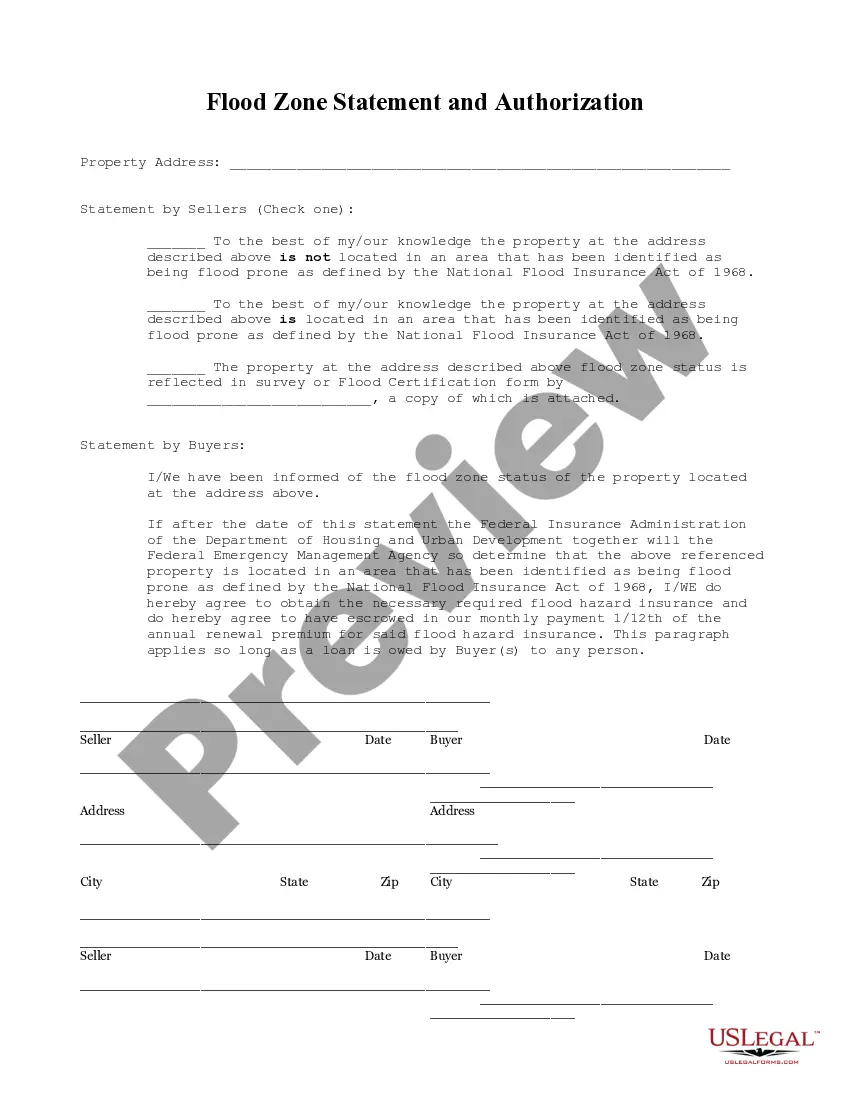

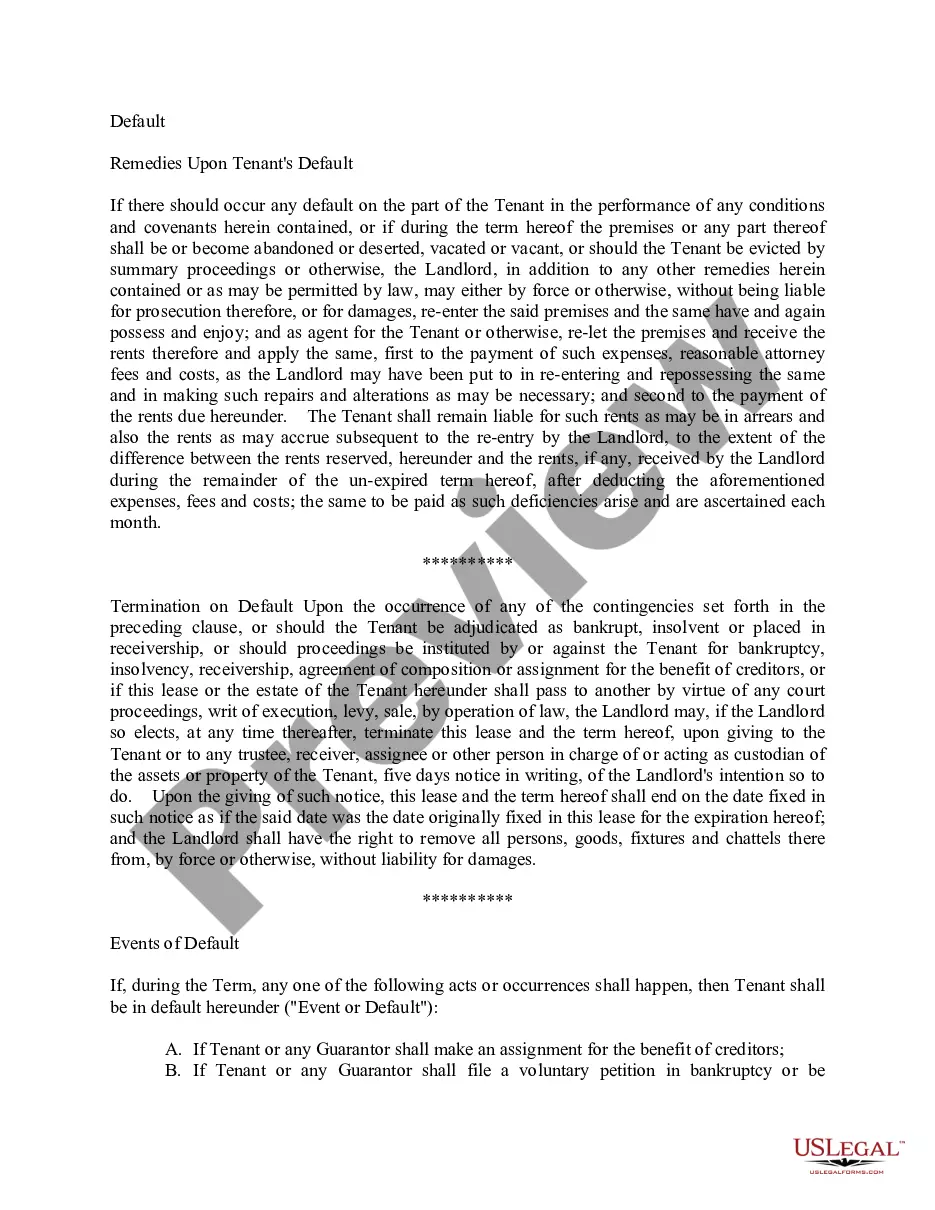

- Find the form you need and ensure it is for the correct city/county.

- Use the Preview button to review the form.

- Check the description to make sure you have selected the right form.

- If the form isn't what you're looking for, utilize the Research section to discover the form that meets your needs.

Form popularity

FAQ

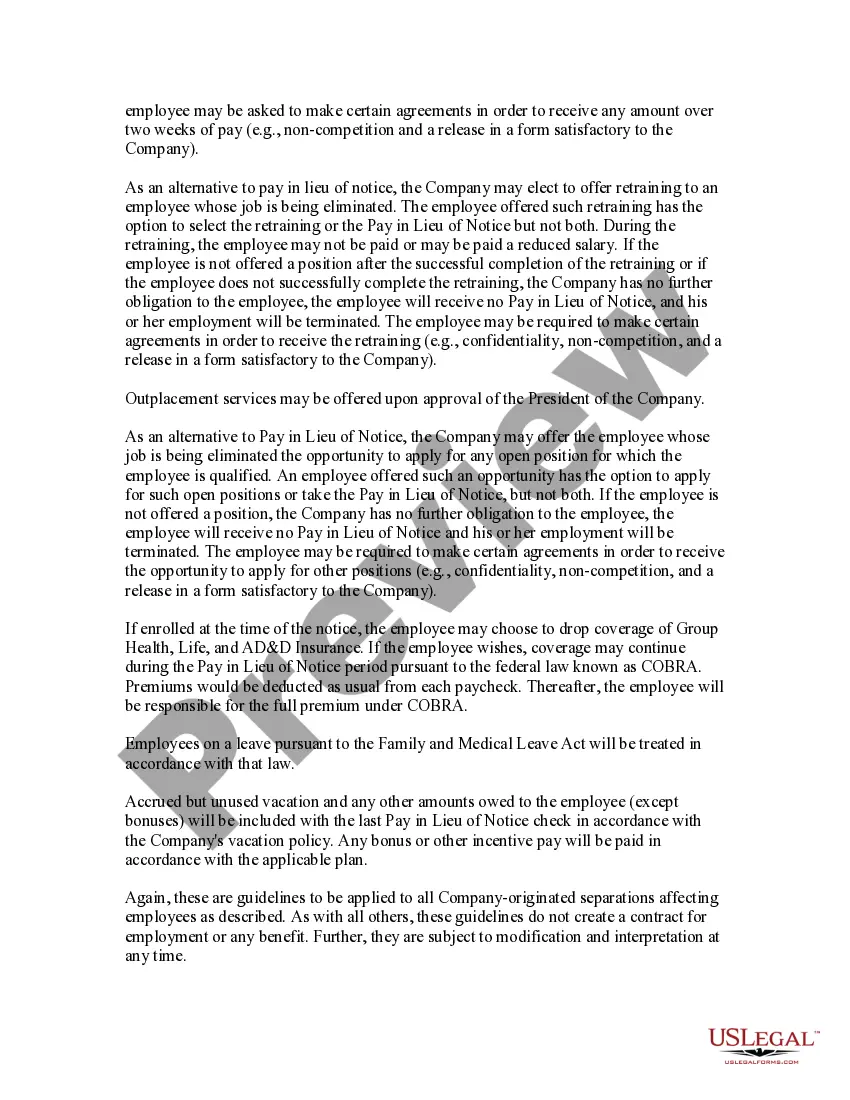

To obtain time in lieu under the Massachusetts Pay in Lieu of Notice Guidelines, it's essential to first review your employment contract or company policy, as they can provide specific instructions. Generally, you should discuss your situation with your employer or HR representative to understand the terms and conditions. If approved, ensure that you receive written confirmation detailing your time-off arrangement. For more clarity and support during this process, consider using the US Legal platform, which offers resources to help navigate employment laws effectively.

To obtain payment in lieu under the Massachusetts Pay in Lieu of Notice Guidelines, employees should first check their employment contract and relevant company policies. Next, they should formally request the payment from their employer, highlighting any applicable laws or guidelines. It may also be beneficial to consult the uslegalforms platform for comprehensive resources and templates to support your request, ensuring you have all the necessary documentation.

Payment in lieu of leave refers to the compensation an employee receives instead of taking their entitled leave. Under Massachusetts Pay in Lieu of Notice Guidelines, if an employee is unable to take their leave, they may be entitled to a payment that reflects their leave entitlement. This ensures that employees are compensated fairly for their unused time off.

Yes, payment in lieu of notice often attracts superannuation contributions. According to the Massachusetts Pay in Lieu of Notice Guidelines, if an employer includes this payment as part of the employee's ordinary wages, then it is subject to superannuation requirements. Consequently, it is advisable for employers to consult with a payroll expert to ensure compliance.

In Massachusetts, resignation in lieu of termination refers to a scenario where an employee chooses to resign instead of being terminated. This option often allows the employee to avoid a formal firing, which can impact their future job prospects. Understanding Massachusetts Pay in Lieu of Notice Guidelines is crucial in these cases, as it may affect the severance package if applicable.

To process payment in lieu of notice under the Massachusetts Pay in Lieu of Notice Guidelines, employers must first calculate the amount owed to the employee. This includes any wages, unused vacation time, and any other applicable compensation. Once determined, the employer provides the payment directly to the employee, often in the next payroll cycle, ensuring compliance with state and federal laws.

A letter payment in lieu of notice by the employer is a formal document that outlines the payment an employee will receive instead of completing their notice period. This letter serves as a record of the agreement and includes details about the payment amount based on the Massachusetts Pay in Lieu of Notice Guidelines. It's an essential document for both parties for clarity and protection.

Processing payment in lieu of notice involves a few critical steps. First, review the employment contract to confirm the notice period required. Next, calculate the payment amount, adhering to Massachusetts Pay in Lieu of Notice Guidelines, and include this amount in the employee's final paycheck. Ensure to communicate with the employee openly about the process and the final calculation for transparency.

To calculate payment in lieu of notice, determine the employee's usual wage and the length of the notice period required. According to the Massachusetts Pay in Lieu of Notice Guidelines, multiply the weekly wage by the number of weeks of notice owed. This calculated amount will provide a fair compensation that aligns with the employee's expected earnings.

Payment in lieu of leave refers to a compensation method when an employee does not take their entitled leave time and receives an equivalent payment instead. Under Massachusetts Pay in Lieu of Notice Guidelines, this payment can serve as an alternative to providing notice or fulfilling the required notice period. This approach ensures that employees receive financial support when transitioning from their position.