Massachusetts General Form of Agreement to Incorporate

Description

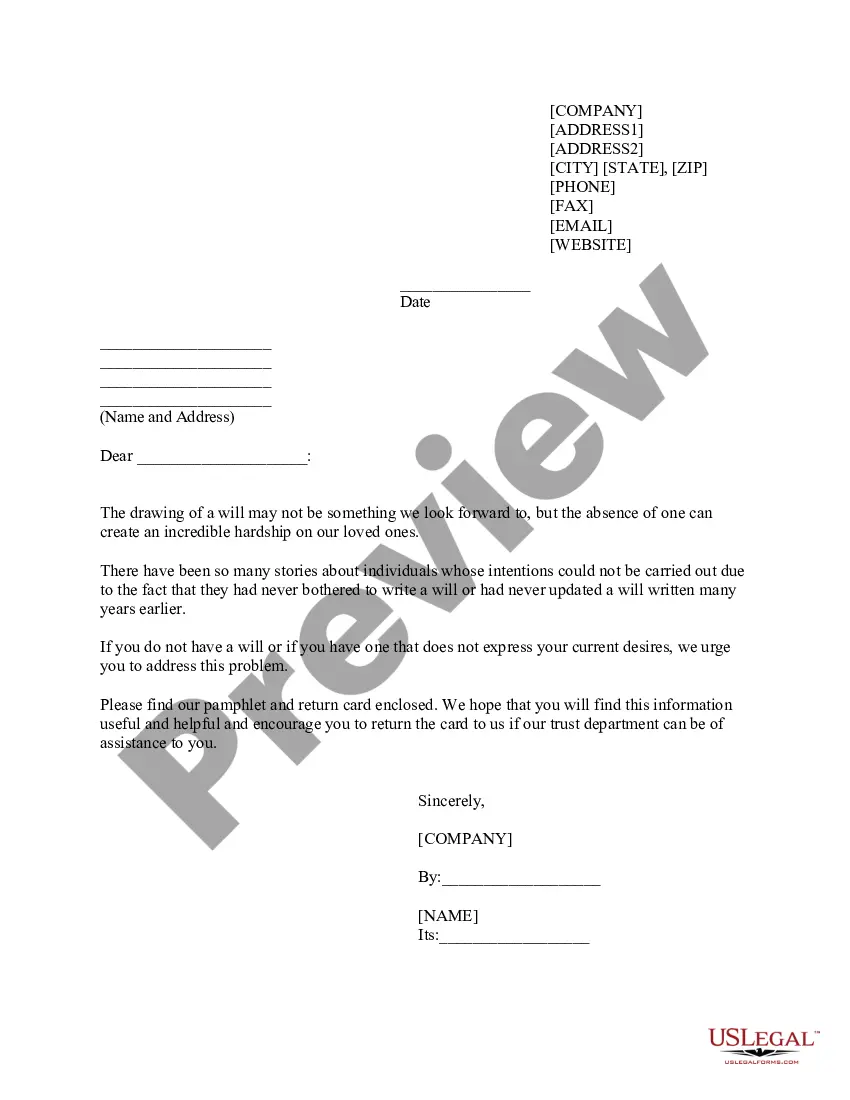

How to fill out General Form Of Agreement To Incorporate?

Are you currently situated in a location where you require documents for both business or specific needs almost every day.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of template options, including the Massachusetts General Form of Agreement to Incorporate, crafted to comply with state and federal regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Massachusetts General Form of Agreement to Incorporate at any time, if needed. Just click on the required form to download or print the template. Use US Legal Forms, the largest collection of legal templates, to save time and avoid mistakes. The service provides professionally designed legal document templates that you can utilize for a variety of purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After logging in, you can download the Massachusetts General Form of Agreement to Incorporate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the right city/region.

- Use the Review button to verify the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search area to find the form that meets your needs and requirements.

- Once you locate the correct form, click on Purchase now.

- Select the pricing plan you prefer, fill out the required information to create your account, and pay for the order with your PayPal or credit card.

Form popularity

FAQ

Form 3 in Massachusetts is a corporate excise tax return that businesses use to report income generated within the state. It details the company's financial activities and tax liabilities to ensure compliance with state tax regulations. Understanding the Massachusetts General Form of Agreement to Incorporate can support your preparation of Form 3, as it lays the groundwork for structured corporate governance.

Massachusetts Form 3 is filed by corporations and certain other business entities engaging in activities within the state. If your business has income from Massachusetts sources, it is essential to file this form to report your earnings. Using the Massachusetts General Form of Agreement to Incorporate as a resource can provide clarity on your filing obligations and enhance your business's compliance.

While Massachusetts does not legally require LLCs to have an operating agreement, it is highly recommended. An operating agreement clarifies how the LLC will operate, how profits will be distributed, and the duties of each member. Implementing the Massachusetts General Form of Agreement to Incorporate as part of your operating agreement can streamline this process and support legal compliance.

To create a general partnership in Massachusetts, you need a formal agreement between the partners that outlines each partner's contributions and responsibilities. While not legally required, it's advisable to use a written document, such as the Massachusetts General Form of Agreement to Incorporate, to clarify terms and expectations. This step can prevent misunderstandings and provide a structured approach to partnership operations.

The M 3 form is required for partnerships and LLCs in Massachusetts, specifically those with total receipts that exceed the specified thresholds. This form details the income and deductions of the entity for taxation purposes. Maintaining proper documentation, including agreements outlined in the Massachusetts General Form of Agreement to Incorporate, can facilitate accurate completion of the M 3.

Any estate that exceeds the Massachusetts estate tax exemption threshold must file an estate tax return. This ensures that the estate meets its tax responsibilities and provides clarity on how the estate will be managed. Utilizing the Massachusetts General Form of Agreement to Incorporate may help with the formalities in handling the estate's affairs.

In Massachusetts, any partnership that conducts business or earns income within the state must file a partnership return. This is important to comply with state tax laws and obligations. The Massachusetts General Form of Agreement to Incorporate can be useful for partnerships as it outlines the foundational agreements between partners, aiding in proper filing.

The approval time for an LLC in Massachusetts typically ranges from a few days to several weeks, depending on the filing method. If you file online, expect faster processing compared to paper submissions. Using the Massachusetts General Form of Agreement to Incorporate can expedite your initial application process. Prompt submission can help you start your business activities sooner and minimize delays.

Incorporating in Massachusetts involves several straightforward steps. First, choose a unique name for your business and then file the Articles of Organization with the state. Utilizing the Massachusetts General Form of Agreement to Incorporate simplifies this process by providing a template to follow. Completing these steps correctly ensures your business is legally recognized and can operate without legal hindrances.

Yes, in Massachusetts, LLCs must file an annual report to maintain good standing. This report includes updated information regarding your business and is essential for compliance. If you haven't already, utilizing the Massachusetts General Form of Agreement to Incorporate can streamline your initial setup process. Keeping your company's information current ensures you avoid penalties and fosters trust with your clients.