Massachusetts Payroll Deduction - Special Services

Description

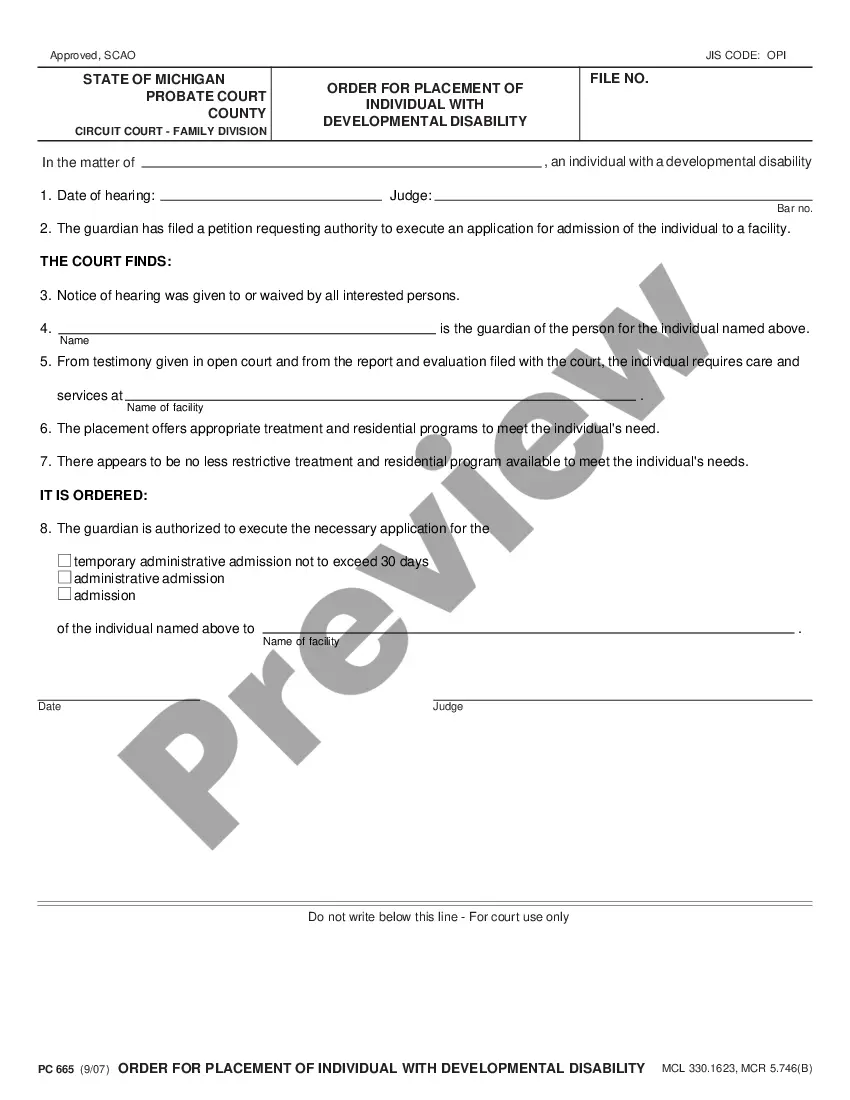

How to fill out Payroll Deduction - Special Services?

If you want to be thorough, retrieve, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search feature to find the documents you require. Various templates for corporate and individual purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to obtain the Massachusetts Payroll Deduction - Special Services with just a few clicks.

Every legal document template you buy is yours permanently. You have access to each form you saved in your account. Visit the My documents section and choose a form to print or download again.

Be proactive and download, and print the Massachusetts Payroll Deduction - Special Services with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the Massachusetts Payroll Deduction - Special Services.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to view the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Massachusetts Payroll Deduction - Special Services.

Form popularity

FAQ

Incorrect payroll deductions are often the result of employers charging their employees for benefits and services that they should be paying themselves. This includes: Federal unemployment tax (FUTA) State unemployment tax. Workers' compensation insurance.

Which of the following is not a statutory deduction? Union Dues.

There are four basic types of payroll taxes: federal income, Social Security, Medicare, and federal unemployment. Employees must pay Social Security and Medicare taxes through payroll deductions, and most employers also deduct federal income tax payments.

If you employ Massachusetts employees, you're required to comply with the PFML law. Learn more about the law, your obligations, how to make contributions, and other employer responsibilities.

Massachusetts employers have until Dec. 20 to opt out of the state's paid family leave program and elect private coverage that meets certain criteria. Employers may opt for such plans to be self-funded or fully insured. "Employers who wish to apply for a self-funded private plan exemption for the quarter beginning Oct.

Non-statutory DeductionsWhat is non-statutory deductions?Trade Union Dues.Personal insurance payments.Group Health and Pension Plan.Credit Union payments.

Almost all employers even those out-of-state employers with at least one Massachusetts employee, as well as certain independent contractors are subject to the new PFML requirements of the state. Municipal employers, districts and their instrumentalities are exempt, along with self-employed individuals.

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments.Child support payments.

Box 14: Your employer may report additional tax information here. If any amounts are reported in Box 14, they should include a brief description of what they're for. For example, union dues, employer-paid tuition assistance or after-tax contributions to a retirement plan may be reported here.

Statutory payroll deductions include: payroll taxes, federal income tax, Social Security tax and Medicare tax, state income tax (if applicable) and local tax withholdings (if applicable) such as city, county, or school district taxes, and state disability.