Massachusetts Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

How to fill out Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

Are you presently in a placement where you need documents for possibly organization or personal functions almost every time? There are a variety of authorized record themes available on the Internet, but getting ones you can rely isn`t straightforward. US Legal Forms delivers a large number of form themes, just like the Massachusetts Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name, that are composed to fulfill federal and state requirements.

If you are already acquainted with US Legal Forms internet site and also have a merchant account, simply log in. Following that, you are able to download the Massachusetts Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name web template.

If you do not come with an account and need to begin to use US Legal Forms, adopt these measures:

- Find the form you require and make sure it is for your correct city/state.

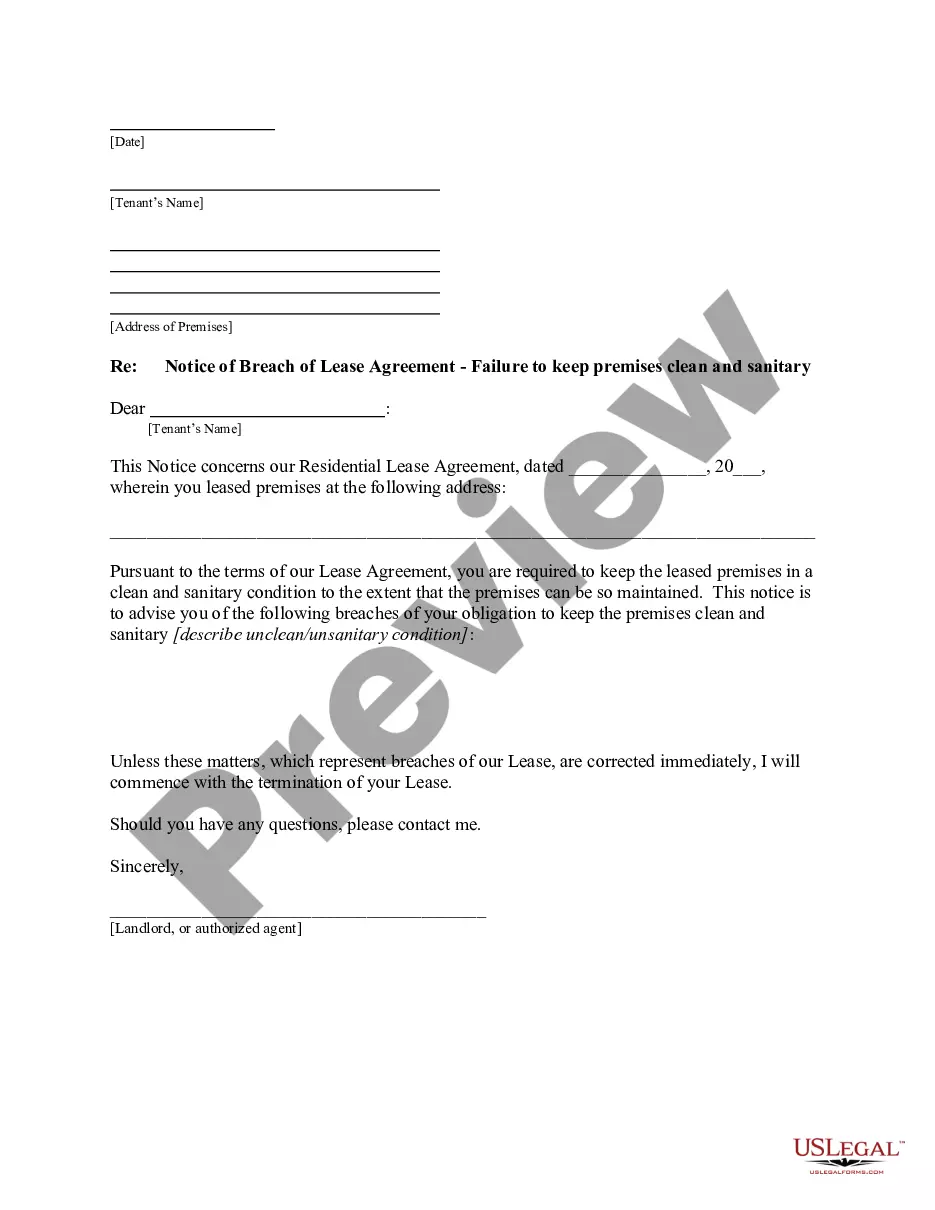

- Take advantage of the Review button to examine the shape.

- Look at the information to ensure that you have selected the appropriate form.

- In the event the form isn`t what you`re searching for, make use of the Search area to get the form that meets your requirements and requirements.

- Once you discover the correct form, simply click Purchase now.

- Select the rates strategy you need, complete the specified information to produce your bank account, and pay for the transaction using your PayPal or charge card.

- Pick a practical paper file format and download your version.

Get every one of the record themes you possess purchased in the My Forms food selection. You can get a extra version of Massachusetts Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name whenever, if possible. Just select the essential form to download or produce the record web template.

Use US Legal Forms, the most substantial variety of authorized varieties, to conserve some time and stay away from blunders. The service delivers appropriately created authorized record themes that can be used for an array of functions. Generate a merchant account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

The Made Whole Doctrine is an equitable defense to the subrogation or reimbursement rights of a subrogated insurance carrier or other party, requiring that before subrogation and/or reimbursement will be allowed the insured must be made whole for all of its damages.

Subrogation is a term describing a right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured. This is done in order to recover the amount of the claim paid by the insurance carrier to the insured for the loss.

Additional Details letter creation date. insured name. claim number and policy number. date of loss. recipient name. damage amount. claims specialist name and title.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

Massachusetts is a no-fault state which means no matter who causes the accident, PIP will pay these expenses for you or anyone you let drive your car, anyone living in your household, passengers in your vehicle and pedestrians.

Acceptance of any compensation under this chapter shall subrogate the commonwealth, to the extent of such compensation paid, to any right or right of action accruing to the claimant or to the victim to recover payments on account of losses resulting from the crime with respect to which the compensation has been paid, ...

Subrogation, in the context of a injury claim arising from a car accident, is a legal principle under which an insurance company that has paid a loss under an insurance policy is entitled to all the rights and remedies belonging to the insured against a third party with respect to any loss covered by the policy.

A subrogation receipt transferring the insured's entire causes of action to the insurer allows the insurer to recover in the insured's name for the entire loss, not just to the extent of its payment.