Massachusetts Sample Letter for Employees Unqualified for Christmas Bonus

Description

How to fill out Sample Letter For Employees Unqualified For Christmas Bonus?

If you require to complete, acquire, or produce authentic documents templates, utilize US Legal Forms, the largest collection of authentic forms, accessible online.

Take advantage of the site's simple and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you desire, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Use US Legal Forms to obtain the Massachusetts Sample Letter for Employees Ineligible for Christmas Bonus with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Massachusetts Sample Letter for Employees Ineligible for Christmas Bonus.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

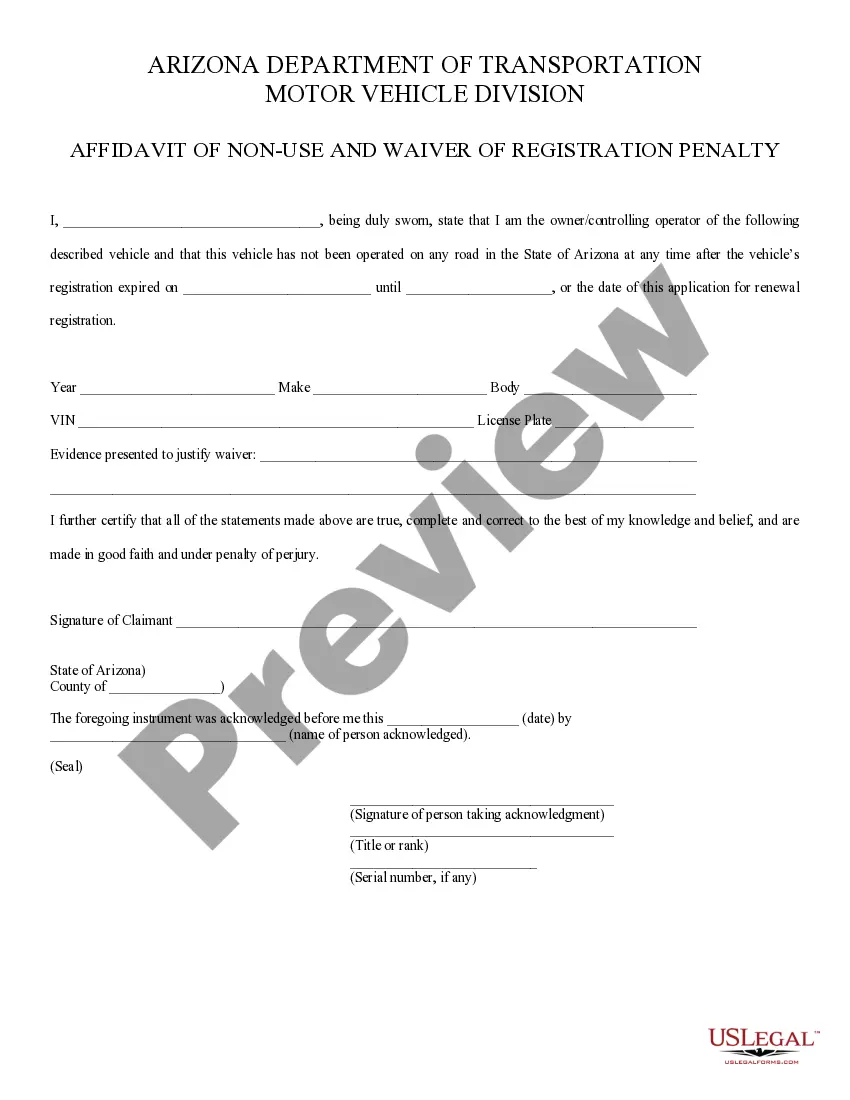

- Step 2. Utilize the Preview option to review the form's content. Don't forget to read the information.

- Step 3. If you are unsatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Employers can typically write off Christmas bonuses as a deductible business expense. This applies when bonuses are considered a mandatory part of employee compensation and follow a consistent company policy. However, it's important to document all aspects of the bonus distribution process. Utilizing a Massachusetts Sample Letter for Employees Unqualified for Christmas Bonus can further clarify bonus policies and procedures.

Employee Christmas gifts can be written off, but there are specific guidelines to follow. Gifts must be of nominal value, and businesses should keep receipts and records for tax purposes. While gifts may enhance employee morale, it is crucial to understand the tax implications. Consulting a tax professional can provide clarity and ensure compliance with all regulations.

Yes, companies can write off employee bonuses as a business expense. This treatment generally applies when bonuses are part of the employee's compensation package and are customary within the industry. However, detailed recordkeeping and adherence to IRS regulations are essential. Ensuring proper documentation helps maintain compliance with tax rules, which can ultimately protect your business.

A bonus letter serves as a formal notification to an employee regarding their bonus. For instance, if an employee qualifies for a bonus, a Massachusetts Sample Letter for Employees Unqualified for Christmas Bonus can clarify the reasons they are not receiving one. This letter should include details about the performance expectations and reasons for the decision. Such transparency helps maintain trust and clarity in the workplace.

When reporting a Christmas bonus, include the amount in the income section of your tax return. Most bonuses will be reported through your W-2 form, which your employer provides. If you need to address any discrepancies or changes in eligibility, the Massachusetts Sample Letter for Employees Unqualified for Christmas Bonus becomes a useful reference point.

To report a Christmas bonus on your taxes, include it in the total wages listed on your tax return. Make sure to check that your employer has properly reported the bonus on your W-2 form. Understanding your bonus, especially if it's unqualified, can help you navigate reporting; for guidance, consider using the Massachusetts Sample Letter for Employees Unqualified for Christmas Bonus.

Bonuses are reported to the IRS as supplemental wages, typically on your W-2 form. Your employer must include the bonus amount in your taxable income, and it's subject to federal income tax withholding. To manage expectations regarding bonus payments, employers can reference the Massachusetts Sample Letter for Employees Unqualified for Christmas Bonus.

Yes, an employer can issue a 1099 for a bonus under certain circumstances, especially for non-employee compensation. If you are treated as an independent contractor for your work, a bonus can appear on a 1099 form. If you're unsure about your classification, reviewing the Massachusetts Sample Letter for Employees Unqualified for Christmas Bonus may clarify your entitlement.

To write a letter of request for a bonus, start with a respectful salutation and state your request upfront. Provide supporting details about your contributions, and express how a bonus would reflect your efforts this year. For additional guidance, reviewing a Massachusetts Sample Letter for Employees Unqualified for Christmas Bonus can be beneficial.

When writing a bonus letter for an offer, clearly articulate the terms of the bonus alongside the job offer. Specify the conditions that must be met to receive the bonus and any timelines involved. Consider drafting this letter in line with a Massachusetts Sample Letter for Employees Unqualified for Christmas Bonus to ensure clarity and professionalism.