Massachusetts Debt Settlement Offer in Response to Creditor's Proposal

Description

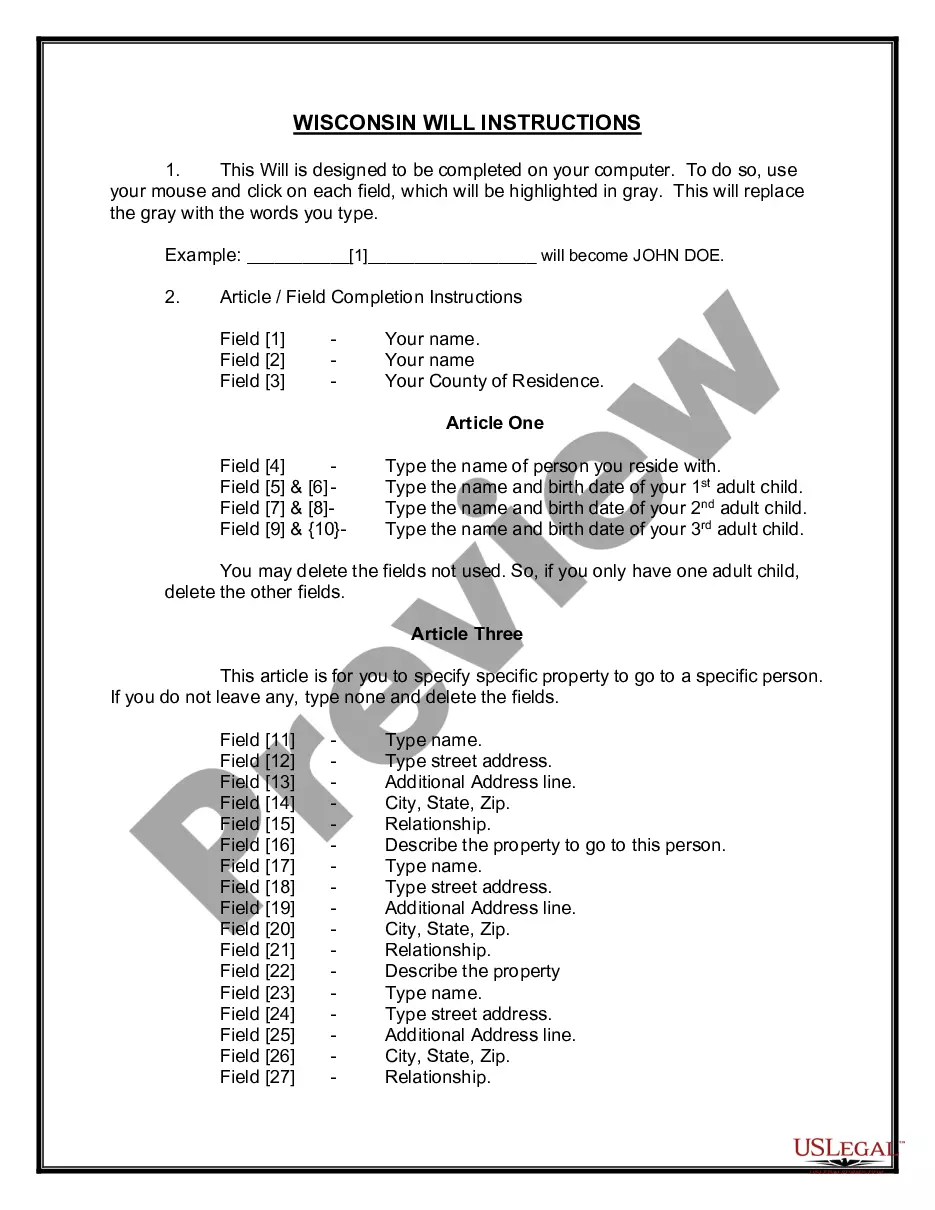

How to fill out Debt Settlement Offer In Response To Creditor's Proposal?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal record categories that you can download or print.

While utilizing the website, you can find thousands of forms for personal and business purposes, organized by categories, states, or search terms. You can access the latest editions of forms such as the Massachusetts Debt Settlement Offer in Response to Creditor's Proposal in just moments.

If you hold a subscription, Log In and retrieve the Massachusetts Debt Settlement Offer in Response to Creditor's Proposal from your US Legal Forms library. The Obtain button will appear on every form you review. You can access all previously acquired forms from the My documents tab in your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the payment.

Select the format and download the form onto your device. Modify it as needed, then fill out, alter, print, and sign the downloaded Massachusetts Debt Settlement Offer in Response to Creditor's Proposal. Every form you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to obtain or print another copy, simply head to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your location/region.

- Click the Preview button to review the form’s content.

- Examine the form summary to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search bar at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose your preferred payment plan and provide your details to create an account.

Form popularity

FAQ

"If you're happy with their offer, and you should be because it's less than what you actually owe them, then you should at least consider it," he says. The alternative, according to Ulzheimer, is the creditor either outsourcing the debt to a collector or even suing you.

Two Options for Taking the Settlement OfferRead the settlement offer carefully or have an attorney review the offer to be sure it's legally binding that the creditor or collector can't come after you for the remaining balance at some point in the future. Or, you can even try to negotiate a lower settlement.

Once you've done your research and put aside some cash, it's time to determine what your settlement offer will be. Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor.

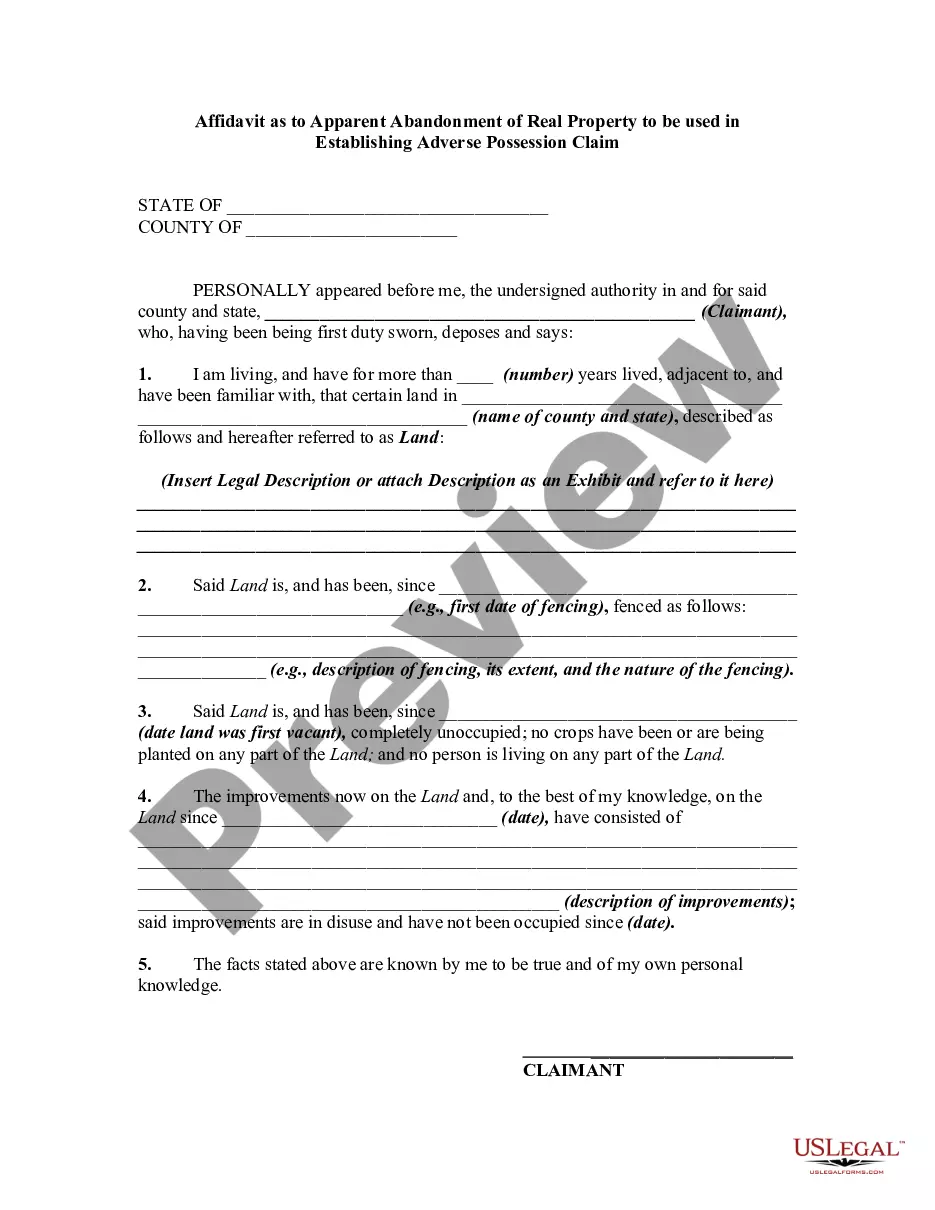

Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report. Ask for a written confirmation after settling on an agreement.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Debt settlement is an offer you make to your creditors to have your debt considered paid in full for payment of less than you owe. Your creditors agree to settle for pennies on the dollar because otherwise, they may see nothing or far less than that.

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.