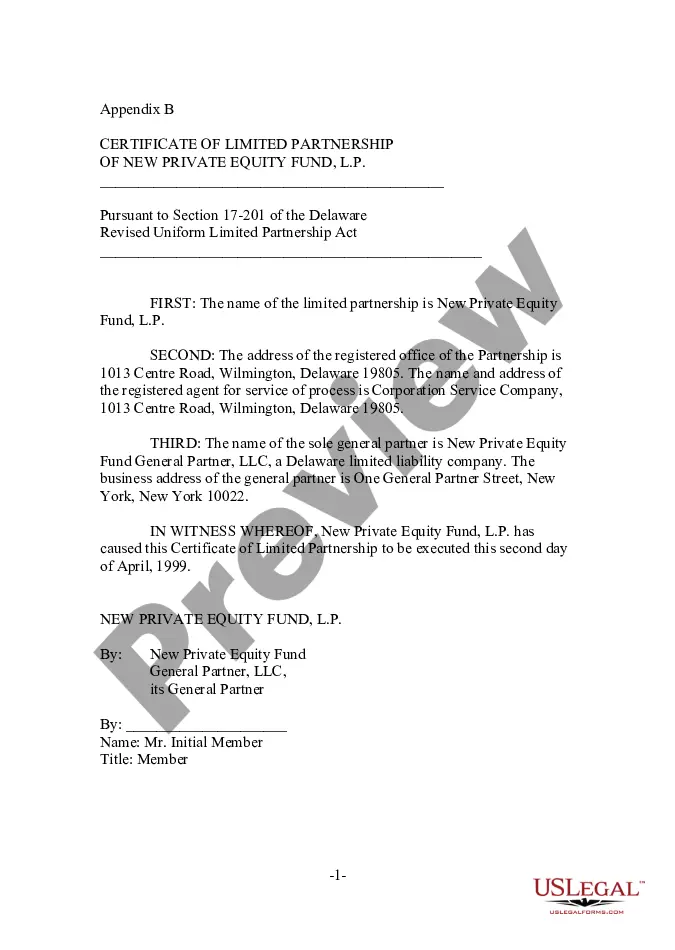

Massachusetts Consultant Agreement with Sharing of Software Revenues

Description

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

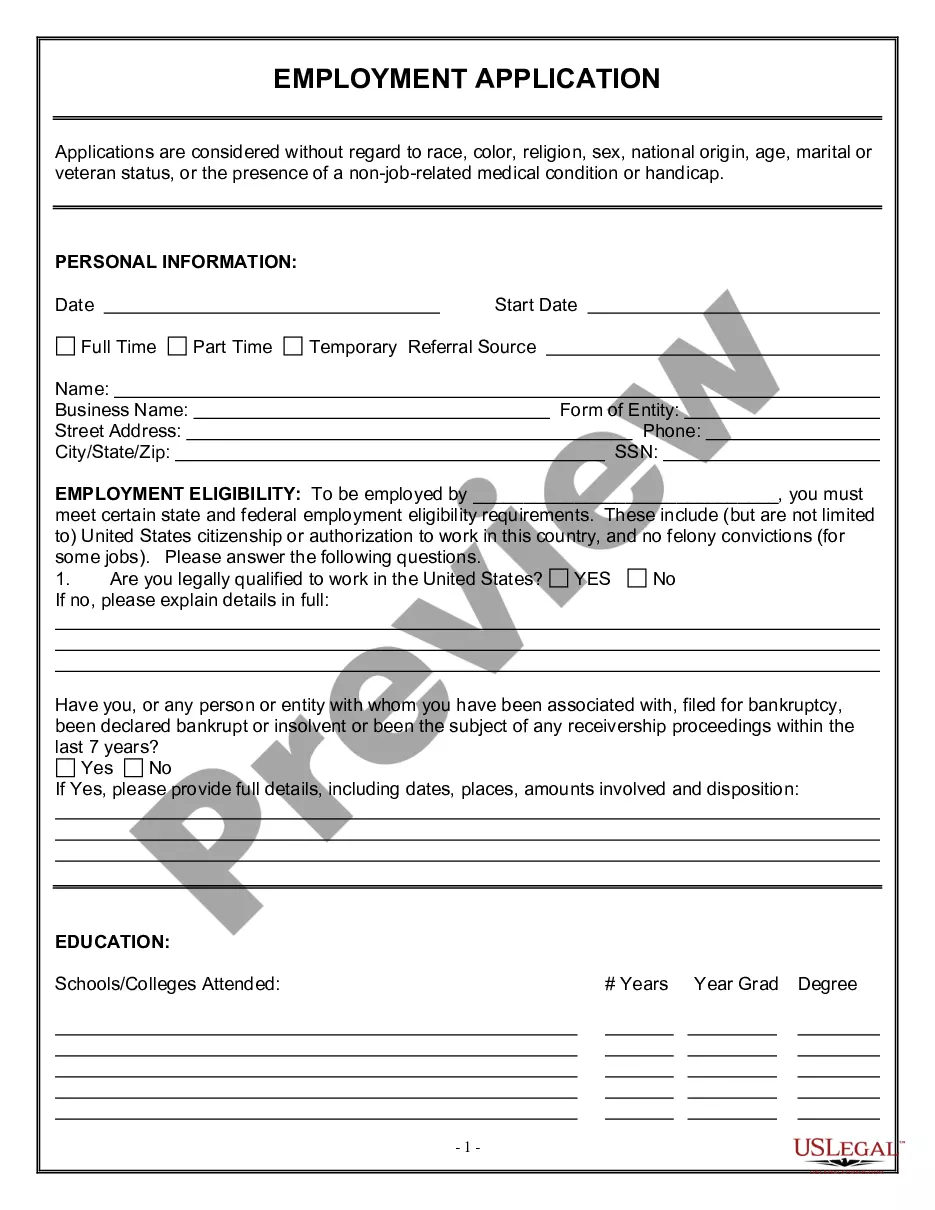

How to fill out Consultant Agreement With Sharing Of Software Revenues?

Selecting the optimal legal document template can be challenging.

Naturally, there are numerous designs accessible online, but how can you obtain the legal document you need.

Utilize the US Legal Forms platform. This service provides thousands of templates, including the Massachusetts Consultant Agreement with Revenue Sharing for Software, which you can employ for business and personal purposes.

You can review the document using the Review button and examine the document details to ensure it is suitable for your needs.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to acquire the Massachusetts Consultant Agreement with Revenue Sharing for Software.

- You can use your account to browse the legal documents you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the appropriate document for your city/region.

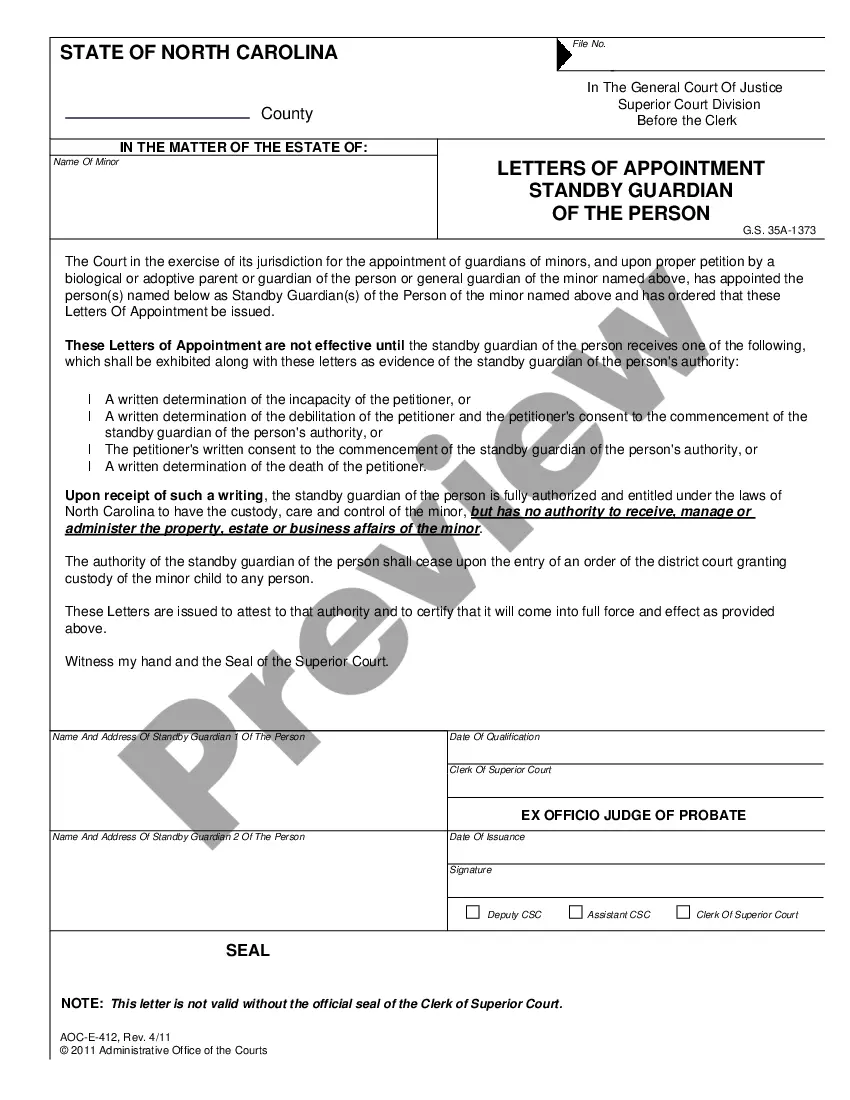

Form popularity

FAQ

An example of a revenue sharing agreement might involve a software developer who partners with a content provider to create an educational platform. The agreement would specify that the software developer receives a percentage of subscriptions while the content provider retains a share for the materials they offer. Using a Massachusetts Consultant Agreement with Sharing of Software Revenues can help formalize these terms and facilitate a successful partnership.

Structuring a revenue sharing agreement requires careful consideration of contributions, revenue sources, and distribution methods. It often includes defining the revenue-sharing percentage, outlining payment timelines, and detailing each party's responsibilities. A professional Massachusetts Consultant Agreement with Sharing of Software Revenues is an effective way to document these elements, ensuring clarity and mutual understanding.

life example of revenue sharing can be found in app development, where a developer collaborates with a marketing firm to launch a product. They may agree to share the revenues equally after expenses are deducted. Utilizing a Massachusetts Consultant Agreement with Sharing of Software Revenues can streamline this process, providing clear expectations and reducing the risk of disputes.

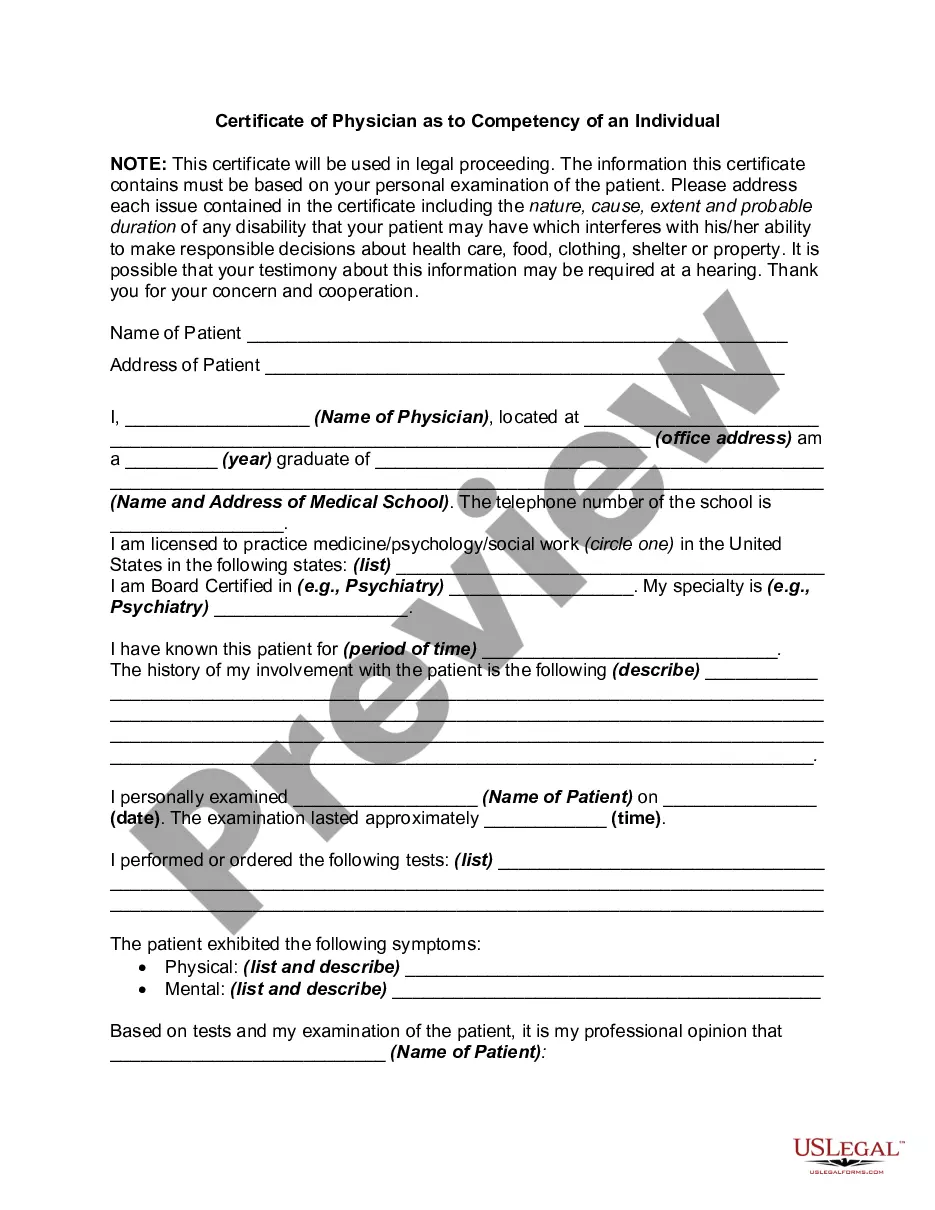

Typical revenue sharing percentages vary widely depending on the industry and the specific agreement between parties. In many cases, percentages can range from 10% to 50%, depending on contributions made by each party. A Massachusetts Consultant Agreement with Sharing of Software Revenues should clearly define the percentage to avoid misunderstandings and ensure both parties are satisfied with their share.

A revenue sharing contract specifies how income will be divided among involved parties. For instance, a licensing agreement between a software developer and a content creator may detail the split of profits generated from a subscription-based service. Creating a comprehensive Massachusetts Consultant Agreement with Sharing of Software Revenues can help both parties outline their rights and obligations regarding revenue distribution.

Revenue sharing refers to the practice of distributing earnings among parties who contribute to a project. For example, suppose a consultant and a software vendor collaborate to create a new application; they may decide to share revenue based on their respective investments in time and resources. A clear Massachusetts Consultant Agreement with Sharing of Software Revenues helps outline the revenue-sharing arrangement, ensuring transparency and fairness.

An example of general revenue sharing occurs when two parties agree to split the income generated from a joint project. For instance, a software developer may work with a marketing agency on an app, splitting the generated revenue in a predetermined ratio. This type of collaboration can be formalized in a Massachusetts Consultant Agreement with Sharing of Software Revenues, ensuring both parties benefit fairly from their joint efforts.

Digital products, such as e-books and digital music, are generally not taxable in Massachusetts. However, there are specific exceptions that may apply, especially if a product includes tangible goods. When drafting a Massachusetts Consultant Agreement with Sharing of Software Revenues, clarifying the tax status of any digital products involved can help avoid potential liabilities.

As of my last update, software as a service (SaaS) is typically not subject to sales tax in Massachusetts. However, this could vary based on how the service is structured and delivered. If you are forming a Massachusetts Consultant Agreement with Sharing of Software Revenues, confirm the current tax policies with a tax advisor or use resources available on platforms like uslegalforms to stay informed.

Subscriptions can have tax implications in Massachusetts, depending on the nature of the subscription. Generally, if the subscription provides access to tangible personal property or certain digital products, it may be taxable. For those engaged in a Massachusetts Consultant Agreement with Sharing of Software Revenues, understanding the tax requirements for subscriptions is crucial to ensure that all aspects of your agreement remain compliant.