Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form

Description

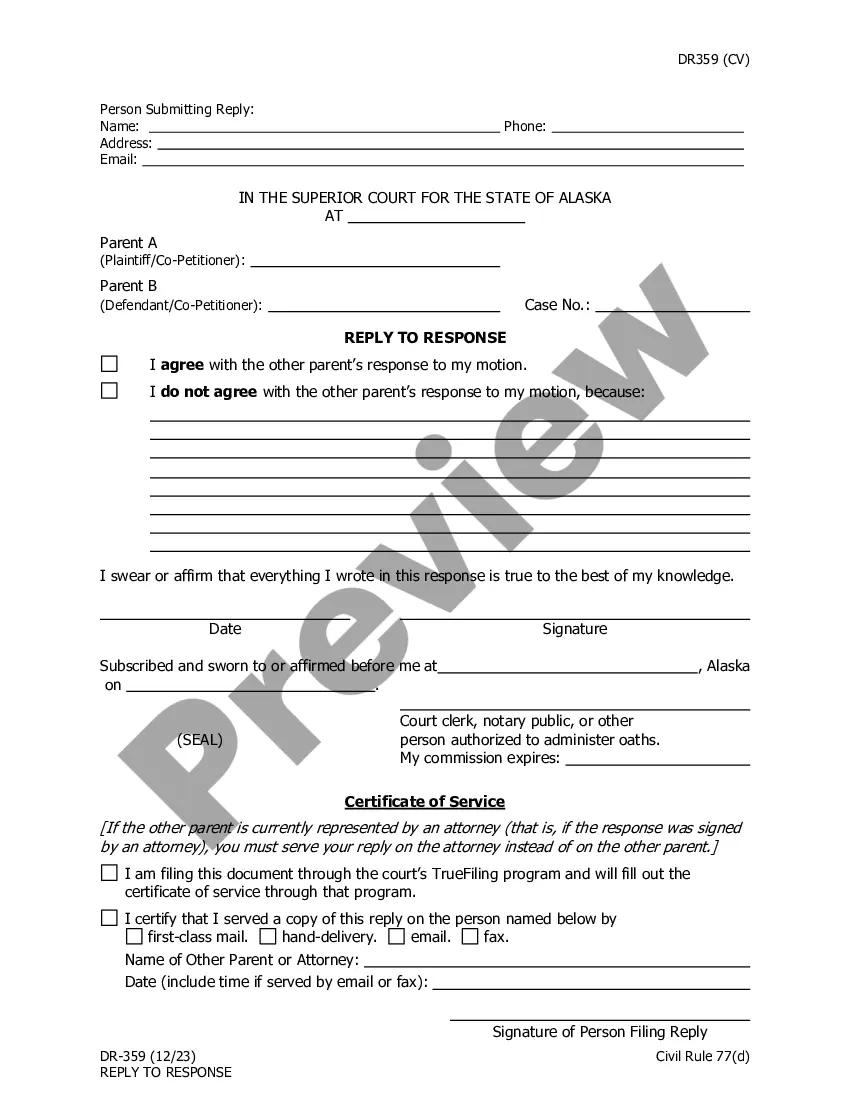

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

You can spend time online searching for the valid document template that satisfies the federal and state requirements you need.

US Legal Forms offers a wide range of valid forms that are reviewed by experts.

You can easily download or print the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form from my services.

First, verify that you have chosen the correct document template for the state/city of your choice. Review the form summary to confirm you have selected the right form. If available, utilize the Review option to examine the document template as well. If you want to find another version of the form, use the Search section to obtain the template that meets your needs and requirements. Once you have found the template you desire, click on Purchase now to proceed. Select the pricing plan you want, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make modifications to your document if possible. You can complete, revise, and sign the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form. Acquire and print numerous document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form.

- Every legal document template you purchase is yours for a lifetime.

- To obtain another copy of a purchased form, visit the My documents tab and click the appropriate option.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

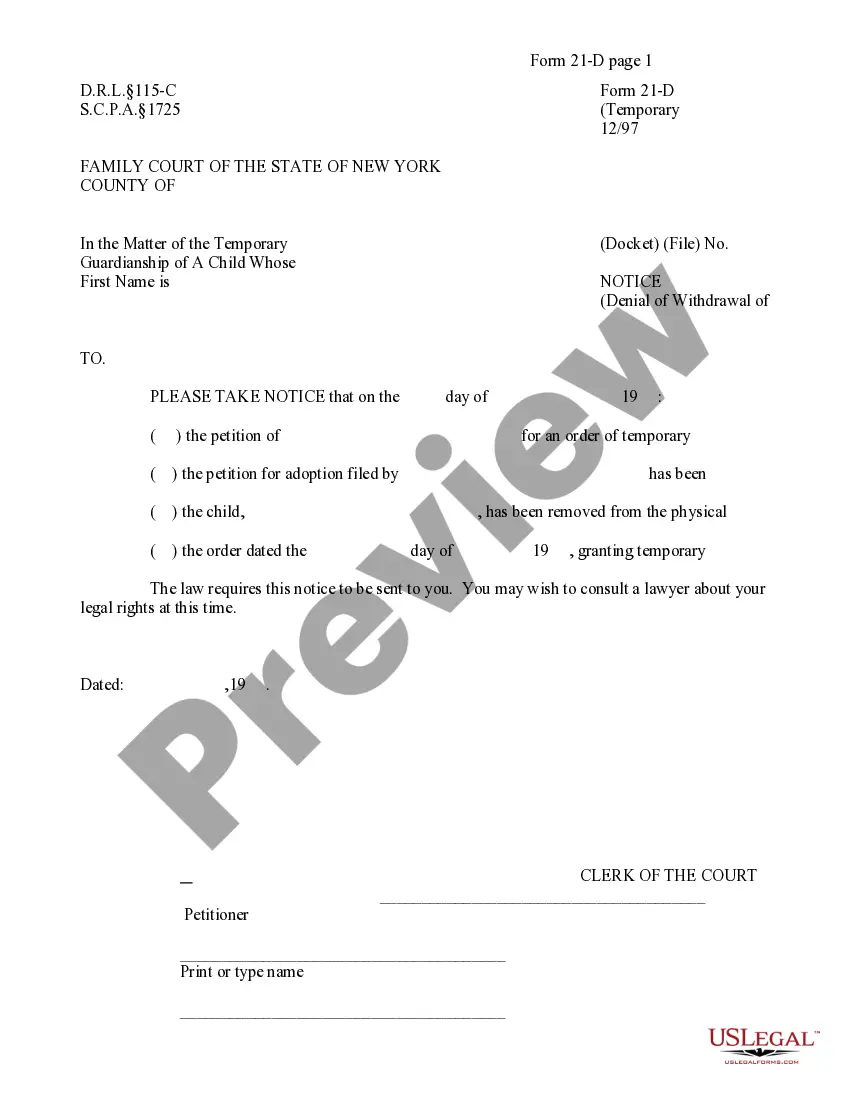

A board or shareholder resolution is a formal decision made by either the board of directors or the shareholders of a company. It documents important actions, such as approving financial matters or changes in corporate policy. In the context of share issuance, both types of resolutions may be necessary, and creating a Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form helps structure this process effectively.

A board resolution for share issuance specifically pertains to the approval of new shares by the board of directors. This resolution details the specifics of the shares being issued, including their class and any associated conditions. Using the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form assists in ensuring legal compliance and transparency in the share issuance process.

A board resolution is an official document that records decisions made by a company's board of directors during a meeting. It serves as an important legal record and is required for various actions, including share issuance. When it comes to issuing shares, the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form provides a structured way to capture these critical decisions.

Yes, a resolution is required to issue shares. This document serves as a legal acknowledgment that the board of directors has agreed to the share issuance. Utilizing the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form helps you create a clear and compliant record of this important decision.

A board resolution for the issue of shares is a formal document that outlines the decision made by a company's board of directors to authorize share issuance. This resolution is essential in stating the number of shares to be issued, their type, and the terms of the issuance. Using a Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form ensures that you comply with the legal requirements and maintain proper documentation.

Line 14 code e on a K-1 form in Massachusetts indicates the allocation of certain types of income, including bonuses that may be issued in stock. This code is crucial for reporting your share of profits or losses accurately, particularly related to the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form. Understanding this line ensures you complete your tax returns correctly. For further assistance with K-1 forms, uslegalforms provides helpful resources and templates.

Box 14 on the W-2 form in Massachusetts is used for reporting various types of income that do not fit into standard categories. This includes reporting the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form, which is vital for tax calculations and compliance. Properly filling out this box helps ensure that you meet all state tax obligations. For clarity and assistance in the preparation of your W-2, consider using uslegalforms.

Chapter 14 tax pertains to specific tax regulations in Massachusetts governing the taxation of certain officer compensation, including stock bonuses. This tax ensures that officers receive tax treatment aligned with state laws. When navigating through these regulations, understanding the implications of the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form is crucial. Resources like uslegalforms can guide you through the complexities of Chapter 14 tax.

UB in box 14 of the W-2 form refers to the line item for the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form. This indicates that a specific type of bonus has been provided to the officer in the form of stock, which is essential for tax reporting. Understanding this designation helps ensure accurate tax filings and compliance with Massachusetts regulations. If you have more questions about handling your W-2 forms, uslegalforms can provide the necessary support.

Yes, stock compensation is classified as an expense on financial statements. This expense is recognized over the vesting period of the stock awards granted. Companies can utilize the Massachusetts Officers Bonus in form of Stock Issuance - Resolution Form to document these awards, making the accounting process more straightforward and compliant.