Massachusetts Lease of Store in Hotel

Description

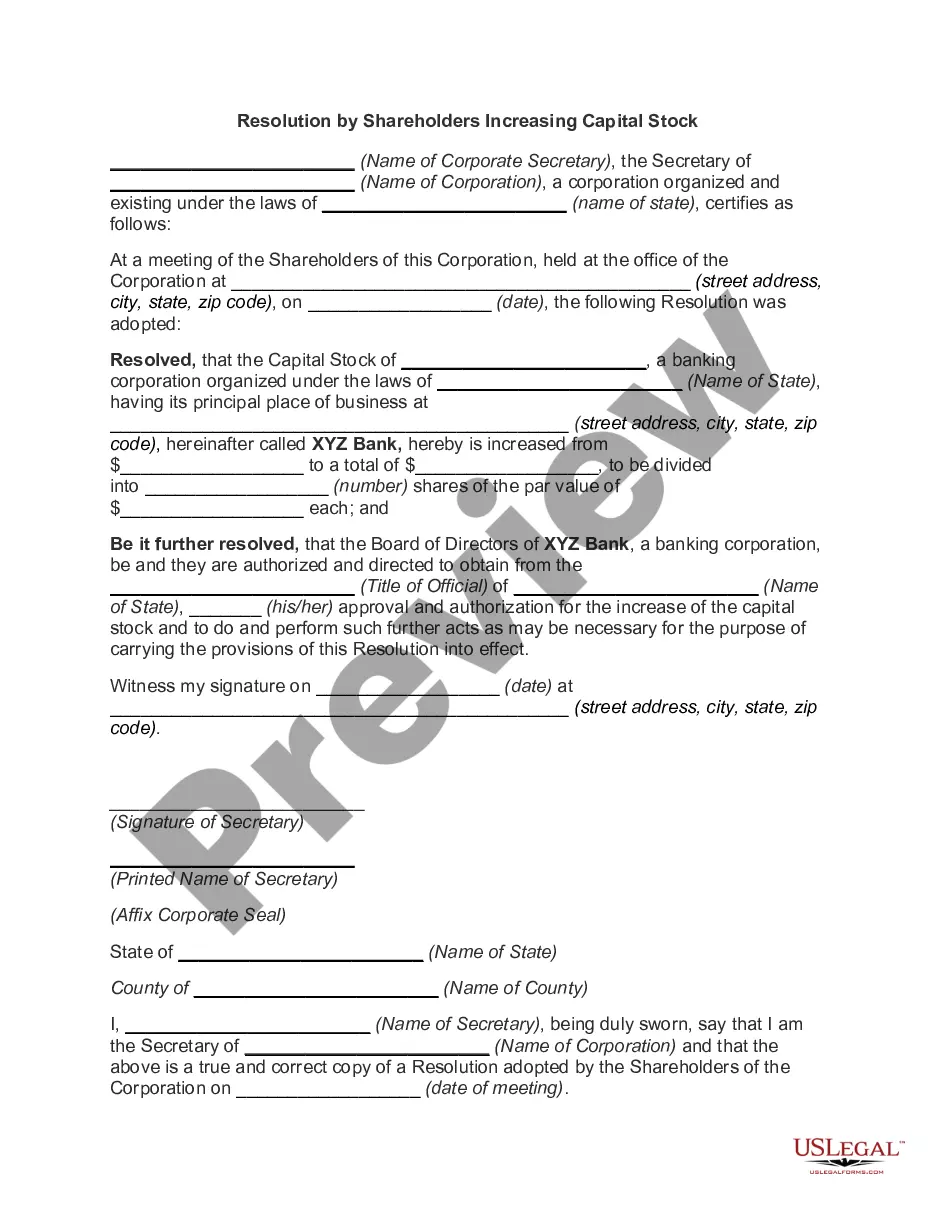

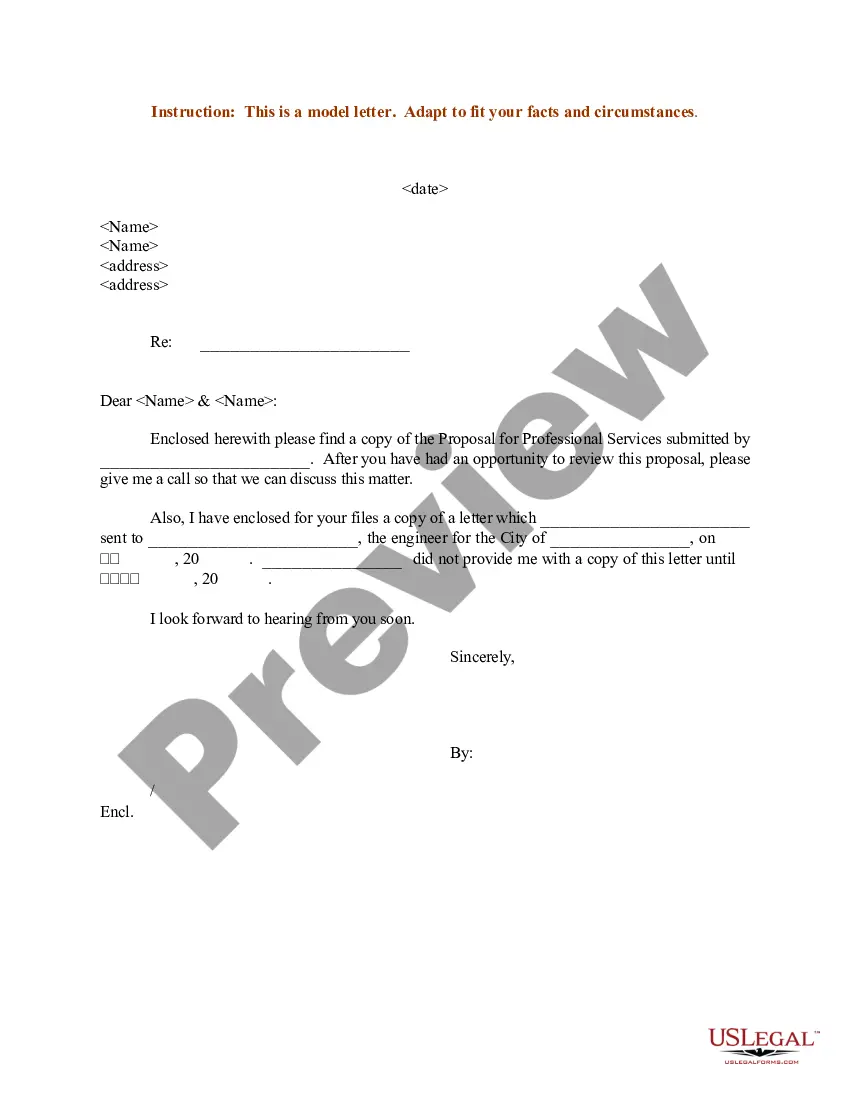

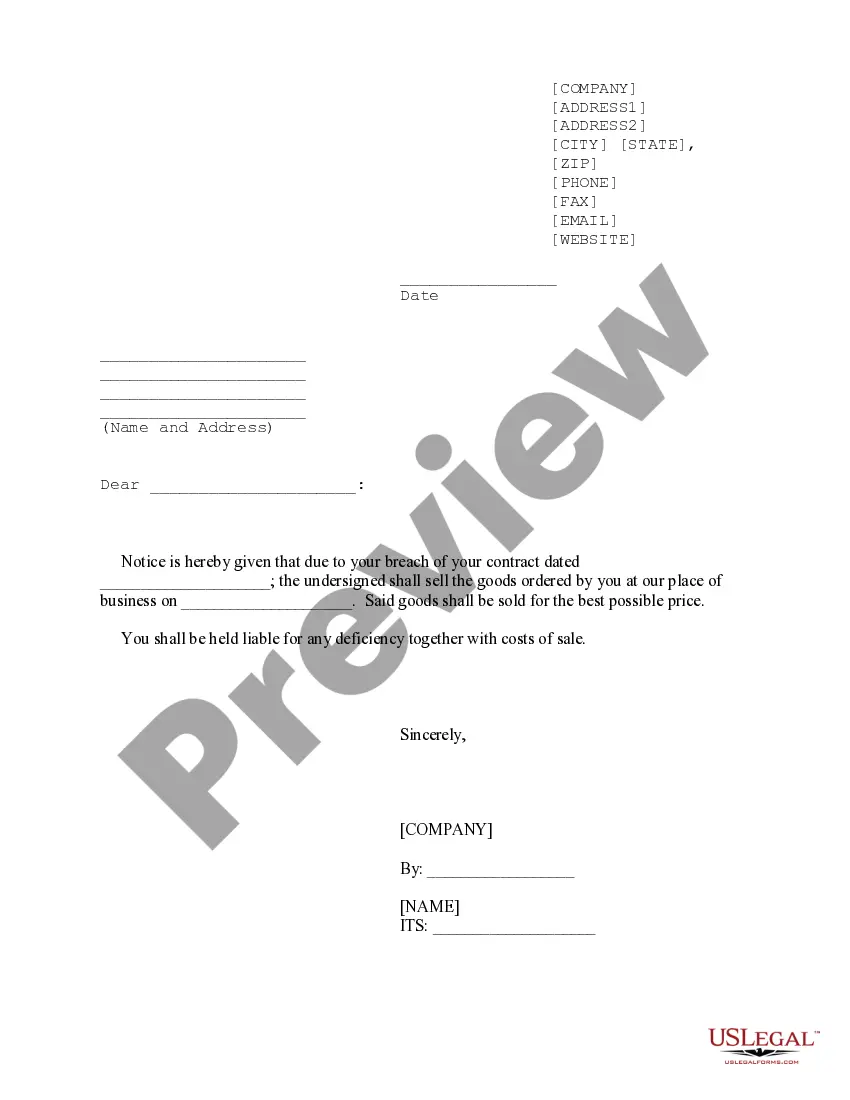

How to fill out Lease Of Store In Hotel?

You have the capability to dedicate time on the internet searching for the legal document template that meets the state and federal requirements you will need.

US Legal Forms provides countless legal forms that can be reviewed by experts.

It is easy to download or print the Massachusetts Lease of Store in Hotel from my service.

To obtain another version of your form, use the Search field to find the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Next, you can complete, edit, print, or sign the Massachusetts Lease of Store in Hotel.

- Each legal document template you acquire is yours indefinitely.

- To get an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have chosen the correct document template for the region/city of your selection. Review the form description to confirm you have selected the correct form.

- If available, use the Review button to preview the document template as well.

Form popularity

FAQ

The minimum term for a commercial lease can vary, but it generally ranges from one to five years. Many landlords prefer longer terms for stability, especially in a Massachusetts Lease of Store in Hotel. Understanding the lease duration is essential for planning your business strategy and financial commitments.

To lease a retail space, you typically need to provide a business plan, financial statements, and personal identification. Landlords often require proof of income and a proper credit score. In the context of a Massachusetts Lease of Store in Hotel, it’s also crucial to understand the local regulations and zoning laws that may apply.

The Massachusetts state hotel tax generally applies at a rate of 5.7% on the lodging charges for stays in hotels, motels, and similar establishments. In certain areas, local taxes can add to this amount, increasing the total tax burden on guests. Understanding these tax implications is vital when negotiating your Massachusetts Lease of Store in Hotel or planning your accommodation budget.

Leasing a retail space in Massachusetts typically requires a signed lease agreement, proof of business identity, financial documentation, and compliance with local zoning laws. Before finalizing any arrangements, ensure that you understand all legalities involved. Platforms like uslegalforms can simplify the process of gathering necessary documents and lease agreements related to the Massachusetts Lease of Store in Hotel.

Massachusetts is not a tax exempt state, as it has various taxes, including income, sales, and property taxes. However, specific exemptions apply for certain types of organizations and transactions. Understanding your obligations is crucial if you plan to enter into a Massachusetts Lease of Store in Hotel.

Massachusetts does not generally offer hotel tax exemptions for most travelers. However, certain organizations may qualify for exemptions under specific circumstances, such as government entities and non-profit groups. When considering a Massachusetts Lease of Store in Hotel, familiarity with these tax regulations can be valuable for effective financial planning.

In Massachusetts, simply staying in a hotel for an extended period does not automatically make you a tenant. The distinction between a hotel guest and a tenant relies heavily on the nature of the stay, the length of occupancy, agreements made, and the specific hotel policies. If you're looking into Massachusetts Lease of Store in Hotel scenarios, it's essential to understand these nuances.

Massachusetts law mandates specific requirements for leases, including essential terms like the duration of the lease, rental payment details, and obligations of both parties. It is crucial to have a written lease agreement to protect both landlords and tenants. When dealing with a Massachusetts Lease of Store in Hotel, understanding these legal requirements ensures compliance and helps avoid disputes.

Leasing a hotel offers numerous advantages, including lower upfront costs and less financial risk compared to purchasing property. It allows you to operate the hotel without the burdens of ownership, such as maintenance and property taxes. Moreover, a Massachusetts Lease of Store in Hotel offers flexibility to adapt to market changes, enabling you to focus on growing your business.

Leasing a hotel involves securing a rental agreement, which outlines the terms of use, duration, and responsibilities of both the landlord and tenant. In a Massachusetts Lease of Store in Hotel, it's essential to discuss aspects such as maintenance, renovations, and revenue obligations. A clear agreement will help foster a successful partnership between parties.