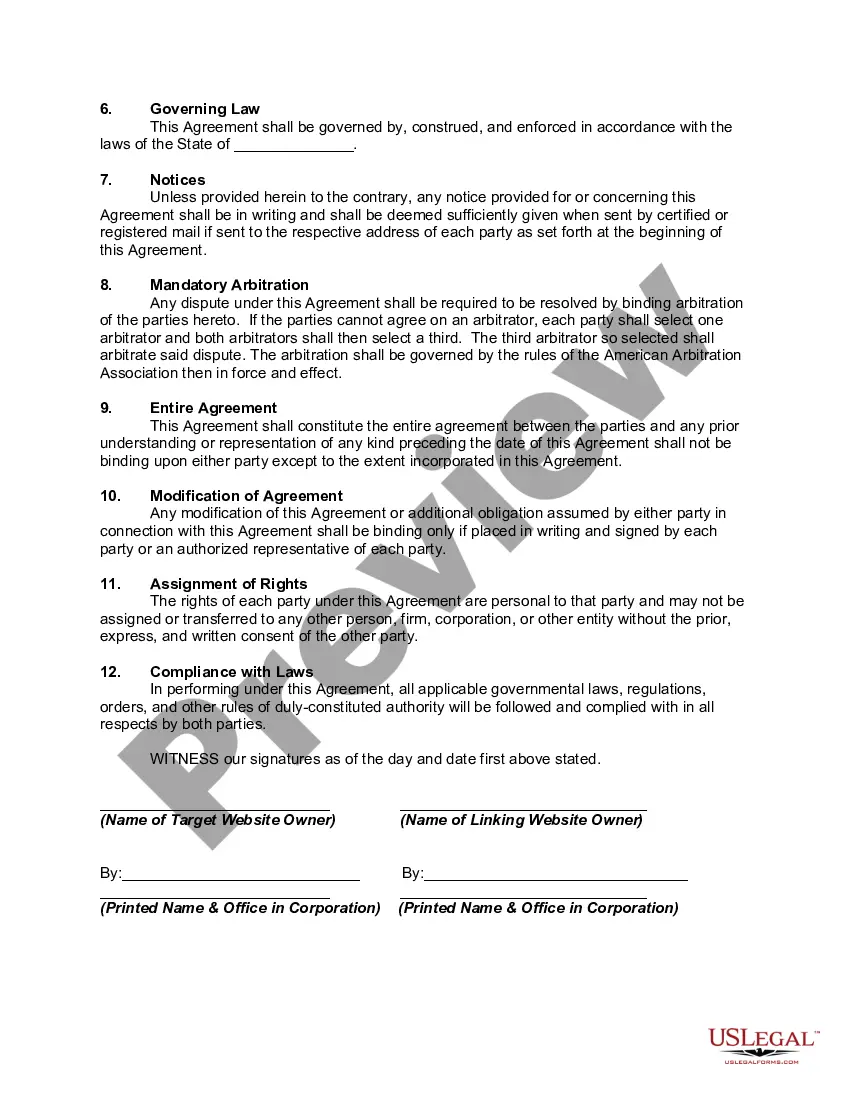

Massachusetts Free Linking Agreement

Description

How to fill out Free Linking Agreement?

Finding the correct valid document template can be a challenge.

Certainly, there are numerous templates accessible online, but how can you locate the valid format you desire.

Utilize the US Legal Forms site. The platform offers a multitude of templates, including the Massachusetts Free Linking Agreement, which you may use for both business and personal needs.

If the document does not meet your requirements, use the Search field to find the appropriate document. When you are certain the document is suitable, select the Download now button to acquire the document. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Massachusetts Free Linking Agreement. US Legal Forms is the largest collection of legal documents where you can find various document templates. Utilize the service to obtain professionally crafted paperwork that meets state regulations.

- Each of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Massachusetts Free Linking Agreement.

- Use your account to search for the legal documents you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

- First, ensure you have selected the correct document for your city/state. You can preview the form using the Preview option and review the form details to make sure it is suitable for you.

Form popularity

FAQ

The State of Massachusetts requires you to file an annual report for your LLC. You can mail in the report or complete it online at the Corporations Division website.

Annual ReportsFiling your annual report is required, and failing to do so will affect your LLC's good standing in the state. You can file by mail in Massachusetts for a $500 fee, and you can file online for a $520 fee. It takes 24 to 36 hours to process your annual report.

File Online A limited liability company may change its resident agent or the street address of the resident agent by filing a Certificate of Statement of Change of Resident Agent/Resident Office.

Operating Agreements aren't required in Massachusetts. But if you don't establish one for your company, its governance will default to the state's general laws for LLCs. This is a lot of control to give up as a business owner.

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

An LLC operating agreement is not required in Massachusetts, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee.

After you file the LLC paperwork with the state or give the IRS your mailing or business address, you have to update them if you change the LLC address. The IRS doesn't let you change the business address online. Instead, the IRS requires you to submit Form 8822-B by mail.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

You may call the RMV's contact center to change your address.(857) 368-8000. From area codes 339, 617, 781, and 857, or from outside Massachusetts.(800) 858-3926. From all other Massachusetts area codes.TTY: (877) 768-8833. For people who are deaf or hard-of-hearing (in Massachusetts)