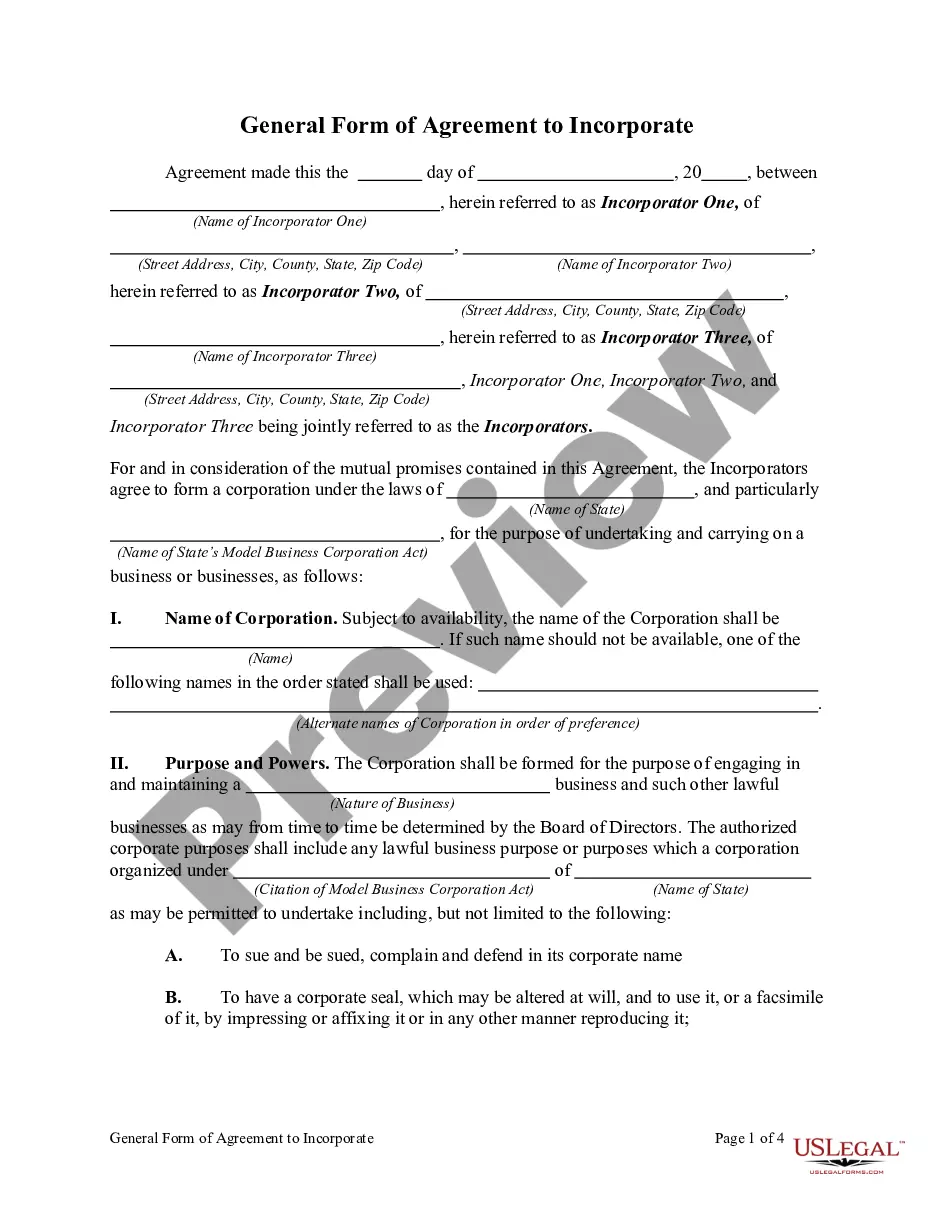

Massachusetts Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Obtaining the correct legal document template can be a challenge.

Of course, there are numerous templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Massachusetts Agreement to Incorporate as an S Corporation and as a Small Business Corporation with Qualification for Section 1244 Stock, which you can use for business and personal needs.

You can preview the form by using the Preview button and read the form description to confirm it is the right one for you.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the Massachusetts Agreement to Incorporate as an S Corporation and as a Small Business Corporation with Qualification for Section 1244 Stock.

- Use your account to browse the legal forms you have previously acquired.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure that you have selected the correct form for your region/state.

Form popularity

FAQ

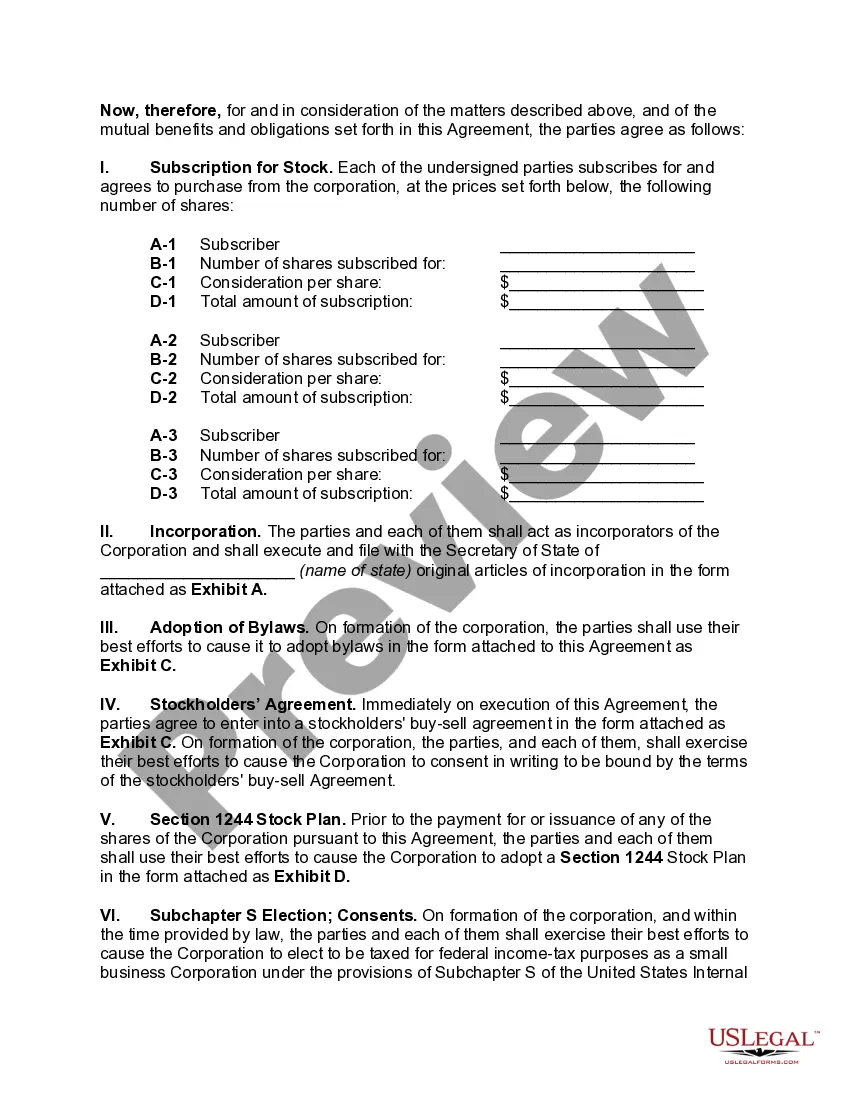

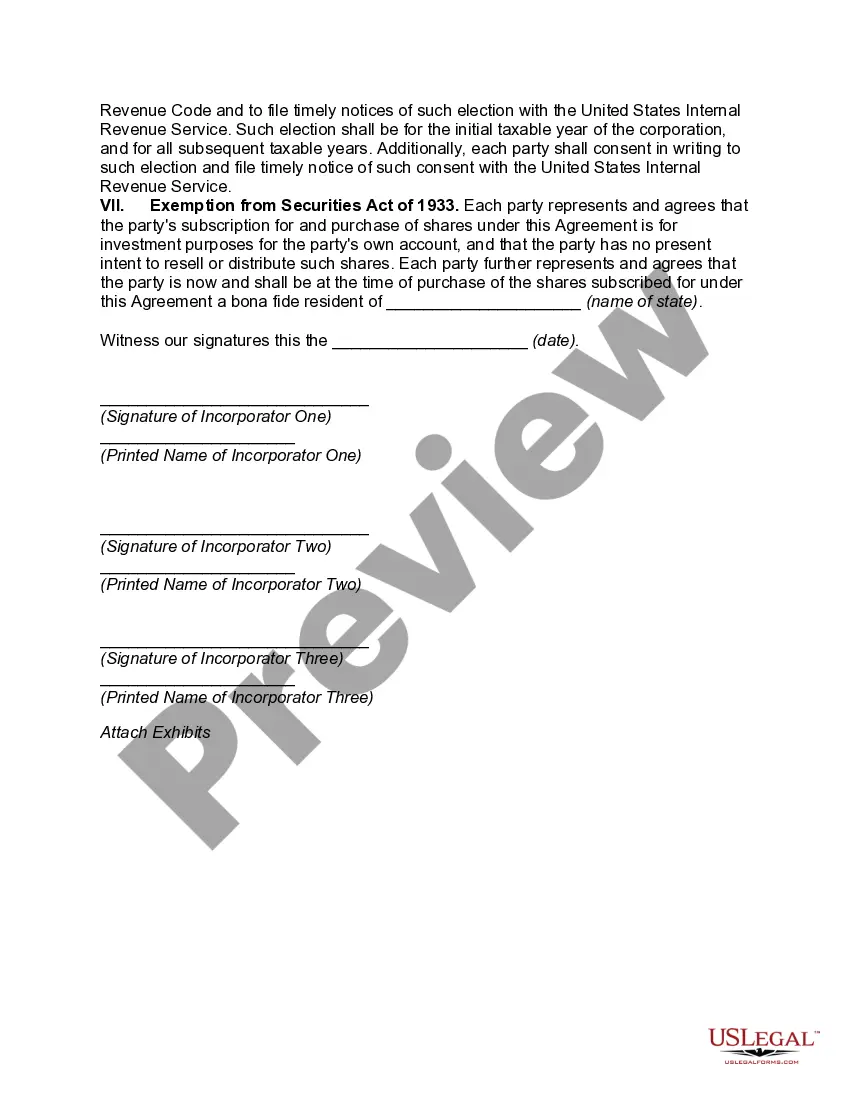

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

1244 loss is the property's adjusted basis reduced by liabilities to which the property is subject or that the corporation assumed. However, if the property's fair market value (FMV) is less than its adjusted basis when it is transferred to the corporation, any Sec.

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

1244(b)). Any loss in excess of the limit is a capital loss, subject to the capital loss rules. Thus, if the potential loss exceeds the $50,000 (or $100,000) limit, the stock should be disposed of in more than one year to maximize the ordinary loss treatment.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec. 1363, which provides that the taxable income of an S corporation must be computed in the same manner as that of an individual.

The maximum aggregate loss that may be treated by a taxpayer as ordinary loss for a taxable year with respect to an issuing corporation's Section 1244 stock is $50,000, or $100,000 for a husband and wife filing a joint return. Any loss in excess of the maximum allowable loss must be treated as a capital loss.