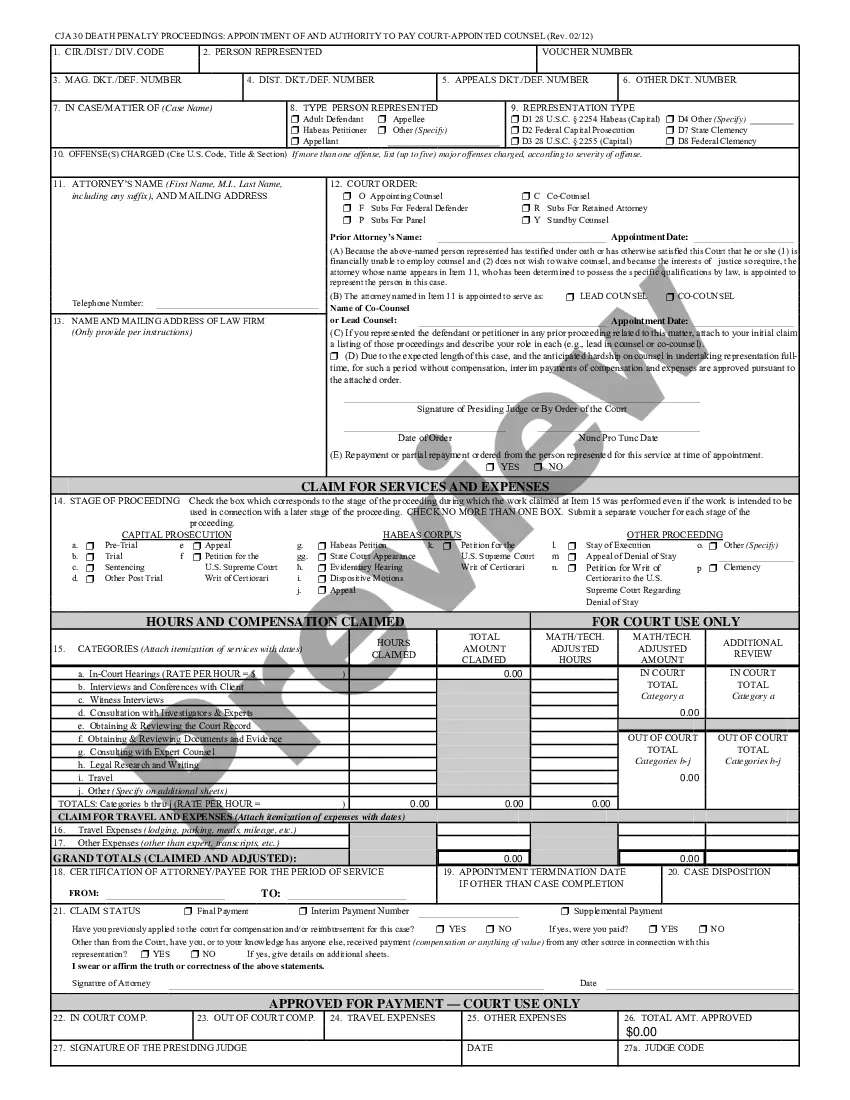

Massachusetts Review of Loan Application

Description

How to fill out Review Of Loan Application?

You can commit hours on the web searching for the legal file design that meets the federal and state specifications you need. US Legal Forms supplies a huge number of legal kinds that are analyzed by professionals. It is possible to download or printing the Massachusetts Review of Loan Application from the assistance.

If you already have a US Legal Forms account, you can log in and click on the Acquire button. After that, you can full, edit, printing, or indication the Massachusetts Review of Loan Application. Each and every legal file design you buy is your own forever. To obtain yet another version of the acquired develop, proceed to the My Forms tab and click on the related button.

If you use the US Legal Forms web site the very first time, keep to the straightforward directions beneath:

- Initial, ensure that you have chosen the correct file design for the area/metropolis of your choice. Browse the develop information to make sure you have selected the right develop. If offered, make use of the Preview button to look throughout the file design at the same time.

- If you want to locate yet another edition from the develop, make use of the Look for field to discover the design that suits you and specifications.

- When you have found the design you desire, just click Get now to move forward.

- Pick the prices strategy you desire, enter your references, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your credit card or PayPal account to purchase the legal develop.

- Pick the formatting from the file and download it for your system.

- Make changes for your file if required. You can full, edit and indication and printing Massachusetts Review of Loan Application.

Acquire and printing a huge number of file themes making use of the US Legal Forms Internet site, which offers the greatest assortment of legal kinds. Use professional and status-specific themes to tackle your business or personal demands.

Form popularity

FAQ

A loan review provides an assessment of the overall quality of a loan portfolio. Specifically, a loan review: ? Assesses individual loans, including repayment risks.

Your income and employment history are good indicators of your ability to repay outstanding debt. Income amount, stability, and type of income may all be considered. The ratio of your current and any new debt as compared to your before-tax income, known as debt-to-income ratio (DTI), may be evaluated.

Getting approved for a personal loan generally takes anywhere from one day to one week. As we mentioned above, how long it takes for a personal loan to go through depends on several factors, like your credit score. However, one of the primary factors that will affect your approval time is where you get your loan from.

A credit review?also known as account monitoring or account review inquiry?is a periodic assessment of an individual's or business's credit profile. Creditors?such as banks, financial services institutions, credit bureaus, settlement companies, and credit counselors?may conduct credit reviews.

Mortgage underwriting is what happens behind the scenes once you submit your application. It's the process a lender uses to take an in-depth look at your credit and financial background to determine if you're eligible for a loan.

When a loan application is under review or pending approval from a lender, it means that the lender is evaluating the borrower's creditworthiness and financial situation to determine whether they are eligible for a loan.

Typically, a loan review is conducted on commercial loan files, either internally by bank or credit union staff, or by hired third-party auditors. These investigators check for completeness of loan documentation and/or evaluate loan performance.

A loan review analyst examines credit data and financial statements to assess the risk of individual loans. As a loan review analyst, you may work with commercial, real estate, business, or agriculture loans.