Section 4(2) of the Securities Act of 1933 exempts from the registration requirements of that Act "transactions by an issuer not involving any public offering.” This is the so-called "private offering" provision in the Securities Act. The securities involved in transactions effected pursuant to this exemption are referred to as restricted securities because they cannot be resold to the public without prior registration. They are also sometimes referred to as "investment letter securities" because of the practice frequently followed by the seller in such a transaction, in order to substantiate the claim that the transaction does not involve a public offering, of requiring that the buyer furnish an investment letter representing that the purchase is for investment and not for resale to the general public. The private offering exemption of Section 4(2) of the Securities Act is available only where the offerees do not need the protections afforded by the registration procedure.

Massachusetts Investment Letter for a Private Sale of Securities

Description

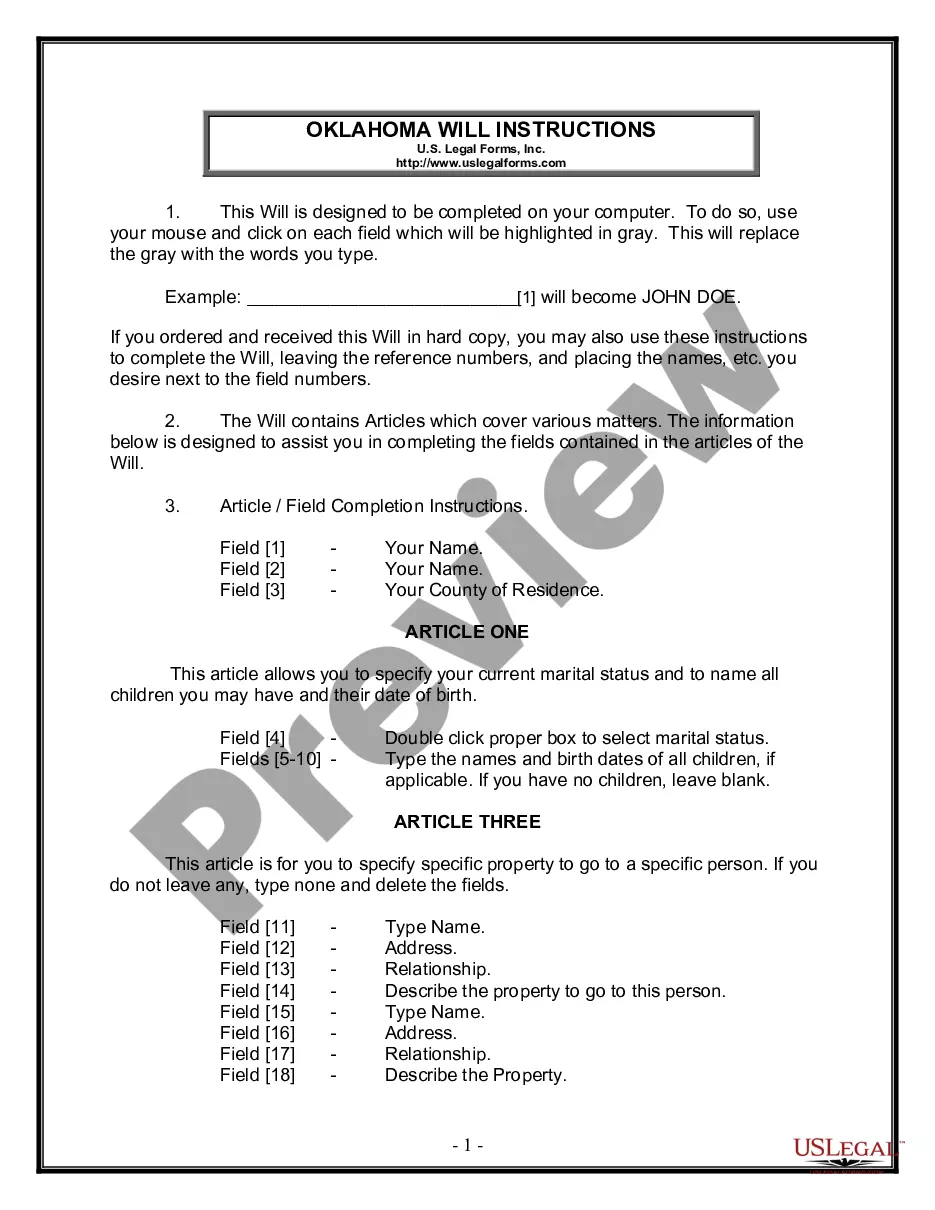

How to fill out Investment Letter For A Private Sale Of Securities?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the Massachusetts Investment Letter for a Private Sale of Securities in moments.

Review the form description to ensure that you have opted for the correct document.

If the form does not suit your needs, utilize the Search field at the top of the screen to find one that does.

- If you already have an account, Log In and download the Massachusetts Investment Letter for a Private Sale of Securities from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can retrieve all previously downloaded forms from the My documents tab in your account.

- If this is your first time using US Legal Forms, here are some straightforward steps to begin.

- Make sure you have chosen the correct form for your city/state.

- Click the Review button to examine the content of the form.

Form popularity

FAQ

Yes, in Massachusetts, individuals and entities must typically register before selling securities. This registration ensures compliance with state regulations and protects investors. If you are considering engaging in private sales, the Massachusetts Investment Letter for a Private Sale of Securities could serve as a key document in facilitating a registered transaction.

A Massachusetts corporate income tax nexus establishes whether a business has sufficient presence in the state to be subject to corporate tax obligations. Factors such as property, employees, and sales can establish this nexus. If your business deals with securities, understanding the nexus in relation to the Massachusetts Investment Letter for a Private Sale of Securities is critical for ensuring proper tax compliance.

In Massachusetts, the minimum franchise tax for an S Corporation is set at $456. However, it is essential to consult current regulations, as this amount may change. If your S Corp is involved in securities transactions, such as the Massachusetts Investment Letter for a Private Sale of Securities, being aware of all tax obligations is vital for compliance.

A Massachusetts Security corporation refers to a business entity that offers securities in accordance with Massachusetts state law. These corporations are subject to specific regulations, including those set forth by blue sky laws. For those interested in private sales, understanding the Massachusetts Investment Letter for a Private Sale of Securities is crucial in navigating the legal landscape.

Blue sky laws in Massachusetts are regulations designed to protect investors from fraudulent sales practices in the securities industry. They require that all securities being sold in the state must be registered unless exempt. This ensures that anyone selling securities, such as those involving a Massachusetts Investment Letter for a Private Sale of Securities, complies with these laws to protect both the seller and the investor.

The tax rate for a security corporation in Massachusetts generally depends on the type of entity. In most cases, standard corporate tax rates apply, which are currently set at 8% for corporations. Additionally, if you're handling securities, understanding the implications of the Massachusetts Investment Letter for a Private Sale of Securities could be essential for your tax planning.

An investment letter is a formal communication that details the terms and conditions of an investment in securities. Specifically, a Massachusetts Investment Letter for a Private Sale of Securities outlines critical information about the nature of the securities, the investors involved, and other pertinent terms. It is essential for documenting the transaction and protecting the interests of all parties involved in the investment.

In general, selling securities without a license is prohibited under both federal and state laws. This includes sales made through a Massachusetts Investment Letter for a Private Sale of Securities. To ensure compliance with legal requirements, it's vital to consult with legal experts or platforms like USLegalForms that can guide you through licensing and regulatory issues.

An invest letter is a document that outlines the details of an investment commitment made by an investor. It is crucial when engaging in a Massachusetts Investment Letter for a Private Sale of Securities, as it formally records the investor's agreement to invest under specified terms. This letter serves not only as a record of commitment but also as a means to inform both parties about their rights and responsibilities.

The primary purpose of an investment letter is to provide a formal declaration regarding the nature of the investment being made. In the context of a Massachusetts Investment Letter for a Private Sale of Securities, it assures that the buyer understands the risks and terms involved in the transaction. Furthermore, it serves as a legal document that can protect both parties by outlining their obligations and expectations.