Massachusetts Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

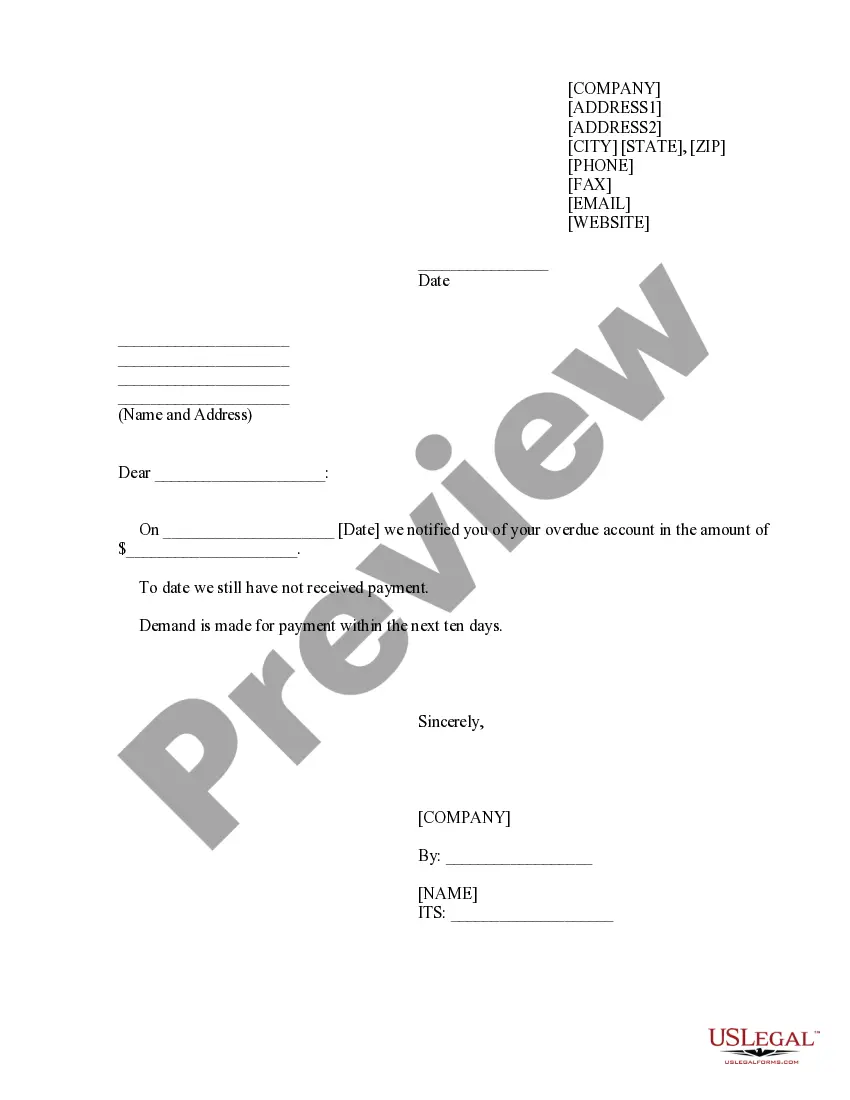

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

Are you in a situation where you need to obtain documents for organizational or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers a wide array of form templates, such as the Massachusetts Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose, designed to meet state and federal requirements.

Select a convenient document format and download your copy.

Explore all the document templates you have purchased in the My documents section. You can access an additional copy of the Massachusetts Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose at any time if needed. Simply click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Massachusetts Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

- Utilize the Review button to inspect the form.

- Check the details to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, use the Search field to find a form that fits your needs.

- When you find the suitable form, click Purchase now.

- Choose the payment plan you desire, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

The cy pres doctrine means "as near as possible" - practically, this means that the court rewrites the charitable gift or trust so that it is no longer impossible or impracticable to carry out.

Many states allow a beneficiary to disclaim, or refuse to take, a bequest. If the charity is left an asset that may impose an undue burden on the charity, it may want to disclaim the asset.

How does it save tax? A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

A testamentary trust (a trust established by will after death) is subject to tax at graduated income tax rates. Conversely, an inter vivos trust (a trust created during a settlor's lifetime) is taxed at the highest marginal tax rate applicable to individuals (currently 43.7% in BC).

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

General Bequests For example, you might say something along the lines of I hereby leave $300,000 to my nephew Aaron, rather than I hereby bequeath my primary residence at 4566 Maple Street in New Hampshire, CT to my nephew Aaron. The bequest is paid using the general pool of assets in the estate.

A bequest is a gift, but a gift is not necessarily a bequest. A bequest describes the act of leaving a gift to a loved one through a Will. For example, you could simply state something like I bequest my red Corvette to my son in a Will. On the other hand, a gift can be made outside of a Will.