Massachusetts Building Loan Agreement between Lender and Borrower

Description

How to fill out Building Loan Agreement Between Lender And Borrower?

Finding the right legitimate papers template might be a have difficulties. Needless to say, there are a variety of web templates available on the Internet, but how will you get the legitimate type you want? Use the US Legal Forms site. The assistance offers a large number of web templates, such as the Massachusetts Building Loan Agreement between Lender and Borrower, which can be used for business and private demands. Each of the types are examined by pros and satisfy federal and state requirements.

If you are already signed up, log in to the profile and click on the Down load key to get the Massachusetts Building Loan Agreement between Lender and Borrower. Use your profile to search throughout the legitimate types you possess ordered in the past. Visit the My Forms tab of your respective profile and obtain one more version of your papers you want.

If you are a new end user of US Legal Forms, allow me to share straightforward instructions that you should comply with:

- First, be sure you have chosen the right type for your metropolis/region. You are able to examine the form using the Preview key and browse the form outline to make certain this is the best for you.

- In case the type fails to satisfy your needs, use the Seach field to obtain the appropriate type.

- When you are sure that the form would work, select the Buy now key to get the type.

- Pick the costs program you need and type in the necessary info. Create your profile and pay for an order with your PayPal profile or bank card.

- Select the data file format and down load the legitimate papers template to the system.

- Total, edit and printing and signal the obtained Massachusetts Building Loan Agreement between Lender and Borrower.

US Legal Forms is definitely the most significant local library of legitimate types where you will find various papers web templates. Use the service to down load appropriately-made paperwork that comply with express requirements.

Form popularity

FAQ

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

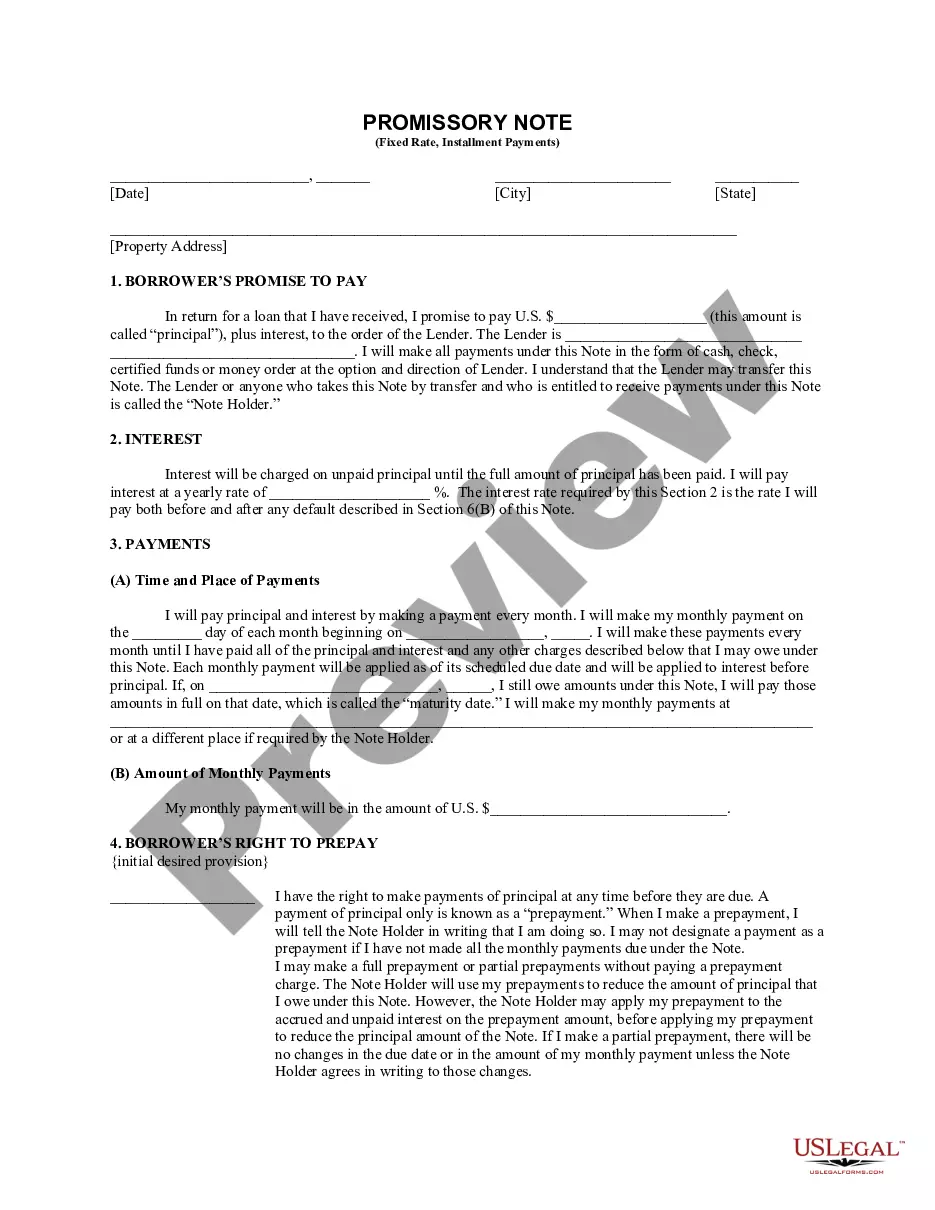

A loan agreement is a legally binding contract between the borrower(s) and the lender that states the terms of borrowing the loan, including the amount to be repaid, the interest rate, and any other conditions.

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

A Loan Agreement, also known as a term loan, demand loan, or loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the loan amount, any interest charges, the repayment plan, and payment dates.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

Loan agreement - Typically refers to a written agreement between a lender and borrower stipulating the terms and conditions associated with a financing transaction and in addition to those included to accompanying note, security agreement and other loan documents.

A credit agreement is a legally binding agreement entered into between a lender and a borrower. It outlines all of the terms of the borrowing relationship, such as the interest rate, costs of originating the loan, and other borrower and lender rights and obligations.

A Loan Agreement, also known as a term loan, demand loan, or a loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the amount of the loan, any interest charges, the repayment plan, and payment dates.