Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

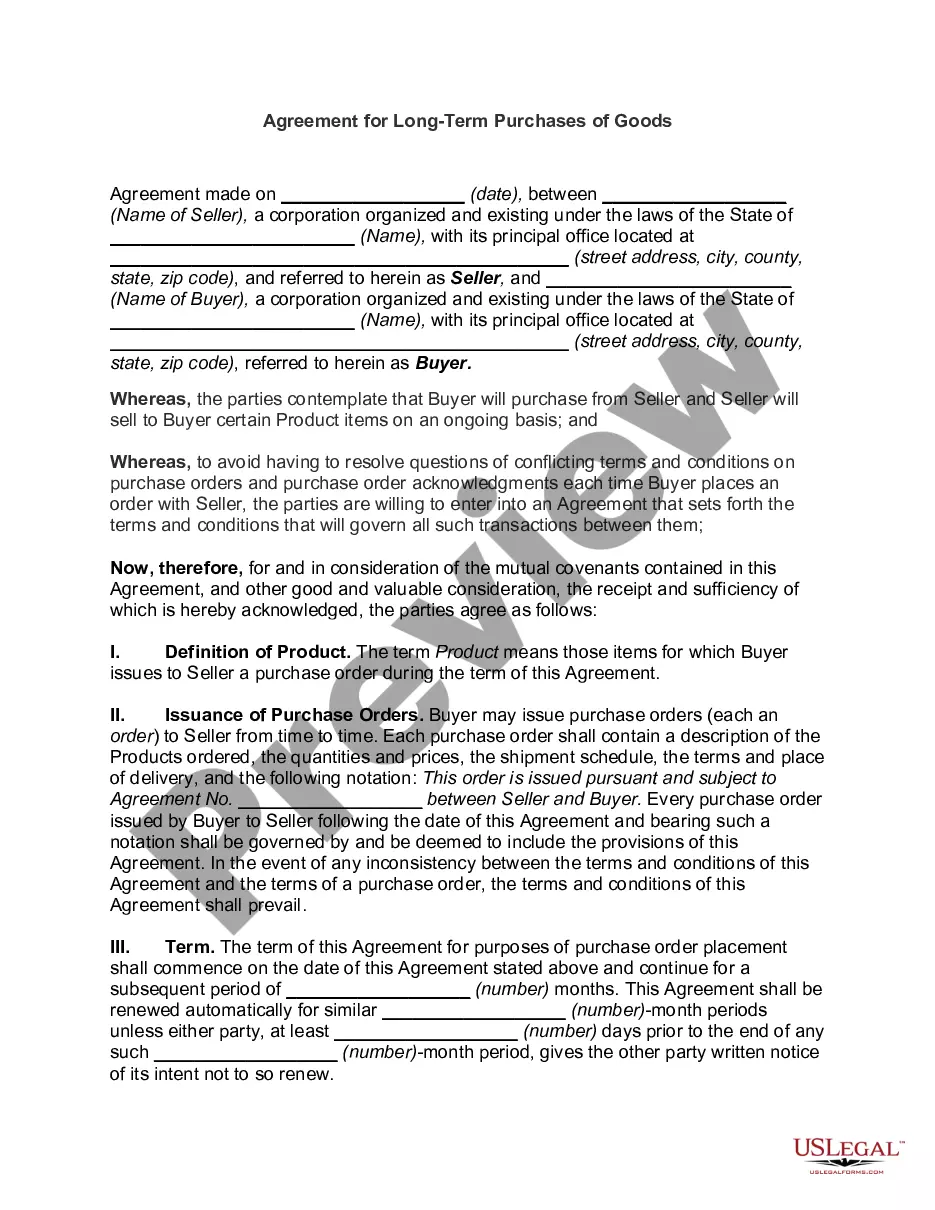

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Shareholders Of Closely Held Corporation?

If you aim to thorough, obtain, or print authentic document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search function to locate the documents you need.

Many templates for business and personal purposes are categorized by groups and regions, or keywords.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Retrieve the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation.

- Use US Legal Forms to find the Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review feature to check the details of the form. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form format.

- Step 4. Once you have located the form you need, click the Purchase now button. Select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

A shareholder buyout agreement outlines how a company's shareholders can buy out another shareholder's interest in the company. This agreement is crucial for maintaining stability within a business, especially in closely held corporations. By defining the terms, the Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation helps ensure that the ownership structure remains intact. This agreement provides clarity on valuation, payment methods, and the responsibilities of the parties involved.

Filling out a buy-sell agreement requires gathering necessary information, such as the names of shareholders, the share valuation method, and transaction terms. When completing the Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation, it is vital to be thorough and clear to avoid ambiguity. Using resources from uslegalforms can assist you in creating a complete and compliant document.

Yes, you can write your own shareholder agreement. However, it is crucial to ensure that it complies with state laws and covers relevant issues like share transfers, which are addressed in the Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation. To avoid potential legal pitfalls, consider using professional templates or consulting legal advice.

Not necessarily. Depending on the provisions defined in your Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation, some agreements may allow for shares to be sold with the approval of a majority rather than requiring unanimous consent. It is important to review your specific agreement to understand the requirements for share sales.

A shareholder agreement regulates the general rights and responsibilities of shareholders, while a buy-sell agreement specifically governs the sale of shares. The Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation is designed to ensure smooth transitions of ownership during sales, whereas a shareholder agreement provides a framework for overall governance. Knowing the distinction helps ensure proper documentation for both aspects.

Writing a Shareholders Agreement requires detailing the rights and obligations of each shareholder. Start by addressing decision-making processes, profit distribution, and dispute resolution methods. Incorporating elements from your Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation can provide additional clarity on how shares can be bought or sold among shareholders.

The agreement of share sale is a legal contract that outlines the terms under which shares will be sold from one party to another. In the context of a Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation, it formalizes the sale process and protects the interests of all parties involved. It is vital for ensuring clarity and preventing disputes during the share transfer.

To sell shares to another shareholder, first review the provisions in your Massachusetts Buy-Sell Agreement between Shareholders of Closely Held Corporation. This document often outlines the process for share transfers and may require a formal valuation. Next, facilitate the sale by drafting an agreement that details the transaction and obtaining any required approvals from other shareholders.

sell agreement and a shareholder agreement are similar but serve different purposes. The Massachusetts BuySell Agreement between Shareholders of Closely Held Corporation specifically focuses on the sale and transfer of shares among shareholders. In contrast, a shareholder agreement outlines the rights, responsibilities, and governance of the shareholders as a whole.

sell agreement is often referred to as a buyout agreement or a buysell contract. This terminology varies, but the purpose remains the same: to outline how shares will be handled during transitions, such as death or retirement. For those navigating corporate intricacies, a welldrafted Massachusetts BuySell Agreement between Shareholders of Closely Held Corporation can provide a clear path forward.