Massachusetts Transfer of Property under the Uniform Transfers to Minors Act

Description

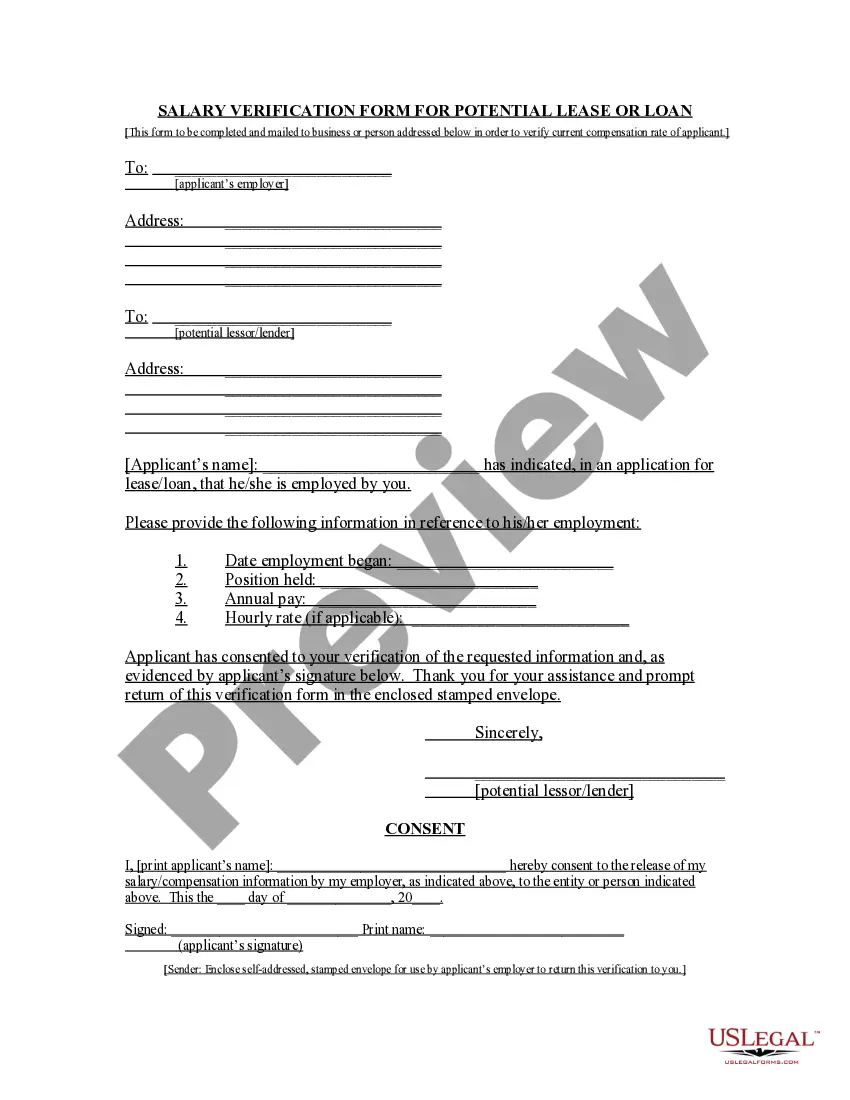

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

US Legal Forms - among the most significant libraries of authorized forms in the USA - provides a wide array of authorized file layouts it is possible to download or printing. Making use of the website, you will get 1000s of forms for enterprise and person purposes, categorized by groups, suggests, or keywords.You will discover the most up-to-date variations of forms just like the Massachusetts Transfer of Property under the Uniform Transfers to Minors Act within minutes.

If you have a monthly subscription, log in and download Massachusetts Transfer of Property under the Uniform Transfers to Minors Act from your US Legal Forms collection. The Acquire key can look on every single type you view. You gain access to all earlier acquired forms from the My Forms tab of your own bank account.

If you would like use US Legal Forms the very first time, listed here are basic guidelines to help you began:

- Ensure you have chosen the proper type for the metropolis/state. Go through the Review key to examine the form`s articles. Look at the type outline to ensure that you have chosen the right type.

- When the type doesn`t fit your specifications, utilize the Research industry near the top of the display to get the the one that does.

- In case you are content with the shape, affirm your decision by visiting the Buy now key. Then, pick the pricing prepare you favor and supply your accreditations to register for an bank account.

- Approach the transaction. Use your Visa or Mastercard or PayPal bank account to perform the transaction.

- Pick the format and download the shape on the system.

- Make adjustments. Fill up, revise and printing and signal the acquired Massachusetts Transfer of Property under the Uniform Transfers to Minors Act.

Each and every design you included in your account lacks an expiry particular date and it is your own property forever. So, if you want to download or printing an additional backup, just go to the My Forms area and click about the type you will need.

Obtain access to the Massachusetts Transfer of Property under the Uniform Transfers to Minors Act with US Legal Forms, by far the most extensive collection of authorized file layouts. Use 1000s of skilled and condition-specific layouts that fulfill your business or person needs and specifications.

Form popularity

FAQ

UGMA/UTMA account assets can be transferred into a new account established by the now adult beneficiary as a sole or joint owner. To get an account application, contact your financial professional or find one by using our financial professional locator. For additional assistance, contact us.

Can You Withdraw Money From an UTMA Account? It's possible to withdraw money from an UTMA account. However, there's one essential rule you've got to bear in mind ? all withdrawals from a custodial account must be for the direct benefit of the beneficiary.

Also, since UGMA and UTMA accounts are in the name of a single child, the funds are not transferrable to another beneficiary. For financial aid purposes, custodial accounts are considered assets of the student. This means that custodial bank and brokerage accounts have a high impact on financial aid eligibility.

Age of Majority and Trust Termination StateUGMAUTMAMaine2118Maryland1821Massachusetts1821Michigan181849 more rows

No, a parent cannot take money out of a UTMA account. The assets remain under the control of the custodian until the minor reaches the majority age.

The Uniform Gift to Minors Act (UGMA) was created to provide a means by which title to property could be passed to minors by use of a custodian. The nature of property which could be transferred under the UGMA was limited to securities, cash or other personal property.

Who should consider an UGMA/UTMA account? Anyone can contribute up to $17,000 per child each year free of gift-tax consequences ($34,000 for married couples). This amount is indexed for inflation and may increase over time. Because contributions are made with after-tax dollars, a deduction cannot be taken.

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.