Massachusetts Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

If you want to compile, obtain, or create official document templates, utilize US Legal Forms, the premier collection of legal documents available online.

Leverage the site’s straightforward and user-friendly search feature to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you obtain is yours indefinitely. You have access to every form you saved in your account. Visit the My documents section and select a form to print or download again.

Be proactive and download, and print the Massachusetts Ratification or Confirmation of an Oral Amendment to a Partnership Agreement with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal requirements.

- Utilize US Legal Forms to quickly find the Massachusetts Ratification or Confirmation of an Oral Amendment to a Partnership Agreement.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Massachusetts Ratification or Confirmation of an Oral Amendment to a Partnership Agreement.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

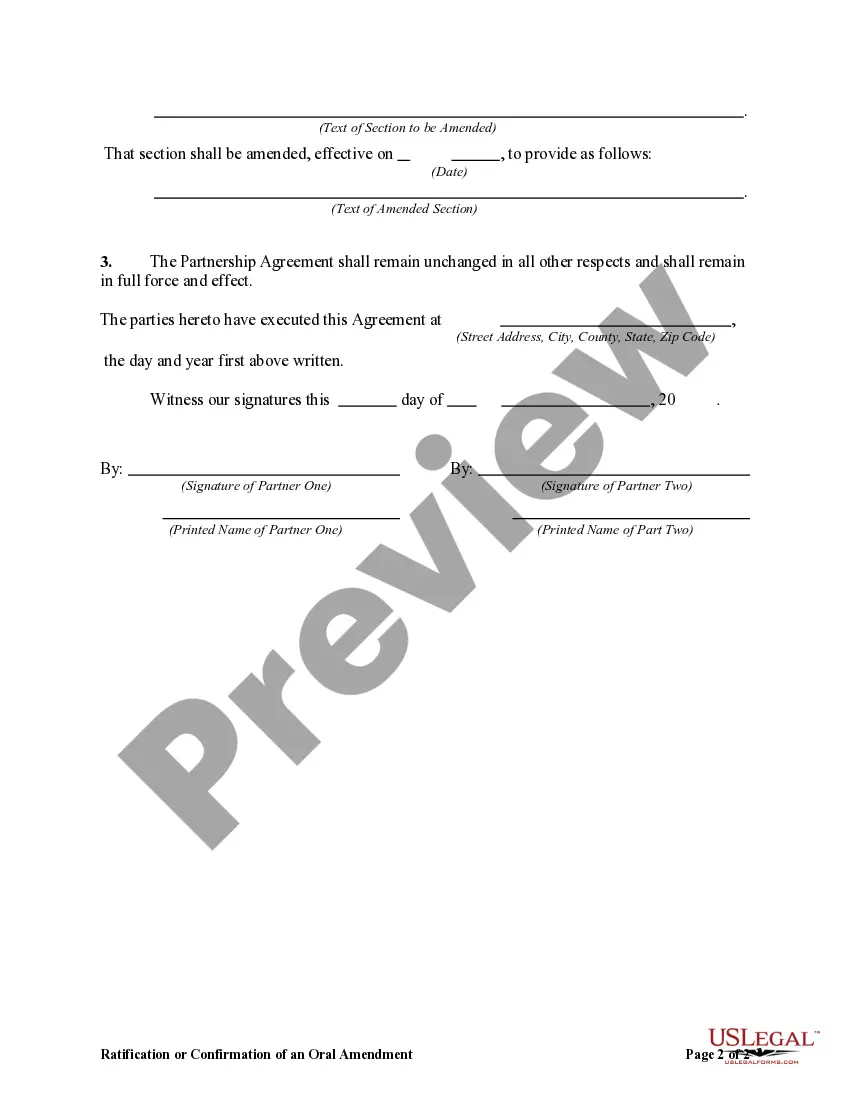

- Step 2. Use the Preview option to review the form's content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Massachusetts Ratification or Confirmation of an Oral Amendment to a Partnership Agreement.

Form popularity

FAQ

While Massachusetts does not have a minimum tax specifically designated for partnerships, the overall excise tax structure applies to most business entities. This means that partnerships must adhere to certain tax regulations that could have minimum thresholds. Ensuring alignment between your partnership agreement and tax obligations can help avoid complications later.

How to Prove a Verbal Agreement?Letters.Emails.Text messages.Texts.Quotes.Faxes.Notes made at the time of the agreement.Proof of payment such as canceled checks or transaction statements.

You do not have to do anything to make it official with the IRS other than enter the appropriate percentages of ownership for each member of the LLC. However, the partnership agreement (LLC operating agreement) must specifically allow for any change.

Drafting and FilingAn amendment to a partnership agreement is a legal document that includes specific information about the action, such as a statement that the amendment is made by unanimous consent, a statement that the undersigned agree to the amendment and an explanation of the amendment.

Do partnership agreements need to be in writing? Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

A Partnership Amendment, also called a Partnership Addendum, is used to modify, add, or remove terms in a Partnership Agreement. A Partnership Amendment is usually attached to an existing Partnership Agreement to reflect any changes.

A Partnership Amendment, also called a Partnership Addendum, is used to modify, add, or remove terms in a Partnership Agreement. A Partnership Amendment is usually attached to an existing Partnership Agreement to reflect any changes.

There are 4 steps to follow for changing the partnership deed:Step 1: Take the mutual consent of partners.Step 2: Prepare for making a supplementary partnership deed.Step 3: Executing supplementary partnership deed.Step 4: Do the filing with Registrar of Firm (RoF).

Partnership deal is an agreement is used to form a partnership business200b.

An oral agreement to form a partnership is valid unless the business cannot be performed wholly within one year from the time that the agreement is made. However, most partnerships have no fixed terms and hence are at-will partnerships not subject to the Statute of Frauds.