Massachusetts Agreement for Purchase of Business Assets from a Corporation

Description

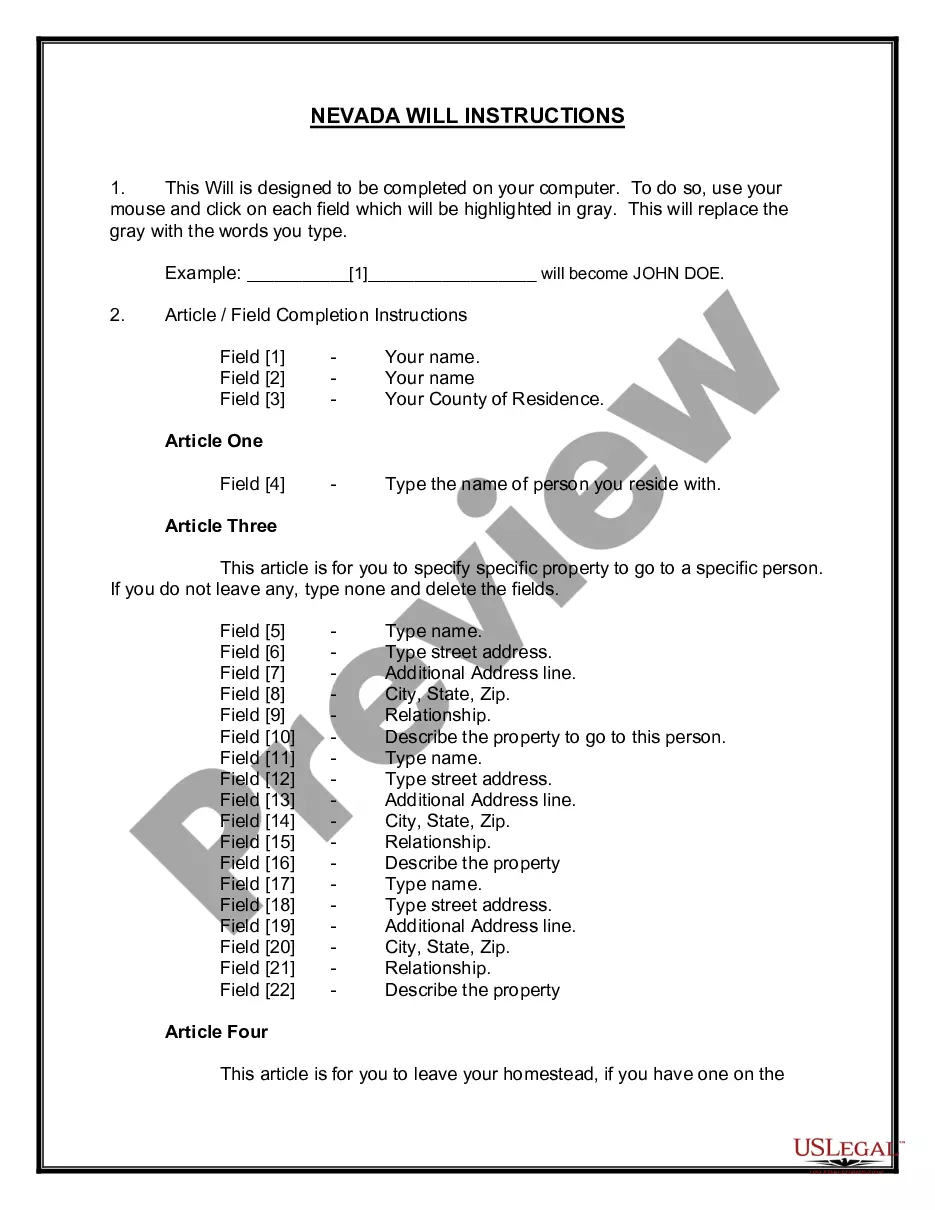

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

Locating the appropriate sanctioned document template might be challenging.

Of course, there are numerous templates accessible online, but how do you obtain the sanctioned form you desire.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Massachusetts Agreement for Purchase of Business Assets from a Corporation, suitable for business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If the form does not meet your requirements, use the Search field to find the correct document. Once you are certain that the form is accurate, click on the Acquire now option to obtain the document. Select the pricing plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Massachusetts Agreement for Purchase of Business Assets from a Corporation. US Legal Forms is the largest collection of legal documents where you can find countless document templates. Utilize the service to download professionally crafted files that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Acquire option to obtain the Massachusetts Agreement for Purchase of Business Assets from a Corporation.

- Use your account to search through the legal documents you have purchased previously.

- Navigate to the My documents tab of your account and download an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have chosen the correct form for your city/area.

- You can review the form using the Review option and check the form description to confirm it is the right one for you.

Form popularity

FAQ

How to Write a Business Purchase Agreement? Step 1 ? Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the contract. ... Step 2 ? Business Assets. ... Step 3 ? Business Liabilities. ... Step 4 ? Purchase Price. ... Step 5 ? Terms. ... Step 6 ? Signatures.

The liquidation of a company is when the company's assets are sold and the company ceases operations and is deregistered. The assets are sold to pay back various claimants, such as creditors and shareholders. The liquidation process happens when a company is insolvent; it can no longer meet its financial obligations.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

In an asset sale, assets to be sold need to be specified and duly transferred. Merger consideration is typically paid directly to stockholders, whereas in an asset sale you have to take the additional step of distributing the sale proceeds to the stockholders.

Also known as divestiture, divestment is effectively the opposite of an investment and is usually done when that subsidiary asset or division is not performing up to expectations. In some cases, however, a company may be forced to sell assets as the result of legal or regulatory action.

Key Takeaways. In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

After you have an accepted offer A purchase & sale agreement (P&S) is a legal document prepared and agreed to by attorneys representing both the buyer and seller in the home purchase transaction. The P&S is signed by both the buyer and seller, and will include final sale price and all terms of the purchase.

Asset Sale Planning Generally speaking, sales of assets such as equipment, buildings, vehicles and furniture will be taxed at ordinary income tax rates, while intangible assets such as goodwill or intellectual property will be taxed at capital gains rates.