Massachusetts Receipt as Payment in Full

Description

How to fill out Receipt As Payment In Full?

If you need to acquire, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's user-friendly search to find the documents you need. Various templates for business and personal purposes are organized by category and state, or by keywords.

Use US Legal Forms to obtain the Massachusetts Receipt as Payment in Full in just a few clicks.

Step 7. Complete, edit, and print or sign the Massachusetts Receipt as Payment in Full.

Every legal document template you purchase is yours indefinitely. You will have access to every form you've acquired within your account. Click the My documents section and choose a form to print or download again. Complete and download, and print the Massachusetts Receipt as Payment in Full with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- In case you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Massachusetts Receipt as Payment in Full.

- You can also access forms you have previously acquired in the My documents section of your account.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Utilize the Preview option to review the details of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have located the form you need, click on the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

Form popularity

FAQ

To request a payment plan on Mass Tax Connect, log into your account and navigate to the payment plan section. Fill out the required information regarding your tax balance and preferred payment terms. The system will guide you through your options, allowing you to manage your tax dues effectively. A payment plan can help you regain control over your finances and utilize the Massachusetts Receipt as Payment in Full when settling your tax account.

You should mail MA Form 2G to the appropriate address listed on the form itself, which is often specific to the type of payment you are making. Generally, this form is sent to the Massachusetts Department of Revenue. Ensuring that you send it to the right address helps you avoid delays and complications with your tax matters. If needed, you can reference the Massachusetts Receipt as Payment in Full when filing to ensure proper processing.

MA Form 355 ES is the estimated tax payment form used in Massachusetts. This form allows taxpayers to submit estimated tax payments throughout the year. Understanding how to use this form can help you manage your tax obligations effectively, ensuring that you stay compliant with Massachusetts laws. If you plan to claim a Massachusetts Receipt as Payment in Full, using MA Form 355 ES properly is essential.

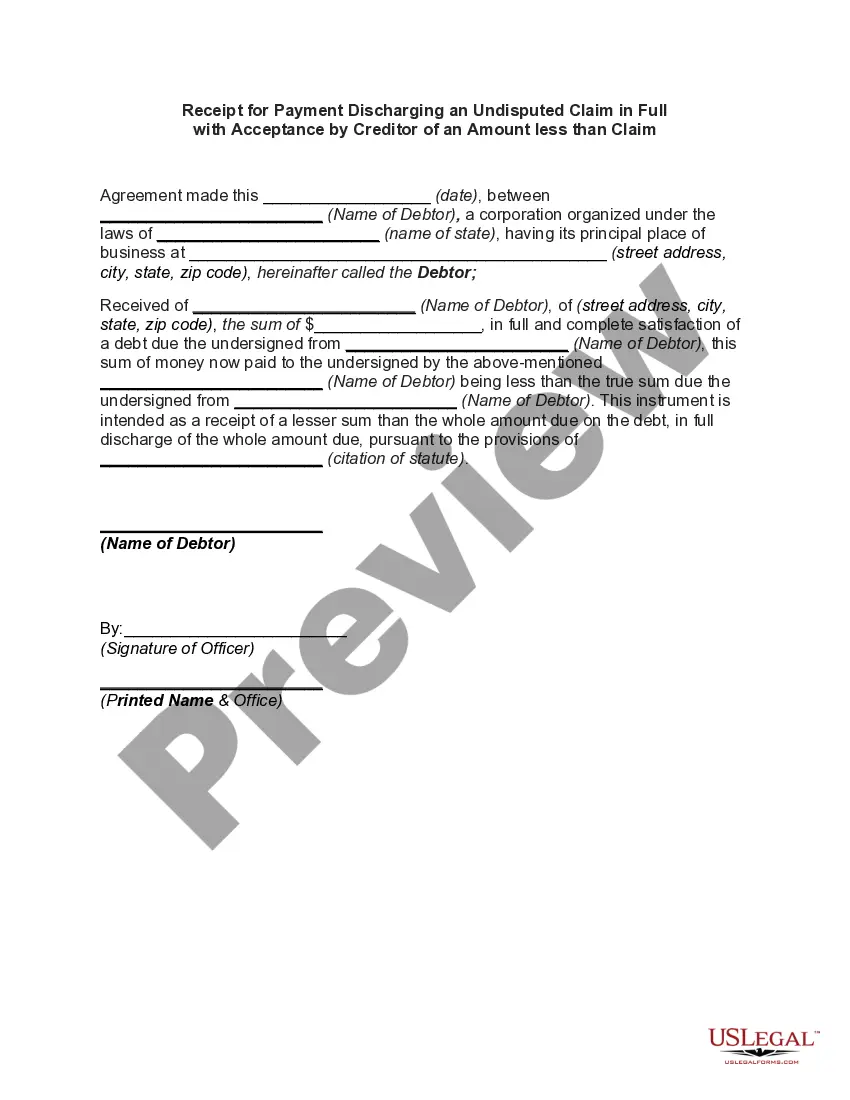

Receipt of payment in full is a statement confirming that a seller has received the entire payment owed by the buyer for a specified transaction. In relation to Massachusetts Receipt as Payment in Full, this receipt serves as crucial documentation, ensuring both parties acknowledge that the account is settled without any outstanding balance. This clarity benefits future transactions and record-keeping.

A receipt acknowledging payment in full serves as a formal document confirming that a buyer has settled their financial obligations completely. In terms of Massachusetts Receipt as Payment in Full, such a receipt provides legal proof that no further payments are required from the buyer. This documentation is essential for both parties to maintain clear financial records.

Upon receipt refers to the requirement that payment is expected immediately after a seller provides a receipt to the buyer. In the framework of Massachusetts Receipt as Payment in Full, this means that once the buyer receives the invoice or receipt, they should complete the payment without delay. This term emphasizes the urgency of settling accounts promptly.

Mailed federal tax returns from Massachusetts should be sent to the address indicated on the form you are using. The destination may vary based on your filing choice, so refer to the instructions carefully. To avoid complications, make sure your tax return is correctly addressed and stamped. This process can be managed efficiently with the help of a Massachusetts Receipt as Payment in Full.

Yes, you can file your Massachusetts taxes online using various e-filing services. These platforms are convenient and allow for rapid processing of your returns. It's essential to choose a reputable tax software that supports Massachusetts tax filings. Using an option that provides a Massachusetts Receipt as Payment in Full can enhance your online filing experience.

You should mail your Massachusetts tax return with payment to the address specified on your tax form. Ensure you are sending it to the correct location depending on whether you are enclosing a payment or not. Double-checking the address helps prevent delays in processing. Remember, if you opt for a Massachusetts Receipt as Payment in Full, it can streamline this aspect of your tax handling.

No, you do not need to send a copy of your federal return along with your Massachusetts state return. Massachusetts does not require this documentation for tax filing. It is crucial, however, to keep your federal return on hand for your records and for reference while preparing your state tax return. Utilizing a Massachusetts Receipt as Payment in Full can simplify your filing process.