Massachusetts New Employee Survey

Description

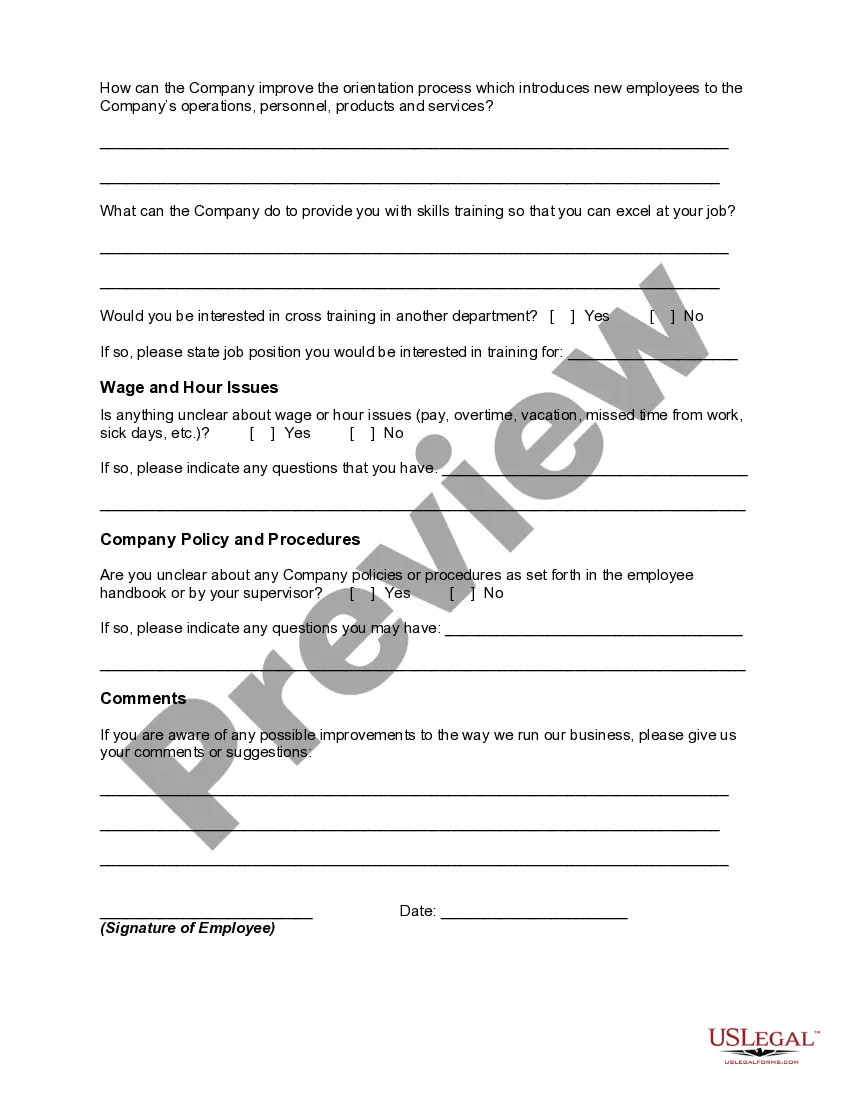

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

Are you currently in a situation where you require documentation for either business or personal purposes almost all the time.

There are numerous valid document templates accessible on the web, but finding ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, such as the Massachusetts New Employee Survey, designed to comply with federal and state regulations.

Once you have the correct form, click on Purchase now.

Select the pricing plan you desire, enter the necessary information to create your account, and complete the transaction using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Massachusetts New Employee Survey anytime if needed. Just click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally drafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts New Employee Survey template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Obtain the form you need and verify that it is for the correct city/state.

- Utilize the Preview feature to review the form.

- Check the description to ensure that you have selected the right form.

- If the form is not what you're seeking, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

Before you can add a new hire to your payroll, you need to know how much money to withhold from their wages for federal and, if applicable, state income taxes. To find out, you need to collect two new hire tax forms: federal and state W-4 forms.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.

How to reportOnline. If you have 25 or more employees, you must file your new hire reports online through MassTaxConnect.By mail. If you have fewer than 25 employees, you can use the New Hire Reporting Form (Form NHR) to submit your new hire reports by mail.By fax.

Forms and notices for newly-hired employeesForm I-9 Employment eligibility verification form, US Dept.Form M-4: Massachusetts employee's withholding exemption certificate, Mass.Form NHR: New hire and independent contractor reporting form, Mass.Form W2 Federal tax withholding, IRS.More items...?

How to reportOnline. If you have 25 or more employees, you must file your new hire reports online through MassTaxConnect.By mail. If you have fewer than 25 employees, you can use the New Hire Reporting Form (Form NHR) to submit your new hire reports by mail.By fax.

Maine - E-Verify is voluntary for all employers. Maryland - E-Verify is voluntary for all employers. Massachusetts - Mandatory E-Verify for state agencies. Michigan - E-Verify is voluntary for most employers and mandatory for contractors and subcontractors of the transportation department.

Federal law requires employers to report basic information on new and rehired employees within 20 days of hire to the state where the new employees work. Some states require it sooner.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Illegal in Massachusetts: Asking Your Salary in a Job Interview.