Massachusetts Escrow Check Receipt Form

Description

How to fill out Escrow Check Receipt Form?

Have you ever found yourself in a situation where you require documents for either business or personal reasons almost daily.

There are many legal document templates available online, but finding reliable ones isn’t straightforward.

US Legal Forms offers a vast selection of form templates, such as the Massachusetts Escrow Check Receipt Form, which can be tailored to meet federal and state requirements.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Massachusetts Escrow Check Receipt Form whenever you need it. Click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Escrow Check Receipt Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Choose the form you need and ensure it is for the correct city/state.

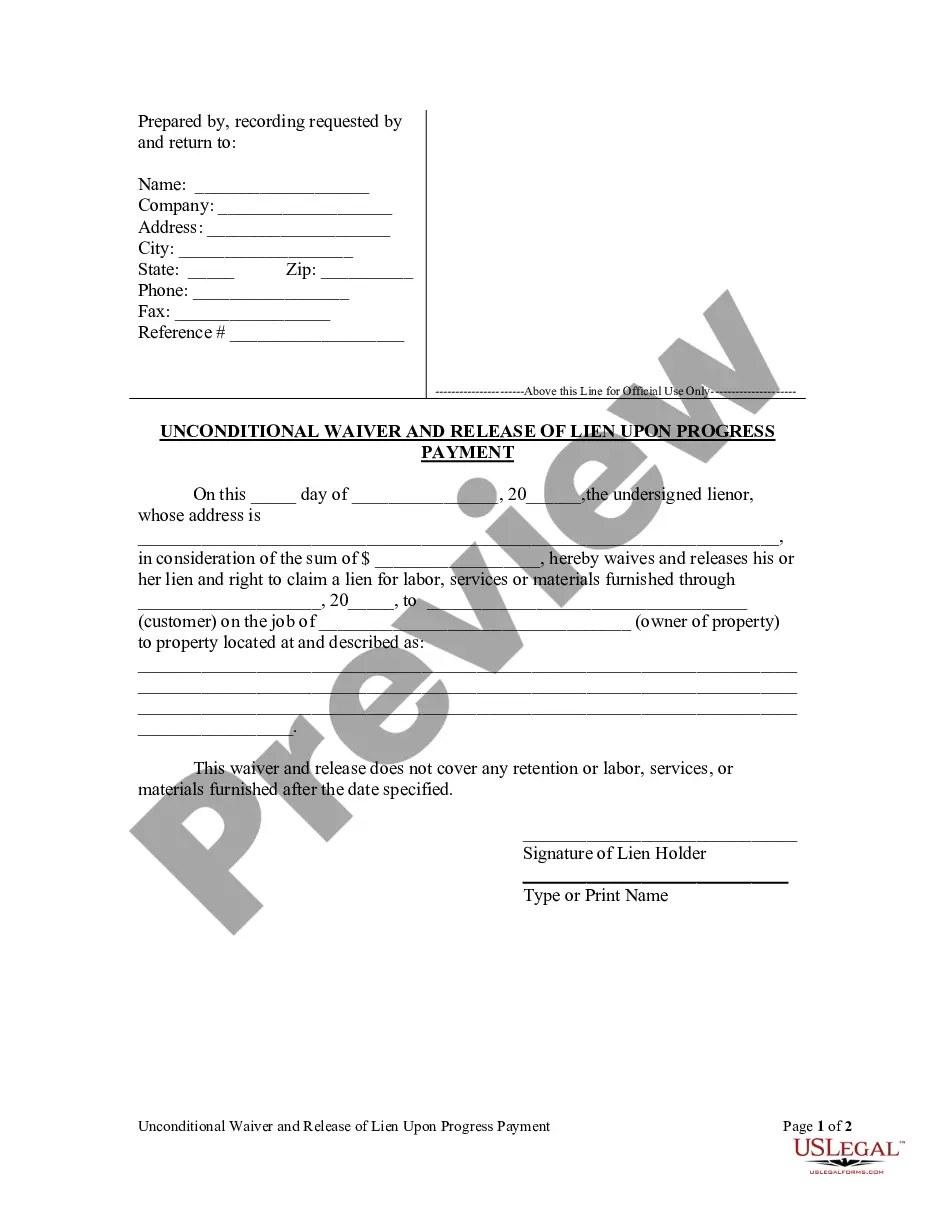

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you’re searching for, use the Lookup section to find the form that meets your needs and requirements.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

Yes, landlords in Massachusetts must put security deposits into an escrow account to comply with state law. This requirement ensures that funds are safeguarded and available for return to tenants. Additionally, the Massachusetts Escrow Check Receipt Form can help landlords document the deposit process effectively. Using this form not only streamlines compliance but also fosters trust and accountability in landlord-tenant relationships.

Yes, Massachusetts law mandates that landlords place security deposits into a designated escrow account. The account must be in a Massachusetts bank and earn interest, which tenants are entitled to receive. By utilizing the Massachusetts Escrow Check Receipt Form, landlords can maintain clear records of the deposit transactions, ultimately benefiting both tenants and landlords. This form serves to enhance transparency regarding the management of escrow funds.

To receive your security deposit back in Massachusetts, you must provide your landlord with a written request. After your lease ends, landlords have 30 days to return the security deposit or provide an itemized list of any deductions. To simplify this process, you can use the Massachusetts Escrow Check Receipt Form, ensuring clear documentation. This form helps protect both parties by detailing deposit amounts and any deductions taken.

The deposit amount, deposit account/account holder, property address, and buyer and seller information should be written on the receipt. Earnest Money Release Form Required to be signed by the buyer and seller if the earnest money is requested to be returned prior to the closing of the property.

Earnest money protects the seller if the buyer backs out. It's typically around 1 3% of the sale price and is held in an escrow account until the deal is complete.

Right way Be Specific:Find out the name of the title company and make the check payable to that particular title company.Put the property address in the memo line.Write a new check for every offer.

This means, as a buyer, when you are making an offer on a property, it is a good idea to move the money into your checking account right away, so that it is available to deposit into escrow. Escrow companies will accept a cashier's check or wire, or a personal check for the earnest money deposit.

This is typically the listing or buyer's agent or a company of their designation. If you don't know to whom to write the check, ask your agent or fill in " Escrow," so you can add a more specific escrow name later. If your offer is rejected, the earnest money is returned to you from escrow.

How to Write1 The Deposit Receipt On This Page Must Be Saved.2 Document The Calendar Date And Payer This Receipt Concerns.3 Report On The Money Received From The Payer.4 This Receipt Must Be Authorized By The Recipient.19-Jan-2022

How to Write1 The Deposit Receipt On This Page Must Be Saved.2 Document The Calendar Date And Payer This Receipt Concerns.3 Report On The Money Received From The Payer.4 This Receipt Must Be Authorized By The Recipient.