Massachusetts Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment

Description

How to fill out Sample Letter For Notice Of Estate Disbursement Plan - Waiver To Entry Of Judgment?

Discovering the right legal file template could be a battle. Naturally, there are plenty of web templates available on the Internet, but how can you find the legal form you require? Make use of the US Legal Forms website. The service gives 1000s of web templates, for example the Massachusetts Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment, that can be used for company and private needs. Every one of the kinds are checked out by pros and meet up with state and federal requirements.

In case you are currently authorized, log in to your profile and click the Acquire button to get the Massachusetts Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment. Make use of your profile to search from the legal kinds you possess ordered in the past. Go to the My Forms tab of your profile and have yet another duplicate of the file you require.

In case you are a whole new end user of US Legal Forms, listed here are easy guidelines for you to comply with:

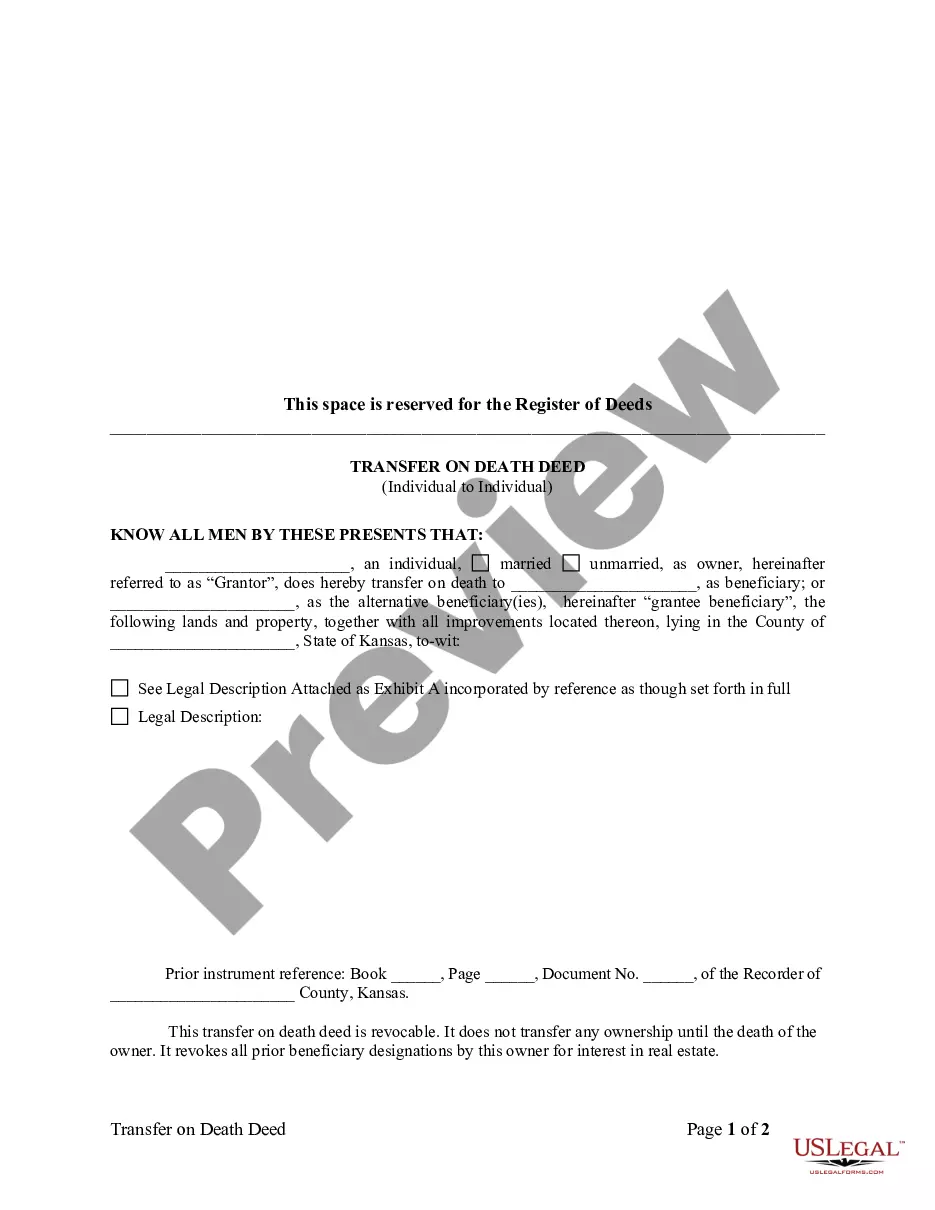

- First, ensure you have selected the proper form for your area/state. You are able to check out the shape making use of the Review button and look at the shape explanation to make sure it will be the right one for you.

- In the event the form does not meet up with your preferences, use the Seach field to get the right form.

- Once you are sure that the shape is proper, select the Purchase now button to get the form.

- Select the rates strategy you need and enter the necessary details. Create your profile and purchase an order utilizing your PayPal profile or credit card.

- Pick the submit format and down load the legal file template to your device.

- Full, edit and printing and sign the obtained Massachusetts Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment.

US Legal Forms may be the largest library of legal kinds where you will find numerous file web templates. Make use of the company to down load skillfully-created files that comply with express requirements.

Form popularity

FAQ

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

When the probate court appoints a personal representative, it issues a document called "Letters." This document is proof of the personal representative's legal authority to collect and manage estate property. The personal representative is entitled to collect a reasonable fee for the work performed for the estate.

What is Distribution? Once disbursement is complete, meaning all debts and final taxes are paid, a trustee can distribute the inheritance to beneficiaries. This is called distribution. It is only then that money should be paid to the benefit or care of the beneficiary.

There are limits on what an executor can and cannot do. If you've been named an executor, a couple basic rules of thumb are that you can't do anything that disregards the provisions in the will, and you can't act against the interests of any of the beneficiaries.

Though dividing funds equally is optimal, there are certain situations that may warrant leaving more to one of your heirs. Having frank discussions with your heirs about your gifting decisions can make things easier for them.

Below are 4 options for closing down an estate in Massachusetts. Option 1 ? Not filing Anything. ... Option 2 ? Filing a Small Estate Closing Statement. ... Option 3 ? Filing a Closing Statement. ... Option 4 ? Petition for Complete Settlement of Estate.

This agreement like any other agreement can direct a different means of distributing the estate from what the Will specifies. It can even supersede the direct distribution of assets under the Last Will (or no Last Will), subject to some stipulations, and conditions to their recognition.

PARTIAL DISTRIBUTION Definition & Legal Meaning a term used when a grant to legatees is made of a portion of an estate before the final settlement is made.