Massachusetts Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

How to fill out Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

If you aim to finalize, acquire, or generate legal document templates, utilize US Legal Forms, the premier selection of legal documents available online.

Take advantage of the site’s user-friendly and efficient search to locate the forms you require.

Various templates for businesses and individual purposes are categorized by groups and states, or keywords and terms.

- Utilize US Legal Forms to obtain the Massachusetts Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Acquire button to access the Massachusetts Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement.

- You can also find previously saved forms in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct location.

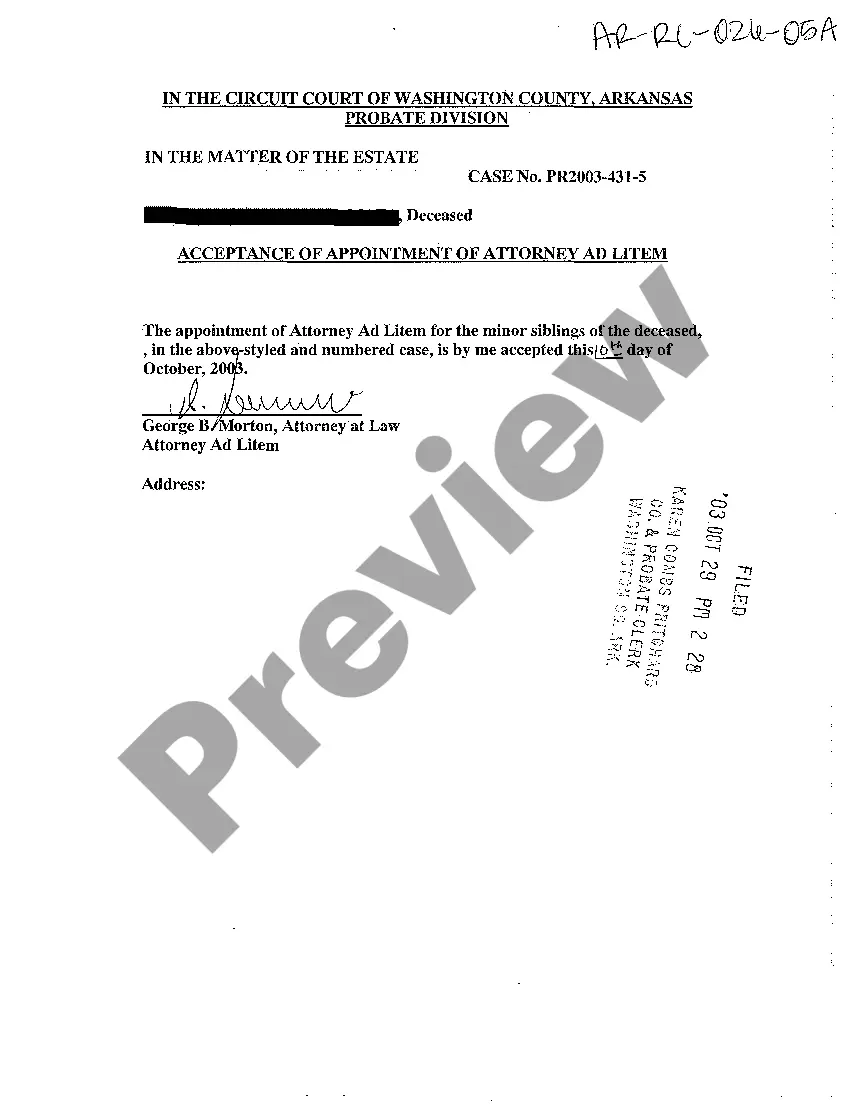

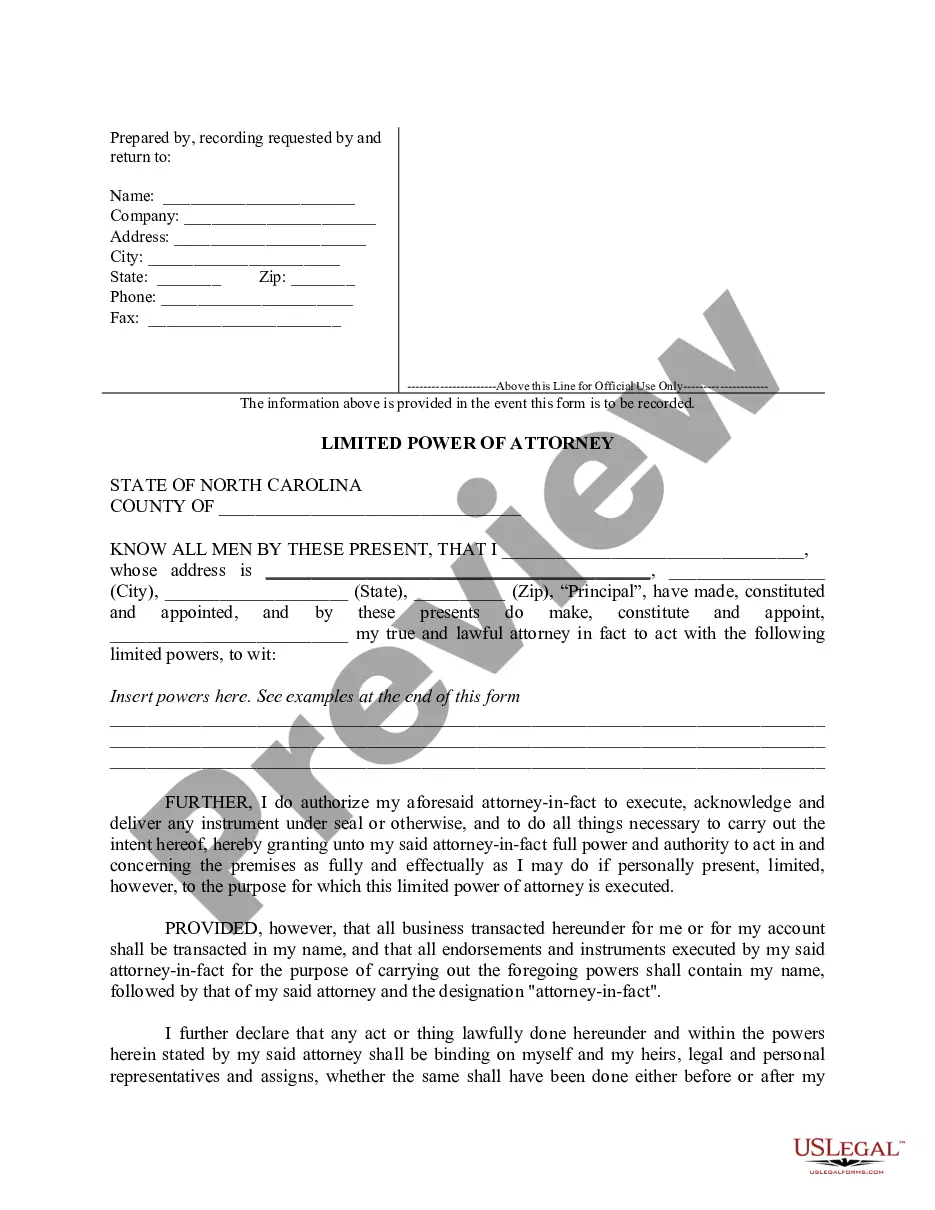

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other types in the legal document template.

- Step 4. Once you find the form you need, click on the Acquire now button. Choose your pricing plan and enter your details to register for an account.

Form popularity

FAQ

This trust type is established by your will. It's an eligible S corporation shareholder for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

Net investment income tax of a QSST 1411(a)(2)). The tax also applies to QSSTs to the extent the net investment income is retained in the trust. Although the S corporation income of a QSST is taxed to the individual income beneficiary, capital gain on the sale of the S corporation stock is taxed at the trust level.

grantor trust is any trust that is not a grantor trust. How they're taxed. As a separate tax entity, a nongrantor trust is required to have its own TIN . Nongrantor trusts must pay taxes on income received, which is typically at much higher rates than for individuals.

Every executor, administrator, trustee, guardian, conservator, trustee in a noncorporate bankruptcy or receiver of a trust or estate that received in- come in excess of $100 that is taxable under MGL ch 62 at the entity level or to a beneficiary(ies) and that is subject to Massachusetts jurisdiction must file a Form 2.

Grantor Trusts If a trust is considered a grantor trust for income tax purposes, all items of income, deduction and credit are not taxed at the trust level, but rather are reported on the personal income tax return of the individual who is considered the grantor of the trust for income tax purposes.

If the proper criteria are met during your lifetime, upon your death, the trust assets will not be included in your estate for estate tax purposes. The beneficiaries of the trust will not have to pay income taxes on the life insurance proceeds that they ultimately receive.

A Crummey trust with one benefi- ciary may be drafted to qualify for the GST annual exclusion, but a Crummey trust with more than one beneficiary does not satisfy the above requirements (although transfers to it, may, in part, qualify for the gift tax annual exclusion).

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.

A QSST is one of several types of trusts that are eligible to hold stock in an S corporation. Its two primary requirements are (1) there can be only one beneficiary of the trust and (2) all income must be distributed at least annually (Sec.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.