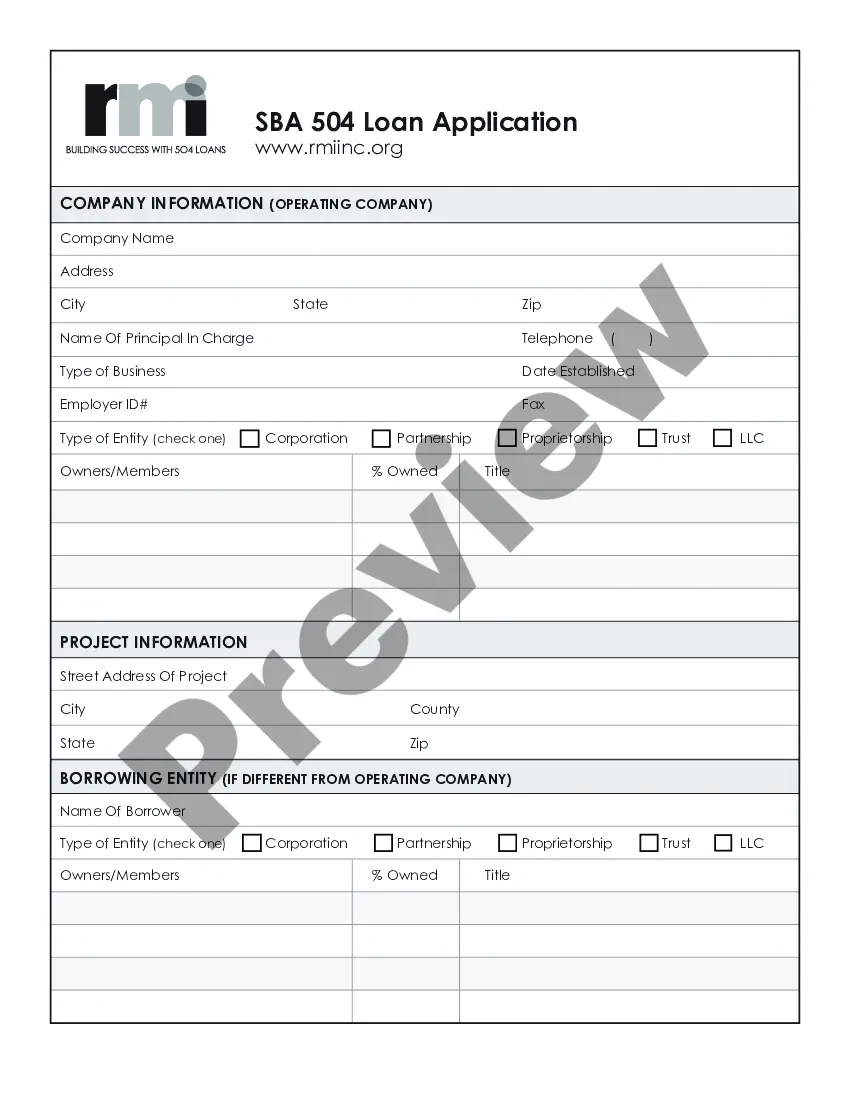

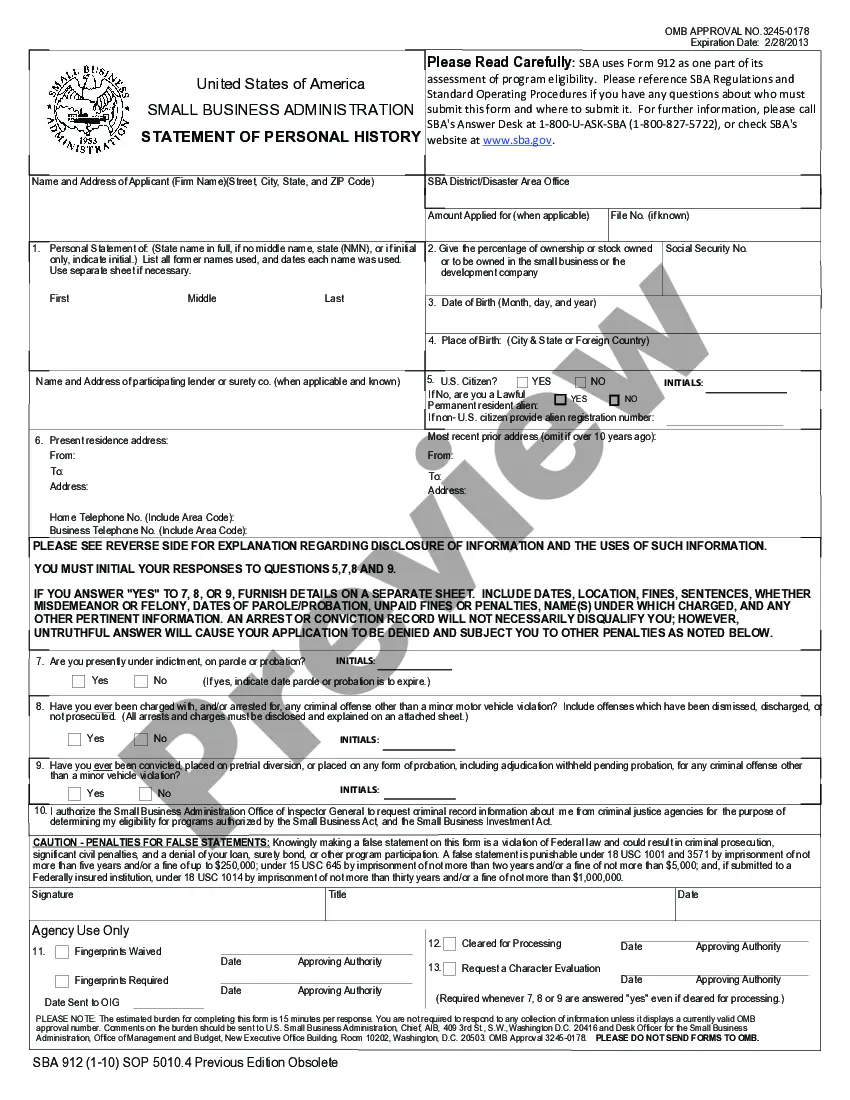

Massachusetts Small Business Administration Loan Application Form and Checklist

Description

How to fill out Small Business Administration Loan Application Form And Checklist?

If you want to comprehensive, down load, or print authorized papers templates, use US Legal Forms, the greatest collection of authorized types, that can be found online. Make use of the site`s simple and easy practical look for to discover the paperwork you require. Numerous templates for business and specific functions are categorized by groups and suggests, or search phrases. Use US Legal Forms to discover the Massachusetts Small Business Administration Loan Application Form and Checklist within a number of click throughs.

If you are already a US Legal Forms client, log in in your profile and click on the Down load switch to have the Massachusetts Small Business Administration Loan Application Form and Checklist. You can even access types you earlier saved in the My Forms tab of your profile.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that appropriate town/land.

- Step 2. Use the Preview option to examine the form`s articles. Don`t forget to see the description.

- Step 3. If you are unhappy together with the form, take advantage of the Search field near the top of the screen to get other variations of your authorized form design.

- Step 4. When you have discovered the shape you require, click the Buy now switch. Pick the rates prepare you favor and include your credentials to register on an profile.

- Step 5. Approach the transaction. You may use your charge card or PayPal profile to accomplish the transaction.

- Step 6. Pick the structure of your authorized form and down load it on your own gadget.

- Step 7. Total, change and print or sign the Massachusetts Small Business Administration Loan Application Form and Checklist.

Each authorized papers design you buy is yours for a long time. You possess acces to every single form you saved inside your acccount. Click on the My Forms area and select a form to print or down load once more.

Compete and down load, and print the Massachusetts Small Business Administration Loan Application Form and Checklist with US Legal Forms. There are millions of specialist and state-certain types you can utilize for the business or specific requirements.

Form popularity

FAQ

In general, SBA loans are not as difficult to get as business bank loans. Because they're backed by the U.S. government, they're less risky for banks than issuing their own loans.

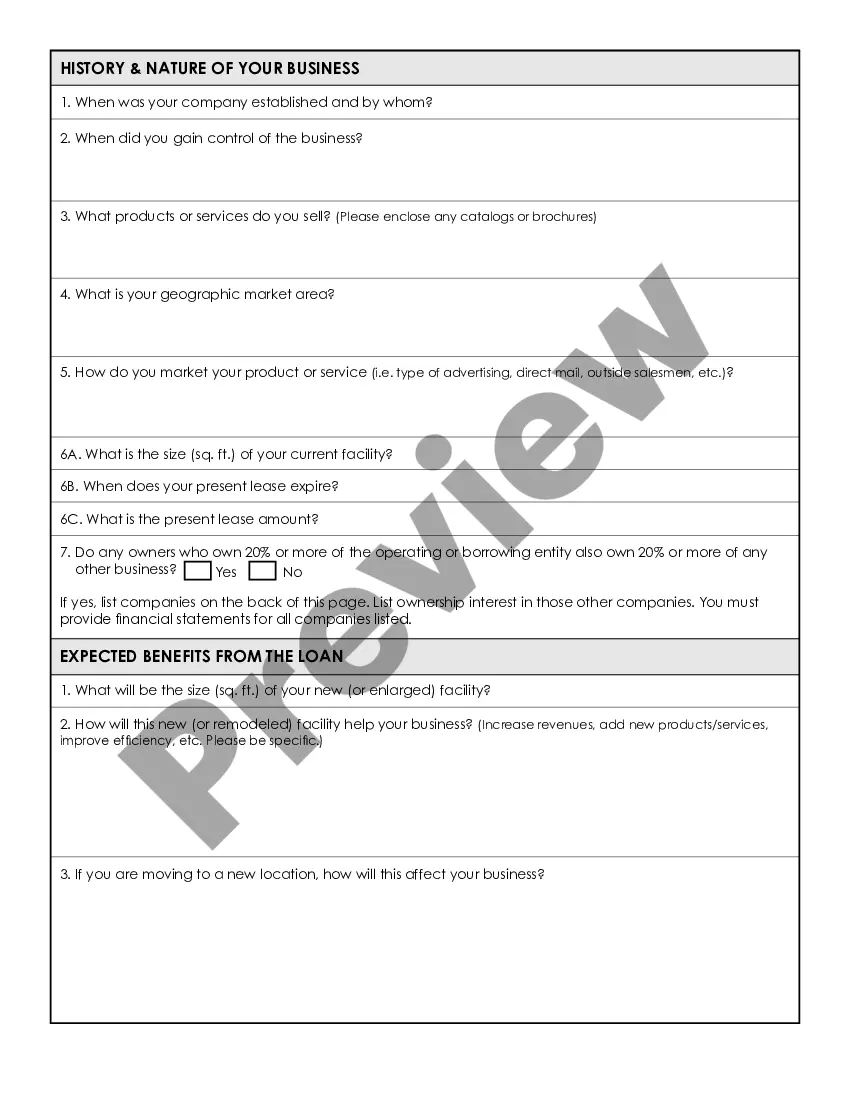

Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose.

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

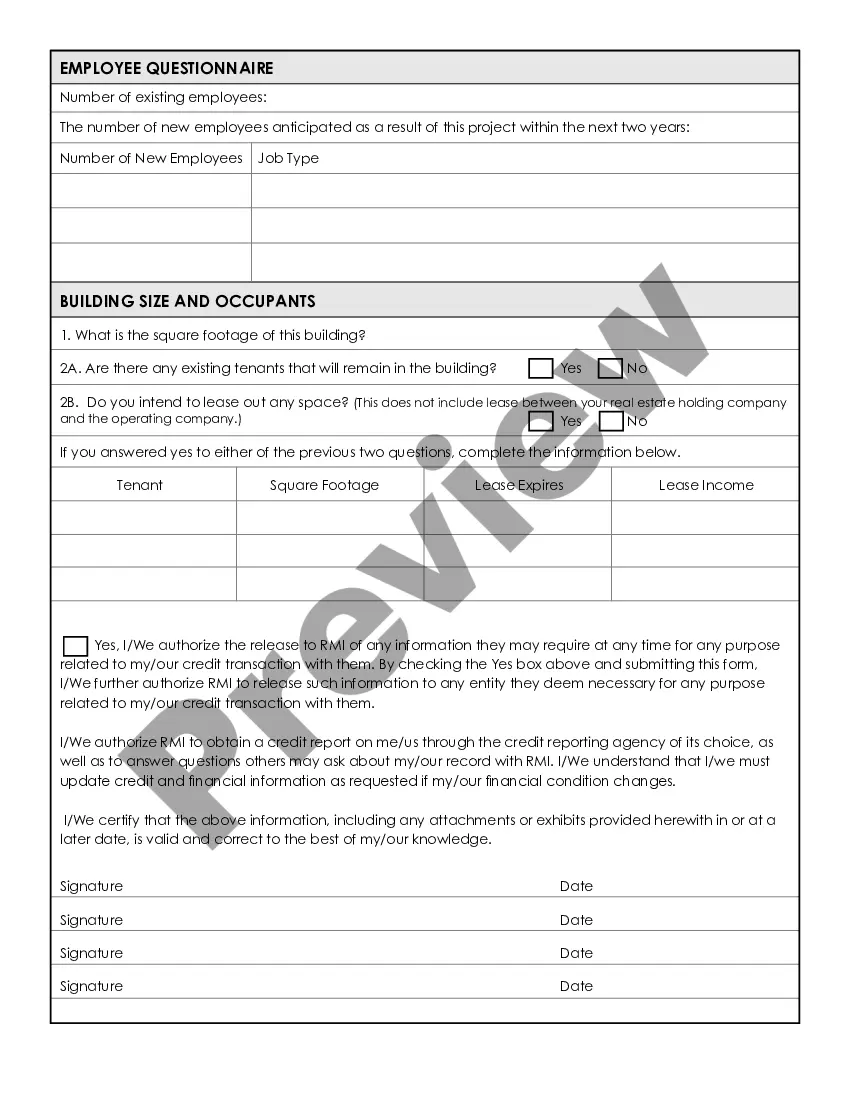

If you plan to apply for a SBA loan, you need to gather several types of documentation together ahead of time. While all loan programs have different requirements, you will most likely need the following documents at a minimum: Personal and business bank statements for the past 12 months.

The SBA requires extensive financial documentation before you can get approved for a loan. This is because SBA loans are usually the main option for small businesses that can't otherwise qualify for loans from traditional banks. The SBA guarantees a portion of the loan with the bank you're working with.

Do SBA loans require a downpayment? Yes, the minimum SBA loan down payment requirement is 10% on 7(a) and 504 loans and is based on a business's cash flow and collateral. Weak cash flow or low-value collateral can increase the down payment requirement to up to 30% of the loan amount.

Although the SBA Form 912 is no longer required, if an individual owner answers ?yes? to question 18 or 19, the individual must provide the details to Page 3 PAGE 3 of 6 EXPIRES: 9-1-21 SBA Form 1353.3 (4-93) MS Word Edition; previous editions obsolete Must be accompanied by SBA Form 58 Federal Recycling Program ...

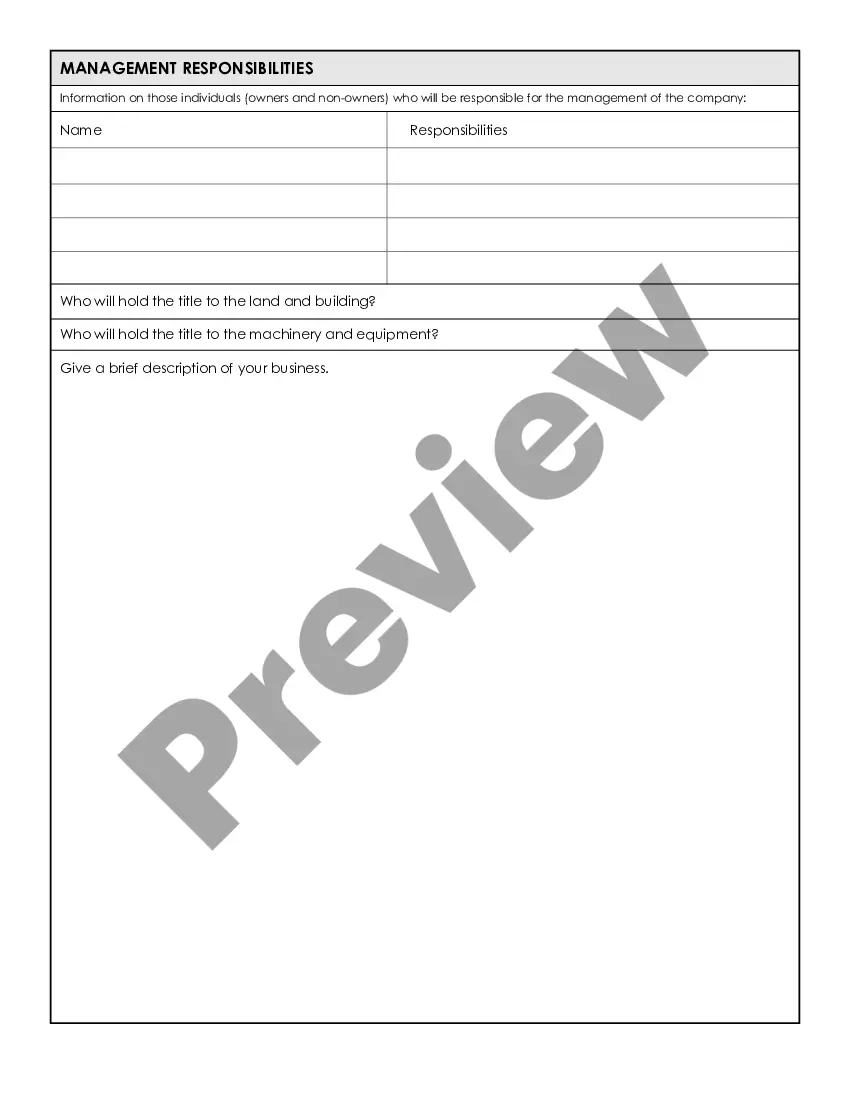

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.