Massachusetts Triple Net Lease for Commercial Real Estate

Description

How to fill out Triple Net Lease For Commercial Real Estate?

Are you currently in a position that requires documents for both business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Massachusetts Triple Net Lease for Commercial Real Estate, that are designed to meet state and federal guidelines.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Massachusetts Triple Net Lease for Commercial Real Estate at any time if needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Triple Net Lease for Commercial Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

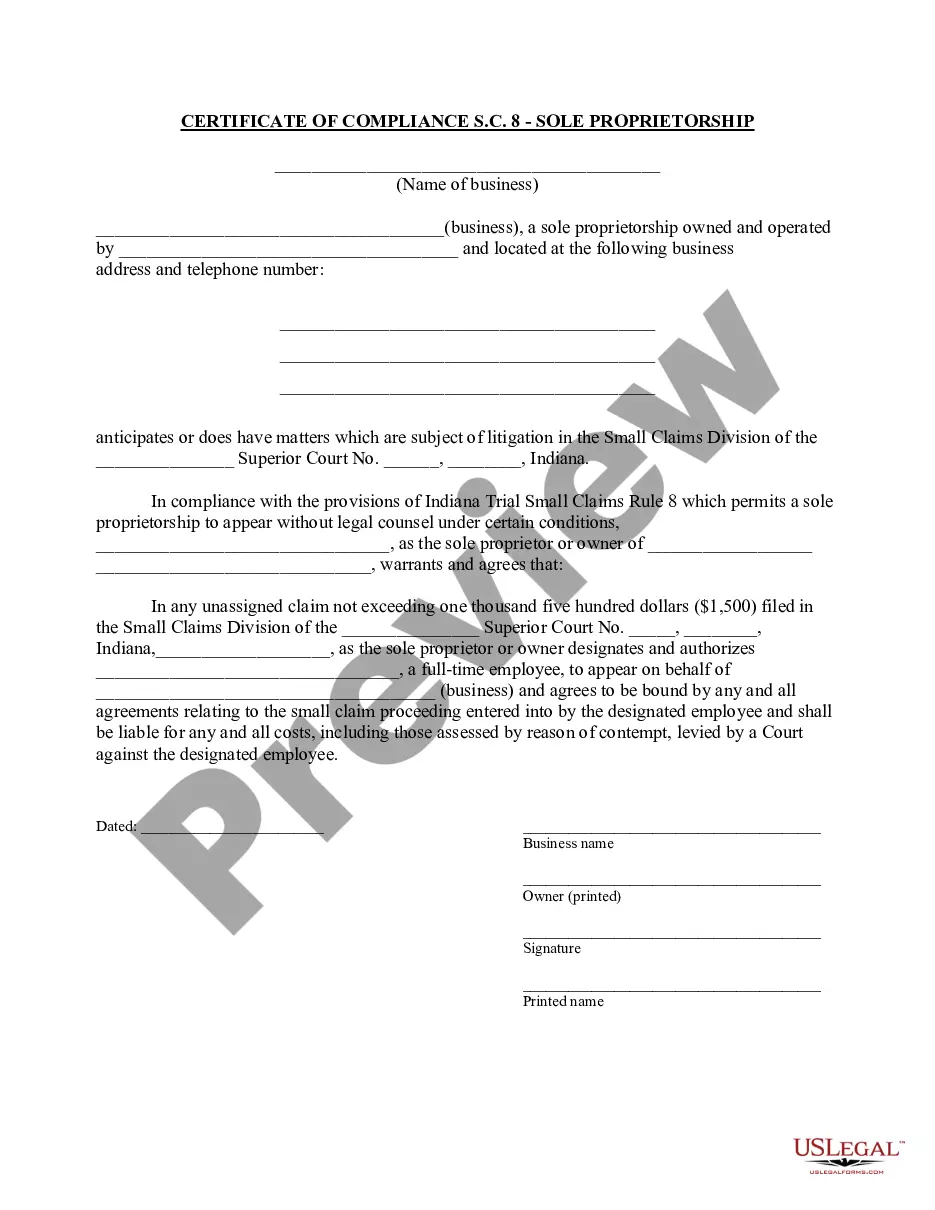

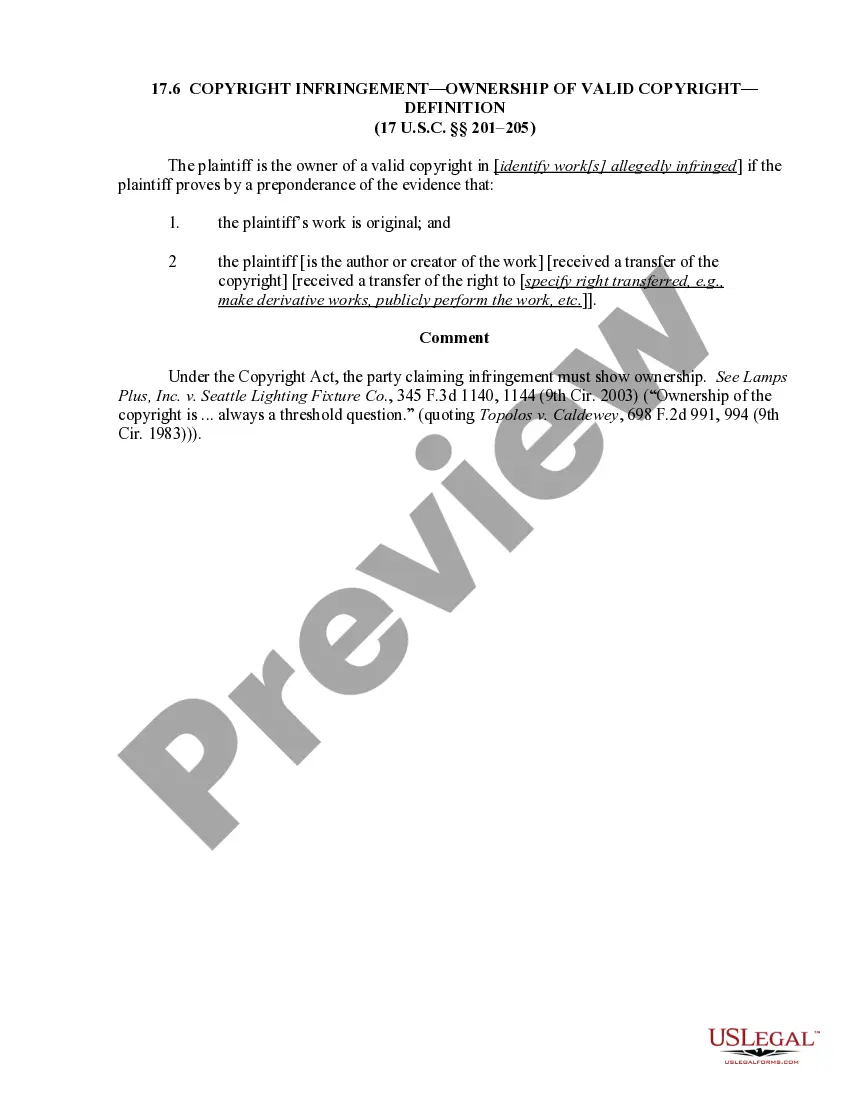

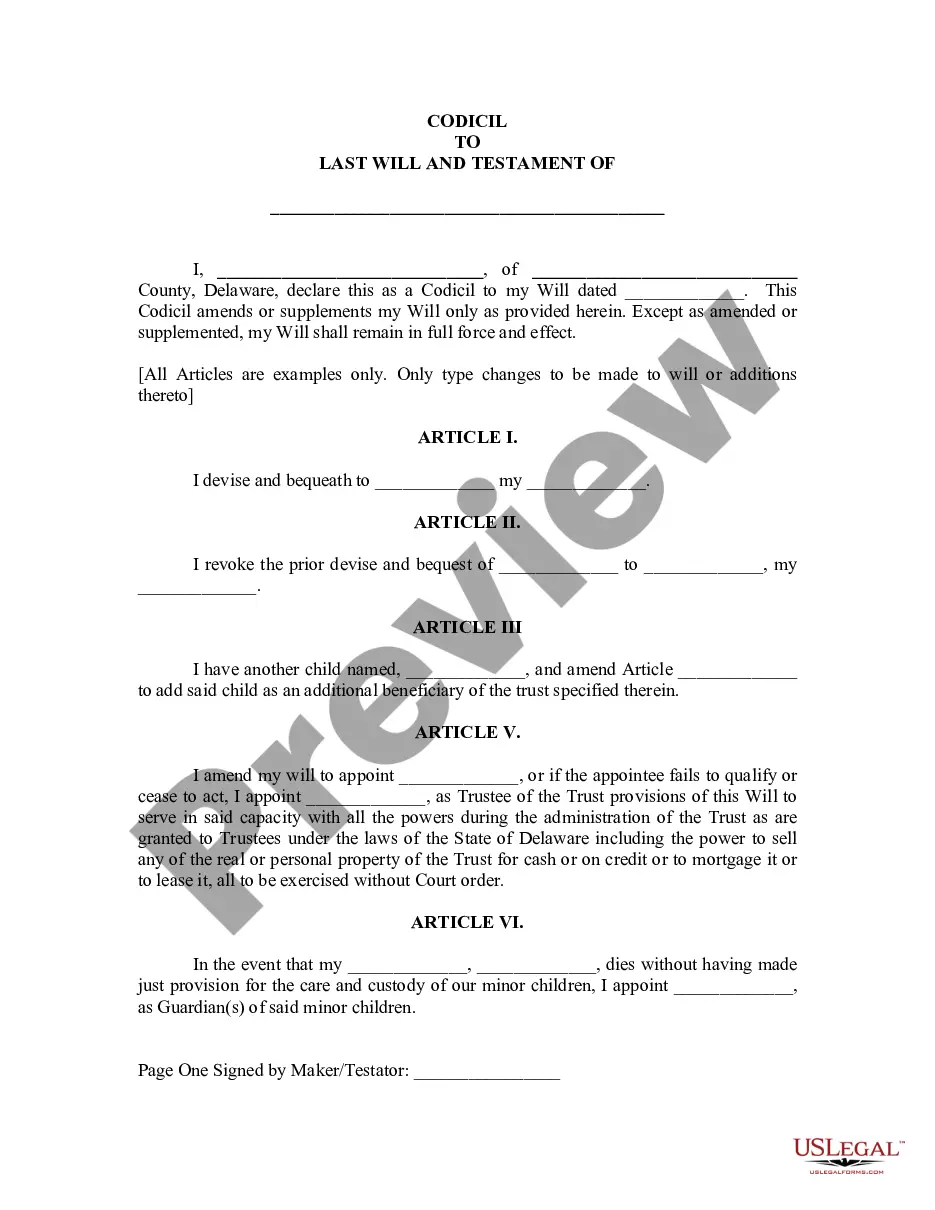

- Obtain the form you need and ensure it is for the correct state/region.

- Use the Preview button to view the form.

- Read the description to confirm you've selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that meets your needs.

- Once you find the appropriate form, click Get now.

- Select the pricing plan you prefer, provide the necessary details to create your account, and pay for the order with your PayPal or credit card.

Form popularity

FAQ

A common example of a Massachusetts Triple Net Lease for Commercial Real Estate is a fast-food restaurant lease where the franchise owner pays rent along with property taxes, insurance, and maintenance costs. This arrangement shifts the financial responsibilities of the property to the tenant, allowing the landlord to receive steady income without ongoing management commitments. Depending on the lease structure, this can be beneficial for both parties, as it stabilizes the expenses for tenants and ensures predictable returns for landlords. Consider using USLegalForms to access relevant documents that assist in creating such leases.

Qualifying for a Massachusetts Triple Net Lease for Commercial Real Estate involves understanding the lease terms and presenting your financial credentials effectively. You will need to demonstrate your business’s profitability and reliability to landlords. Leveraging resources like USLegalForms can help you access templates and guidance to prepare your application accurately, ensuring you meet all necessary qualifications.

To get approved for a Massachusetts Triple Net Lease for Commercial Real Estate, you should demonstrate your financial stability and ability to meet lease obligations. Landlords typically require proof of income, credit history, and possibly references from previous landlords. By preparing these documents and showcasing your readiness, you can enhance your chances of approval.

Individuals often choose a Massachusetts Triple Net Lease for Commercial Real Estate to transfer certain financial responsibilities from the landlord to the tenant. This structure benefits landlords by providing predictable income with fewer management responsibilities. Tenants appreciate the long-term commitment and often negotiate favorable rental terms, making it an attractive option for both parties.

The criteria for a Massachusetts Triple Net Lease for Commercial Real Estate typically include a clear agreement outlining tenant responsibilities for property taxes, insurance, and maintenance costs. Additionally, the lease should specify the duration of the lease term, the rental amount, and any additional terms or conditions. Understanding these criteria ensures a smooth leasing process and helps both landlords and tenants set clear expectations.

To get approved for a Massachusetts Triple Net Lease for Commercial Real Estate, demonstrate your business’s financial stability and creditworthiness. Landlords often request financial documents to assess risk, so prepare items like tax returns and bank statements. Additionally, a solid business plan showcases your ability to maintain lease obligations. Using platforms like uslegalforms can assist in ensuring you have the right documentation and understanding of lease terms.

Entering a Massachusetts Triple Net Lease for Commercial Real Estate involves several steps, starting with research to identify properties that match your business needs. Next, working with a real estate agent who understands commercial leasing can simplify the process. Thoroughly review potential leases to find terms favorable to your investment strategy. When ready, negotiating effectively is key to securing a lease that aligns with your financial goals.

Tenants often choose a Massachusetts Triple Net Lease for Commercial Real Estate because it typically comes with lower base rent compared to other lease structures. This arrangement allows tenants greater control over property expenses, fostering a sense of ownership. Moreover, a well-negotiated lease can lead to long-term stability in tenancy, which is favorable for businesses looking to grow without relocating frequently.

In a Massachusetts Triple Net Lease for Commercial Real Estate, tenants are responsible for property expenses such as taxes, insurance, and maintenance. This can lead to unexpected costs, especially if the property needs extensive repairs. Additionally, fluctuations in property values can impact the financial viability of the lease. As a tenant, it is vital to read the lease terms carefully to understand all potential liabilities.

While a Massachusetts Triple Net Lease for Commercial Real Estate offers benefits, such as predictable expenses for landlords, it also comes with challenges. Tenants may face escalating costs, including taxes and maintenance, which can add financial strain. Additionally, if the property requires significant repairs, tenants are liable. Therefore, it’s vital to review lease terms carefully and consider potential long-term costs before committing.