Massachusetts Corporate Resolution Authorizing a Charitable Contribution

Description

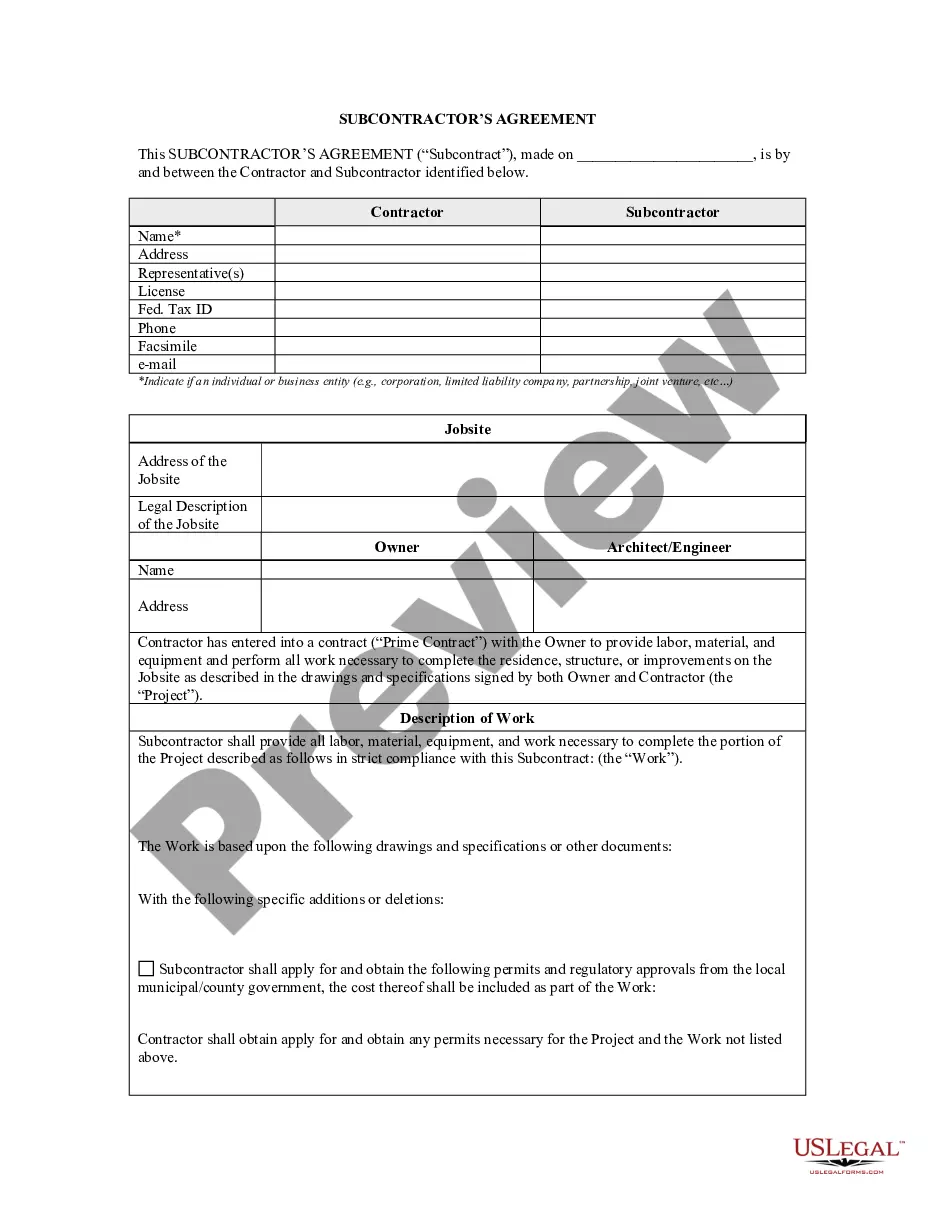

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a range of legal document templates that you can download or print. By utilizing the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Massachusetts Corporate Resolution Authorizing a Charitable Contribution in a matter of minutes.

If you already hold a monthly membership, Log In and download the Massachusetts Corporate Resolution Authorizing a Charitable Contribution from the US Legal Forms library. The Download button will appear on each document you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the downloaded Massachusetts Corporate Resolution Authorizing a Charitable Contribution. Every document you add to your account has no expiration date, so it belongs to you indefinitely. Therefore, if you wish to download or print another copy, just visit the My documents area and click on the document you need. Gain access to the Massachusetts Corporate Resolution Authorizing a Charitable Contribution with US Legal Forms, arguably the most comprehensive library of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal requirements and standards.

- Ensure that you have selected the correct form for your region/area.

- Click the Review button to see the content of the form.

- Read the form description to confirm that you have chosen the right document.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

No, Qualified Charitable Distributions (QCDs) are not taxable in Massachusetts. This means that if your organization utilizes a QCD as part of its charitable strategy, there is no state income tax liability on that amount. A Massachusetts Corporate Resolution Authorizing a Charitable Contribution can streamline this process and ensure your contributions are well documented. Always remember to verify compliance with IRS guidelines for QCDs.

In Massachusetts, taxpayers can deduct certain IRA contributions from their state income taxes, but there are conditions. Contributors need to meet eligibility requirements based on income levels and participation in an employer-sponsored retirement plan. If your organization is looking toward future planning, a Massachusetts Corporate Resolution Authorizing a Charitable Contribution might benefit how you structure these contributions. Always consult a tax expert to clarify your specific situation.

Massachusetts does tax most IRA withdrawals as regular income. Therefore, when you withdraw funds, they may be subject to state income tax. If your organization is considering a charitable contribution from an IRA withdrawal, remember that a Massachusetts Corporate Resolution Authorizing a Charitable Contribution can help formalize this process. Evaluating the tax implications in advance will serve your organization well.

Yes, you can carry forward excess charitable donations in Massachusetts. If your charitable contributions exceed the allowable deduction limit in a given tax year, you may use the excess amounts to offset future taxes for up to five years. This means that your corporate resolution authorizing a charitable contribution can effectively maximize your tax benefits over time. It’s important to consult with a tax professional to ensure proper reporting.

Not all non-profit corporations qualify as charities; however, many do. Non-profits focus on a variety of goals, while charity relates specifically to organizations that engage in activities for public benefit. When creating a Massachusetts Corporate Resolution Authorizing a Charitable Contribution, knowing the distinction will help you align your organization’s mission with its legal identity.

Massachusetts has specific laws governing solicitation to protect both donors and charitable organizations. These laws require certain organizations to register before soliciting funds and to disclose specific information about their fundraising efforts. Understanding these regulations is vital when crafting a Massachusetts Corporate Resolution Authorizing a Charitable Contribution, ensuring that your organization operates within legal boundaries.

A charitable solicitation refers to any request made to the public for financial support or contributions to a charitable organization. This can occur through various mediums, including online campaigns, mail, or in-person events. When organizing a charitable solicitation, it's wise to create a Massachusetts Corporate Resolution Authorizing a Charitable Contribution to formalize your intents and ensure you meet all legal requirements.

The form PC filing in Massachusetts is a document that non-profit organizations must submit to register as a charitable solicitation entity. This form requires detailed information about the organization's financial status and planned fundraising activities. If your organization aims to establish a Massachusetts Corporate Resolution Authorizing a Charitable Contribution, filing the form PC is crucial for transparency and legal compliance.

The non-solicitation law in Massachusetts regulates how businesses and charities engage in fundraising. This law prevents unsolicited requests for donations without prior consent from potential donors. If you're considering a Massachusetts Corporate Resolution Authorizing a Charitable Contribution, understanding this law is essential to ensure compliance and protect your organization.

Charitable donations made outside the US may not be tax deductible for Massachusetts state taxes. However, some exceptions exist if the foreign charity qualifies as a recognized charity under IRS regulations. Always verify eligibility to ensure compliance with tax laws. If you want to authorize extensive charitable contributions abroad, consider drafting a Massachusetts Corporate Resolution Authorizing a Charitable Contribution for clarity.