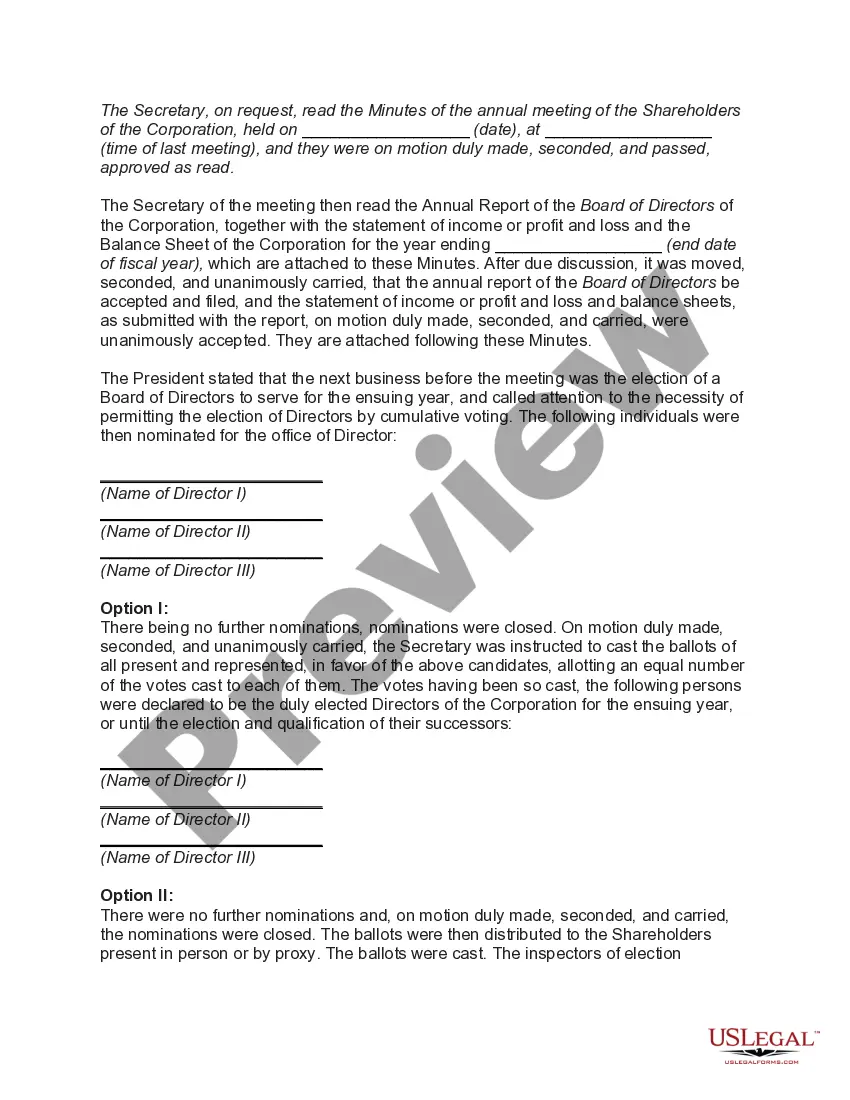

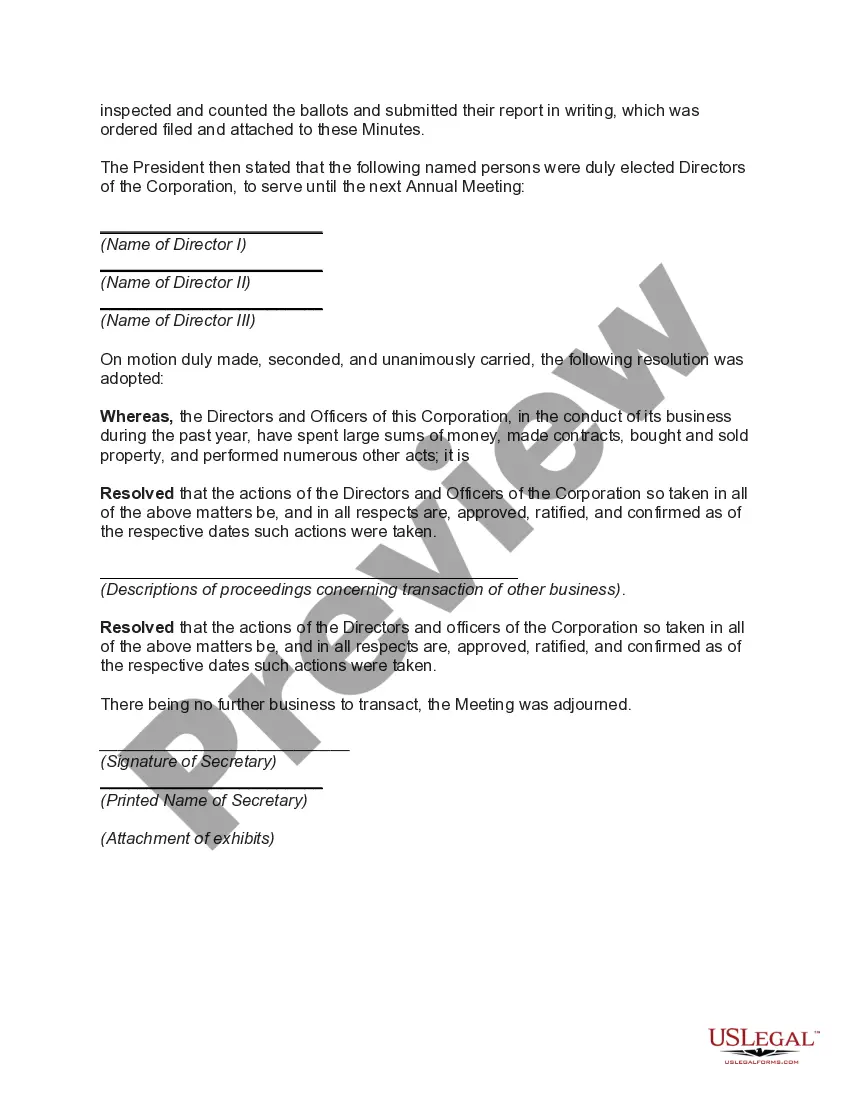

Massachusetts Minutes of Annual Meeting of Stockholders of Corporation

Description

How to fill out Minutes Of Annual Meeting Of Stockholders Of Corporation?

Locating the appropriate sanctioned document template can be a challenge. Naturally, there are numerous designs accessible online, but how do you identify the sanctioned format you require.

Utilize the US Legal Forms site. The platform provides a vast array of formats, including the Massachusetts Minutes of Annual Meeting of Stockholders of Corporation, which you can use for business and personal purposes. All templates are reviewed by professionals and meet federal and state regulations.

If you are already a registered user, Log In to your account and click the Download button to acquire the Massachusetts Minutes of Annual Meeting of Stockholders of Corporation. Use your account to browse through the legal documents you have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you need.

Select the file format and download the legal document template to your device. Fill out, revise, and print and sign the acquired Massachusetts Minutes of Annual Meeting of Stockholders of Corporation. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Utilize the service to obtain properly-crafted documents that adhere to state standards.

- First, ensure you have selected the correct form for your location.

- You can explore the form using the Preview option and review the form details to ensure it is suitable for your needs.

- If the form does not meet your expectations, utilize the Search field to find the appropriate document.

- Once you are confident the form is correct, click the Order now button to obtain it.

- Choose the pricing plan you desire and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda.

Under Robert's Rules of Order, minutes that do not come up for review quarterly, may be approved by the board. Since annual meetings are annual not quarterly, the board can approve the minutes. "Minutes of one annual meeting should not be held for action until the next one a year later." (Robert's Rules, 11th ed., p.

Corporate minutes are an official and legal record of the major discussions, activities, and decisions made by a company during meetings.

Scheduled meetings Your business should hold at least one annual shareholders' meeting. You can have more than one per year, but one per year is often the required minimum. An annual board of directors meeting is often also held in conjunction with the shareholders' meeting as well.

Internal documents, such as corporate bylaws, may require that certain information be contained in the minutes, so it is important to check for these rules and follow them closely. Officers, shareholders, and directors can demand a copy of the meeting minutes at any time.

Section 303 of the Companies Act 2006 requires the directors to call a general meeting once the company has received requests from members representing 5% of the paid up share capital those entitled to vote at general meetings of the company.

Of course, shareholders have a legal right to attend annual meetings. It is, after all, the one time each year they have an opportunity to sit in the same room with representatives from the company.

The Managing Contact is typically the one who approves the meeting minutes while the Prepared By is the scribe of all meeting items documented during the meeting. Review to ensure these parties are properly identified. 4.

While it is not required, you can state your annual profit and loss statement in the annual minutes. Also, record any important changes to the business throughout the year. If your corporate bylaws and articles of incorporation provide for electing officers each year, then elect officers.

The board meeting minutes will then act as evidence that, in taking a particular decision, the directors considered their duties. The courts will look at this evidence if the company was ever to run into legal trouble. You are legally required to keep minutes for at least 10 years from the date of the meeting.